Decentralized over-the-counter (OTC) trading enables peer-to-peer asset exchanges without intermediaries, enhancing privacy and reducing counterparty risk. Brokerage platforms act as regulated intermediaries facilitating trades with added services like market analysis and customer support. Explore the differences and advantages of these trading methods to optimize your investment strategy.

Why it is important

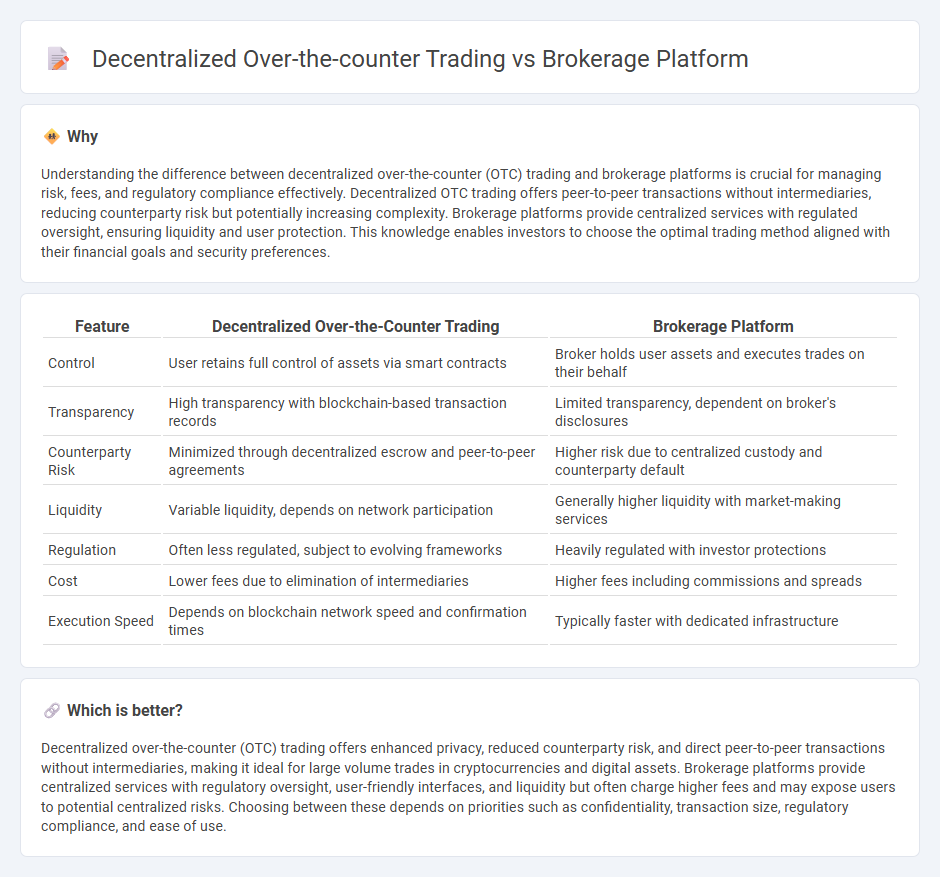

Understanding the difference between decentralized over-the-counter (OTC) trading and brokerage platforms is crucial for managing risk, fees, and regulatory compliance effectively. Decentralized OTC trading offers peer-to-peer transactions without intermediaries, reducing counterparty risk but potentially increasing complexity. Brokerage platforms provide centralized services with regulated oversight, ensuring liquidity and user protection. This knowledge enables investors to choose the optimal trading method aligned with their financial goals and security preferences.

Comparison Table

| Feature | Decentralized Over-the-Counter Trading | Brokerage Platform |

|---|---|---|

| Control | User retains full control of assets via smart contracts | Broker holds user assets and executes trades on their behalf |

| Transparency | High transparency with blockchain-based transaction records | Limited transparency, dependent on broker's disclosures |

| Counterparty Risk | Minimized through decentralized escrow and peer-to-peer agreements | Higher risk due to centralized custody and counterparty default |

| Liquidity | Variable liquidity, depends on network participation | Generally higher liquidity with market-making services |

| Regulation | Often less regulated, subject to evolving frameworks | Heavily regulated with investor protections |

| Cost | Lower fees due to elimination of intermediaries | Higher fees including commissions and spreads |

| Execution Speed | Depends on blockchain network speed and confirmation times | Typically faster with dedicated infrastructure |

Which is better?

Decentralized over-the-counter (OTC) trading offers enhanced privacy, reduced counterparty risk, and direct peer-to-peer transactions without intermediaries, making it ideal for large volume trades in cryptocurrencies and digital assets. Brokerage platforms provide centralized services with regulatory oversight, user-friendly interfaces, and liquidity but often charge higher fees and may expose users to potential centralized risks. Choosing between these depends on priorities such as confidentiality, transaction size, regulatory compliance, and ease of use.

Connection

Decentralized over-the-counter (OTC) trading platforms facilitate peer-to-peer asset exchanges without intermediaries, enhancing privacy and reducing counterparty risk, which directly complements brokerage platforms that traditionally mediate trades. Integrating decentralized OTC mechanisms within brokerage frameworks streamlines liquidity access, reduces reliance on centralized systems, and fosters transparent, secure transactions for institutional and retail investors. This synergy accelerates efficient market execution, minimizes settlement times, and leverages blockchain technology to ensure immutable trade records and compliance.

Key Terms

Intermediary

Brokerage platforms rely on intermediaries to facilitate trades, ensuring regulatory compliance and providing market liquidity through centralized order books. Decentralized over-the-counter (OTC) trading eliminates intermediaries by enabling direct peer-to-peer transactions via smart contracts on blockchain networks, enhancing privacy and reducing counterparty risk. Explore the advantages and risks of each model to determine the best fit for your trading strategy.

Custodial Control

Brokerage platforms maintain custodial control by holding clients' assets within centralized wallets, ensuring regulatory compliance and streamlined trade execution. Decentralized over-the-counter (OTC) trading empowers users with self-custody, enabling peer-to-peer asset transfers without intermediaries, enhancing privacy and reducing counterparty risk. Explore deeper insights into how custodial custody impacts security and flexibility in trading environments.

Counterparty Risk

Brokerage platforms centralize trades, maintaining control over transactions but increasing counterparty risk due to reliance on a single entity's solvency and security measures. Decentralized over-the-counter (OTC) trading mitigates counterparty risk by enabling direct peer-to-peer exchanges on blockchain networks, reducing reliance on intermediaries. Explore detailed comparisons to understand how each model manages counterparty risk and impacts trading security.

Source and External Links

Brokerage account - Schwab - Schwab offers brokerage accounts with $0 online equity trades, no minimums or fees, easy-to-use platforms, 24/7 support, and trading education, suitable for managing stocks, options, bonds, ETFs, and more.

Best online brokers of 2025: Top places to invest your money - Bankrate - Interactive Brokers and Merrill Edge are highlighted for their competitive commission structures, advanced platforms, extensive mutual fund offerings, and strong research integration, particularly favored by active and cost-conscious investors.

Trading & Brokerage Services - Fidelity - Fidelity provides brokerage accounts with $0 commission trades, powerful research tools, flexible trading platforms including an advanced desktop option, and educational resources for investors at all levels, along with an award-winning mobile app.

dowidth.com

dowidth.com