Alternative data in finance refers to non-traditional data sources such as satellite imagery, social media sentiment, and transaction records that provide unique insights beyond conventional financial metrics. Fundamental data consists of traditional financial information like earnings reports, balance sheets, and macroeconomic indicators used to evaluate a company's intrinsic value. Explore how integrating alternative data with fundamental analysis can enhance investment decisions and drive superior performance.

Why it is important

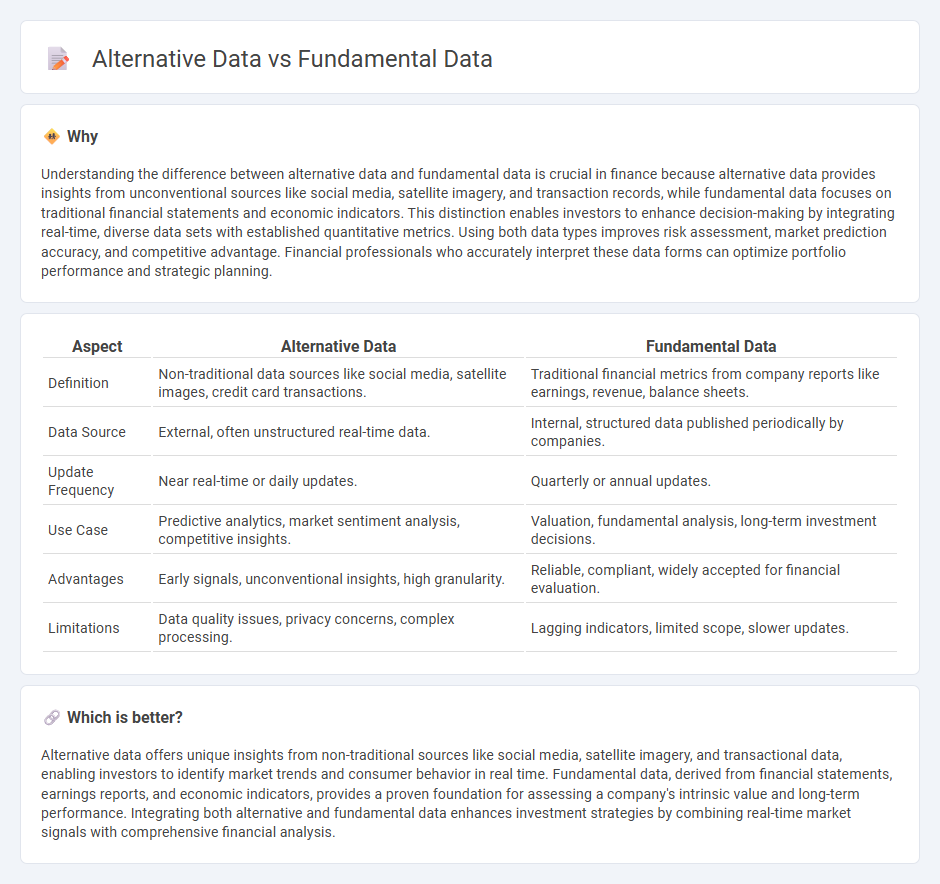

Understanding the difference between alternative data and fundamental data is crucial in finance because alternative data provides insights from unconventional sources like social media, satellite imagery, and transaction records, while fundamental data focuses on traditional financial statements and economic indicators. This distinction enables investors to enhance decision-making by integrating real-time, diverse data sets with established quantitative metrics. Using both data types improves risk assessment, market prediction accuracy, and competitive advantage. Financial professionals who accurately interpret these data forms can optimize portfolio performance and strategic planning.

Comparison Table

| Aspect | Alternative Data | Fundamental Data |

|---|---|---|

| Definition | Non-traditional data sources like social media, satellite images, credit card transactions. | Traditional financial metrics from company reports like earnings, revenue, balance sheets. |

| Data Source | External, often unstructured real-time data. | Internal, structured data published periodically by companies. |

| Update Frequency | Near real-time or daily updates. | Quarterly or annual updates. |

| Use Case | Predictive analytics, market sentiment analysis, competitive insights. | Valuation, fundamental analysis, long-term investment decisions. |

| Advantages | Early signals, unconventional insights, high granularity. | Reliable, compliant, widely accepted for financial evaluation. |

| Limitations | Data quality issues, privacy concerns, complex processing. | Lagging indicators, limited scope, slower updates. |

Which is better?

Alternative data offers unique insights from non-traditional sources like social media, satellite imagery, and transactional data, enabling investors to identify market trends and consumer behavior in real time. Fundamental data, derived from financial statements, earnings reports, and economic indicators, provides a proven foundation for assessing a company's intrinsic value and long-term performance. Integrating both alternative and fundamental data enhances investment strategies by combining real-time market signals with comprehensive financial analysis.

Connection

Alternative data complements fundamental data by providing non-traditional insights such as social media trends, satellite imagery, and transaction records that enhance financial analysis and investment decision-making. Integrating alternative data with traditional fundamental metrics like earnings reports and balance sheets enables more accurate forecasting and risk assessment. This combined approach improves portfolio management by uncovering hidden patterns and market signals not evident through conventional data sources alone.

Key Terms

Earnings Reports

Earnings reports represent fundamental data by providing key financial metrics directly from a company's official disclosures, such as revenue, net income, and earnings per share, essential for evaluating profitability and growth potential. Alternative data complements earnings reports with insights from non-traditional sources like social media sentiment, satellite imagery, and web traffic patterns, offering a broader context to forecast earnings trends and market reactions. Explore more about integrating fundamental earnings data with alternative data to enhance investment strategies.

Social Media Sentiment

Fundamental data consists of traditional financial metrics such as earnings, revenue, and balance sheet information, which investors use to assess a company's intrinsic value. Alternative data, especially social media sentiment, captures real-time public opinions and market trends through platforms like Twitter and Reddit, offering unique insights beyond conventional metrics. Explore how integrating social media sentiment with fundamental data can enhance investment strategies and improve decision-making.

Satellite Imagery

Satellite imagery offers alternative data that complements traditional fundamental data by providing real-time visual insights into economic activities such as crop health, construction progress, and supply chain logistics. Unlike fundamental data, which often relies on financial statements and market reports, satellite imagery enables investors and analysts to monitor physical assets and environmental changes directly from space. Explore how integrating satellite imagery with fundamental data can enhance decision-making and forecasting accuracy.

Source and External Links

Data for Fundamental Analysis - Provides essential data sources for fundamental analysis, including financial statements and public filings.

Nasdaq Fundamental Data - Offers security master and market summary statistics for Nasdaq securities on a T+1 basis.

S&P Global Fundamental Data - Delivers comprehensive financial statements, ratios, and press releases for timely investment analysis.

dowidth.com

dowidth.com