Laddered bond ETFs spread investments across multiple bonds with staggered maturities, providing steady income and reducing interest rate risk. Target maturity ETFs focus on bonds that mature in a specific year, allowing investors to align their portfolio with future financial goals and potentially minimize reinvestment risk. Explore more to understand which strategy best suits your fixed-income investment objectives.

Why it is important

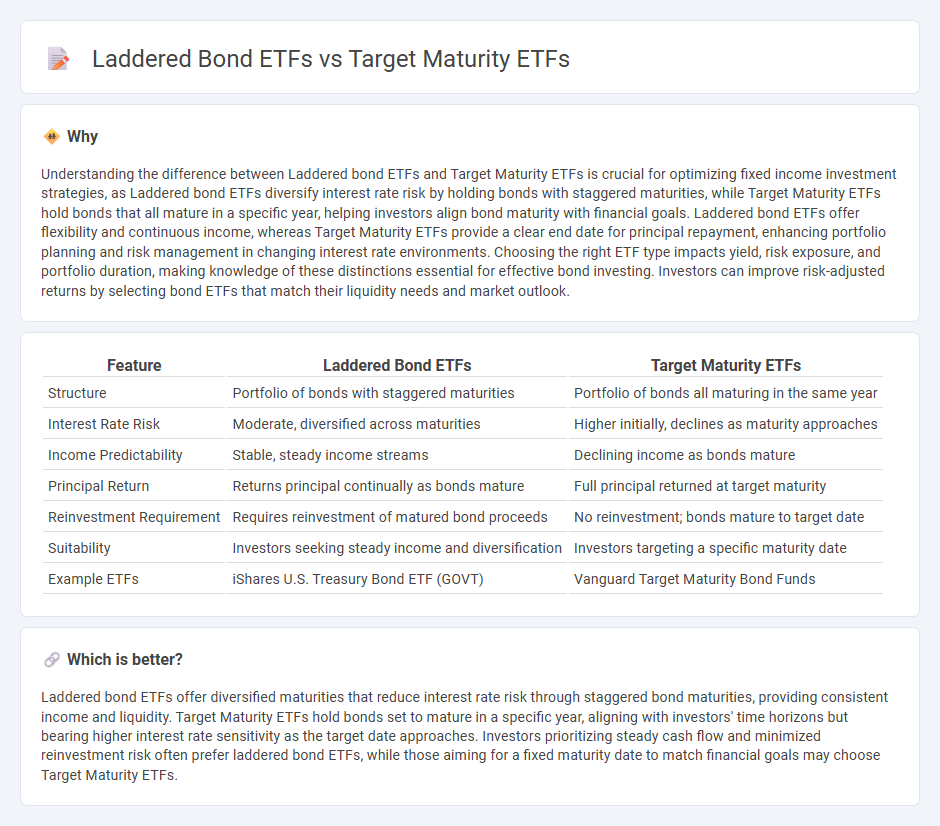

Understanding the difference between Laddered bond ETFs and Target Maturity ETFs is crucial for optimizing fixed income investment strategies, as Laddered bond ETFs diversify interest rate risk by holding bonds with staggered maturities, while Target Maturity ETFs hold bonds that all mature in a specific year, helping investors align bond maturity with financial goals. Laddered bond ETFs offer flexibility and continuous income, whereas Target Maturity ETFs provide a clear end date for principal repayment, enhancing portfolio planning and risk management in changing interest rate environments. Choosing the right ETF type impacts yield, risk exposure, and portfolio duration, making knowledge of these distinctions essential for effective bond investing. Investors can improve risk-adjusted returns by selecting bond ETFs that match their liquidity needs and market outlook.

Comparison Table

| Feature | Laddered Bond ETFs | Target Maturity ETFs |

|---|---|---|

| Structure | Portfolio of bonds with staggered maturities | Portfolio of bonds all maturing in the same year |

| Interest Rate Risk | Moderate, diversified across maturities | Higher initially, declines as maturity approaches |

| Income Predictability | Stable, steady income streams | Declining income as bonds mature |

| Principal Return | Returns principal continually as bonds mature | Full principal returned at target maturity |

| Reinvestment Requirement | Requires reinvestment of matured bond proceeds | No reinvestment; bonds mature to target date |

| Suitability | Investors seeking steady income and diversification | Investors targeting a specific maturity date |

| Example ETFs | iShares U.S. Treasury Bond ETF (GOVT) | Vanguard Target Maturity Bond Funds |

Which is better?

Laddered bond ETFs offer diversified maturities that reduce interest rate risk through staggered bond maturities, providing consistent income and liquidity. Target Maturity ETFs hold bonds set to mature in a specific year, aligning with investors' time horizons but bearing higher interest rate sensitivity as the target date approaches. Investors prioritizing steady cash flow and minimized reinvestment risk often prefer laddered bond ETFs, while those aiming for a fixed maturity date to match financial goals may choose Target Maturity ETFs.

Connection

Laddered bond ETFs and target maturity ETFs both aim to manage interest rate risk by structuring fixed-income investments around staggered or fixed maturity dates. Laddered bond ETFs diversify exposure across multiple bond maturities, creating a sequence of maturities that spreads out reinvestment risk and enhances liquidity. Target maturity ETFs, in contrast, invest in bonds that all mature in a specific year, providing investors with a predictable payout timeline and reducing duration risk as the fund approaches maturity.

Key Terms

Maturity Date

Target Maturity ETFs strategically hold bonds that all mature on a specific date, aligning with investor goals for predictable income and principal return. Laddered bond ETFs maintain a diversified portfolio of bonds with staggered maturities, offering consistent income and risk mitigation through rolling maturities. Explore deeper insights on how these ETF structures impact portfolio management and income strategies.

Yield

Target Maturity ETFs offer a defined end date and typically provide higher yield as they hold bonds maturing in the same year, reducing interest rate risk. Laddered bond ETFs diversify maturity dates across bonds, potentially smoothing returns but often yielding less due to staggered interest rate exposure. Explore the nuances of both strategies to determine which aligns best with your income objectives.

Liquidity

Target maturity ETFs provide predictable liquidity by aligning redemption dates with bond maturities, minimizing interest rate risk and enhancing cash flow planning. Laddered bond ETFs distribute bond maturities evenly over time, offering continuous liquidity but exposing investors to interest rate fluctuations. Explore how each strategy impacts liquidity management tailored to your investment goals.

Source and External Links

RBC Target Maturity Bond ETFs - RBC Target Maturity Bond ETFs offer diversified bond portfolios with bonds maturing in the same year, paying monthly income with defined maturity similar to individual bonds, providing transparency and tradability.

TD Target Maturity Bond ETFs - TD Target Maturity ETFs invest in investment-grade corporate bonds with a set maturity date, providing diversification, regular income, lower volatility, and liquidity in both Canadian and U.S. dollar versions.

BulletShares(r) fixed income ETFs - Invesco - BulletShares ETFs have defined maturity dates to mimic holding bonds to maturity, allowing investors to manage income and risk with a planned termination and final distribution of net asset value in the maturity year.

dowidth.com

dowidth.com