Robo advisory platforms use algorithms and AI to provide automated investment management with minimal human intervention, while financial planning software offers tools for budgeting, retirement, and goal analysis mainly through user input and customization. Robo advisors typically focus on portfolio optimization and asset allocation, whereas financial planning software delivers comprehensive financial insights and scenario forecasting. Explore the differences and benefits of each to determine the best fit for your financial goals.

Why it is important

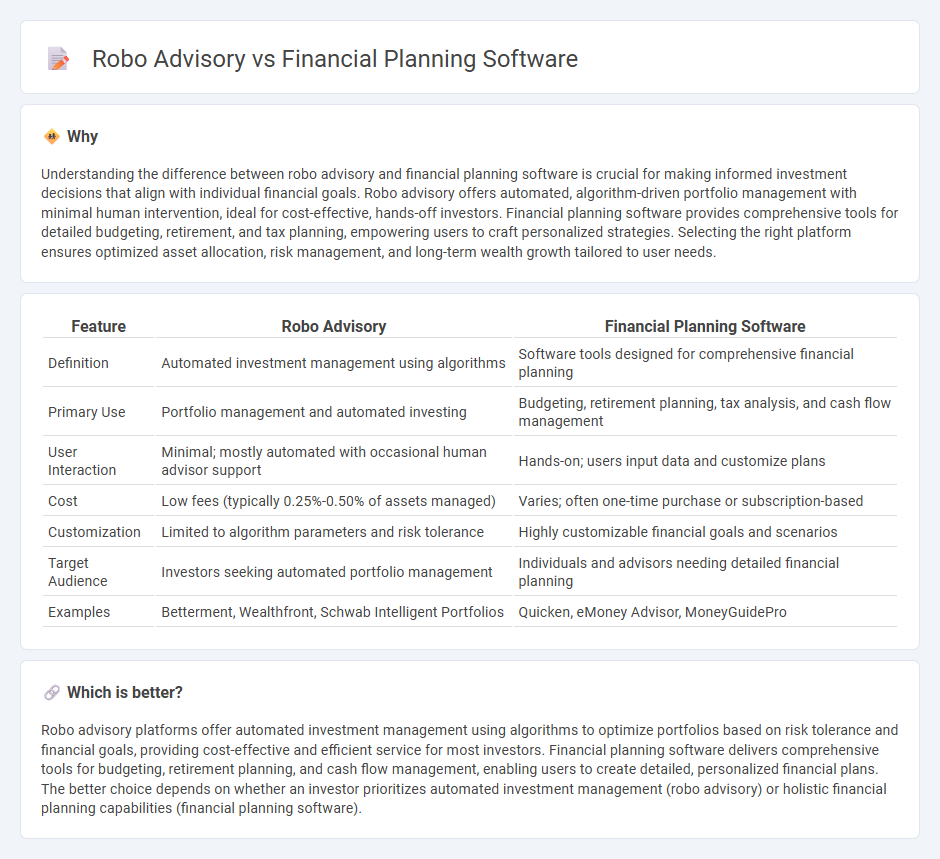

Understanding the difference between robo advisory and financial planning software is crucial for making informed investment decisions that align with individual financial goals. Robo advisory offers automated, algorithm-driven portfolio management with minimal human intervention, ideal for cost-effective, hands-off investors. Financial planning software provides comprehensive tools for detailed budgeting, retirement, and tax planning, empowering users to craft personalized strategies. Selecting the right platform ensures optimized asset allocation, risk management, and long-term wealth growth tailored to user needs.

Comparison Table

| Feature | Robo Advisory | Financial Planning Software |

|---|---|---|

| Definition | Automated investment management using algorithms | Software tools designed for comprehensive financial planning |

| Primary Use | Portfolio management and automated investing | Budgeting, retirement planning, tax analysis, and cash flow management |

| User Interaction | Minimal; mostly automated with occasional human advisor support | Hands-on; users input data and customize plans |

| Cost | Low fees (typically 0.25%-0.50% of assets managed) | Varies; often one-time purchase or subscription-based |

| Customization | Limited to algorithm parameters and risk tolerance | Highly customizable financial goals and scenarios |

| Target Audience | Investors seeking automated portfolio management | Individuals and advisors needing detailed financial planning |

| Examples | Betterment, Wealthfront, Schwab Intelligent Portfolios | Quicken, eMoney Advisor, MoneyGuidePro |

Which is better?

Robo advisory platforms offer automated investment management using algorithms to optimize portfolios based on risk tolerance and financial goals, providing cost-effective and efficient service for most investors. Financial planning software delivers comprehensive tools for budgeting, retirement planning, and cash flow management, enabling users to create detailed, personalized financial plans. The better choice depends on whether an investor prioritizes automated investment management (robo advisory) or holistic financial planning capabilities (financial planning software).

Connection

Robo advisory and financial planning software are interconnected through their use of advanced algorithms and data analytics to provide automated, personalized investment advice and portfolio management. These technologies leverage real-time market data and client financial profiles to optimize asset allocation and risk management efficiently. Integration of robo advisory into financial planning software enhances predictive modeling and improves decision-making accuracy for investors.

Key Terms

Customization

Financial planning software offers extensive customization options, allowing users to tailor budgeting, investment strategies, and retirement goals according to their unique financial situations. Robo advisory platforms provide algorithm-driven investment management with limited personalization, primarily focusing on portfolio allocation based on risk tolerance and time horizon. Explore further to understand which solution fits your financial customization needs best.

Automation

Financial planning software offers extensive automation tools that streamline budgeting, investment tracking, and tax planning by integrating personal financial data and generating customized reports. Robo advisory platforms primarily automate portfolio management using algorithms to provide low-cost, algorithm-driven investment advice based on risk tolerance and financial goals. Explore more about how automation in these technologies can optimize your financial decision-making.

Human Intervention

Financial planning software offers tailored strategies that often require human expertise to interpret complex financial situations and provide personalized advice. Robo advisory platforms use algorithms to automate portfolio management with minimal human intervention, appealing to investors seeking cost-effective, hands-off solutions. Explore the nuances of human involvement in these tools to choose the best fit for your financial goals.

Source and External Links

Top Financial Planning Software Tools for SMBs - Abacum stands out as an intuitive, real-time integrated financial planning platform tailored for mid-sized companies, automating workflows and supporting diverse budgeting methods with excellent user experience and data integration features.

Best Financial Planning Software Of 2025 - MaxiFi is a financial planning software ideal for DIY users and those approaching retirement, offering dynamic, economics-based spending forecasts and risk analysis to optimize retirement timing and income strategies.

ProjectionLab - Modern Financial & Retirement Planning Tools - ProjectionLab provides advanced simulation tools for personal financial and retirement planning, allowing users to model detailed life milestones and visualize a broad range of financial outcomes with privacy-focused design.

dowidth.com

dowidth.com