Alternative data encompasses non-traditional information sources like satellite imagery, social media activity, and web traffic that offer unique insights into financial markets. Mobile data, a subset of alternative data, specifically involves information collected from smartphones, including location patterns and app usage, which can reveal consumer behavior trends and economic activity. Explore how leveraging these datasets can enhance investment strategies and financial analysis.

Why it is important

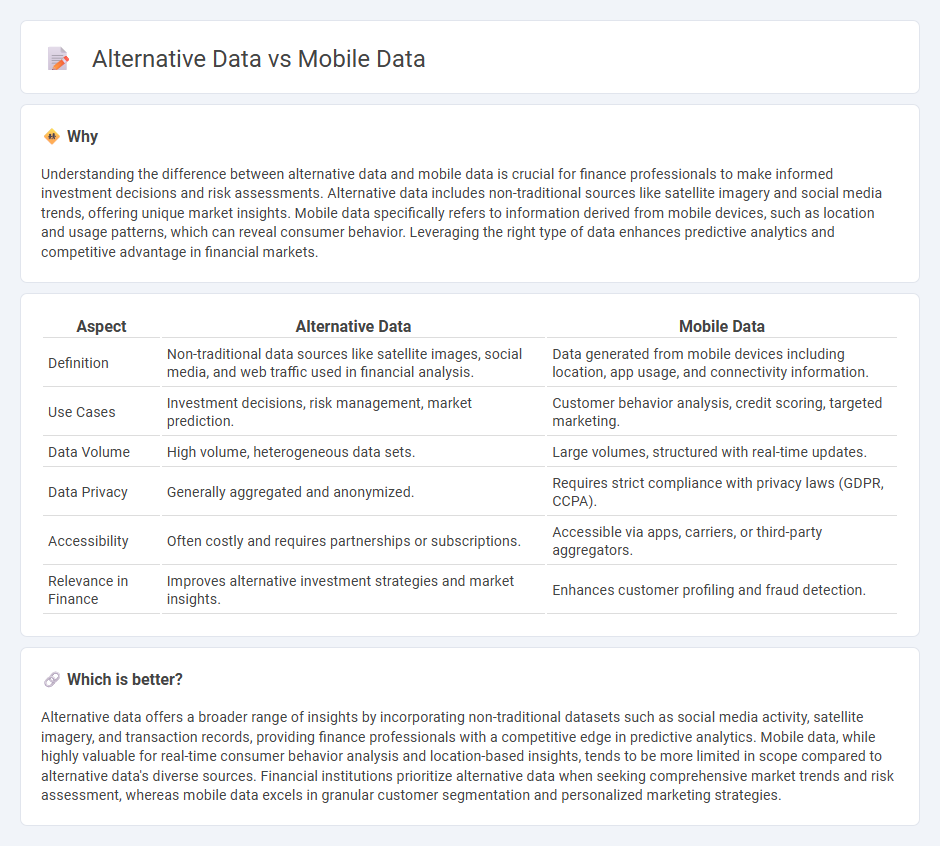

Understanding the difference between alternative data and mobile data is crucial for finance professionals to make informed investment decisions and risk assessments. Alternative data includes non-traditional sources like satellite imagery and social media trends, offering unique market insights. Mobile data specifically refers to information derived from mobile devices, such as location and usage patterns, which can reveal consumer behavior. Leveraging the right type of data enhances predictive analytics and competitive advantage in financial markets.

Comparison Table

| Aspect | Alternative Data | Mobile Data |

|---|---|---|

| Definition | Non-traditional data sources like satellite images, social media, and web traffic used in financial analysis. | Data generated from mobile devices including location, app usage, and connectivity information. |

| Use Cases | Investment decisions, risk management, market prediction. | Customer behavior analysis, credit scoring, targeted marketing. |

| Data Volume | High volume, heterogeneous data sets. | Large volumes, structured with real-time updates. |

| Data Privacy | Generally aggregated and anonymized. | Requires strict compliance with privacy laws (GDPR, CCPA). |

| Accessibility | Often costly and requires partnerships or subscriptions. | Accessible via apps, carriers, or third-party aggregators. |

| Relevance in Finance | Improves alternative investment strategies and market insights. | Enhances customer profiling and fraud detection. |

Which is better?

Alternative data offers a broader range of insights by incorporating non-traditional datasets such as social media activity, satellite imagery, and transaction records, providing finance professionals with a competitive edge in predictive analytics. Mobile data, while highly valuable for real-time consumer behavior analysis and location-based insights, tends to be more limited in scope compared to alternative data's diverse sources. Financial institutions prioritize alternative data when seeking comprehensive market trends and risk assessment, whereas mobile data excels in granular customer segmentation and personalized marketing strategies.

Connection

Alternative data, including social media activity, transaction records, and geolocation information, is often collected through mobile devices, making mobile data a crucial subset of alternative data in finance. Financial institutions leverage mobile data to gain real-time insights into consumer behavior, credit risk assessment, and market trends that traditional data sources may not capture. Integrating mobile data with other alternative datasets enhances predictive analytics, enabling more accurate decision-making and personalized financial services.

Key Terms

Data Sources

Mobile data primarily originates from smartphones and mobile devices, capturing location, network usage, and app interactions to analyze consumer behavior and movement patterns. Alternative data encompasses diverse sources such as social media platforms, satellite imagery, credit card transactions, and sensor networks, offering broader insights beyond traditional datasets. Explore the varying data sources to understand their unique applications and advantages.

Predictive Analytics

Mobile data, derived from users' smartphone activities, offers real-time behavioral insights crucial for predictive analytics applications such as customer targeting and demand forecasting. Alternative data encompasses diverse sources like satellite imagery, social media feeds, and web scraping, providing unconventional yet valuable indicators to enhance predictive models. Explore our in-depth analysis to understand how integrating mobile and alternative data can revolutionize predictive analytics strategies.

Credit Scoring

Mobile data offers real-time insights into consumer behavior through call records, SMS patterns, and mobile money transactions, while alternative data includes utility payments, social media activity, and e-commerce transactions, enhancing credit scoring models for improved accuracy. Integrating both data sources enables lenders to assess creditworthiness for unbanked or thin-file consumers more effectively by filling gaps left by traditional credit reports. Explore how combining mobile and alternative data revolutionizes credit scoring and financial inclusion.

Source and External Links

What Is Mobile Data & How Does It Work? | Samsung UK - Mobile data, also called cellular data, is internet connectivity delivered wirelessly to mobile devices over 3G, 4G, or 5G networks, enabling internet use without Wi-Fi and measured in megabytes or gigabytes within various phone plans.

What is mobile data? - TechTarget - Mobile data delivers internet content to smartphones and tablets using cellular connections, with usage tracked separately from voice and affecting monthly costs based on data consumption and plan limits.

What is mobile data & how does it work? - Astound - Mobile data is the digital information sent to and from mobile devices over cellular networks to enable browsing, streaming, and communication, with plan costs varying by provider and usage.

dowidth.com

dowidth.com