Altcoins staking involves locking digital assets in a blockchain network to support operations and earn rewards, offering predictable returns based on network participation. Decentralized finance (DeFi) pools allow users to contribute assets to liquidity pools, facilitating trading and lending with variable yields influenced by market dynamics. Explore the differences and benefits of altcoins staking and DeFi pools to optimize your crypto investment strategy.

Why it is important

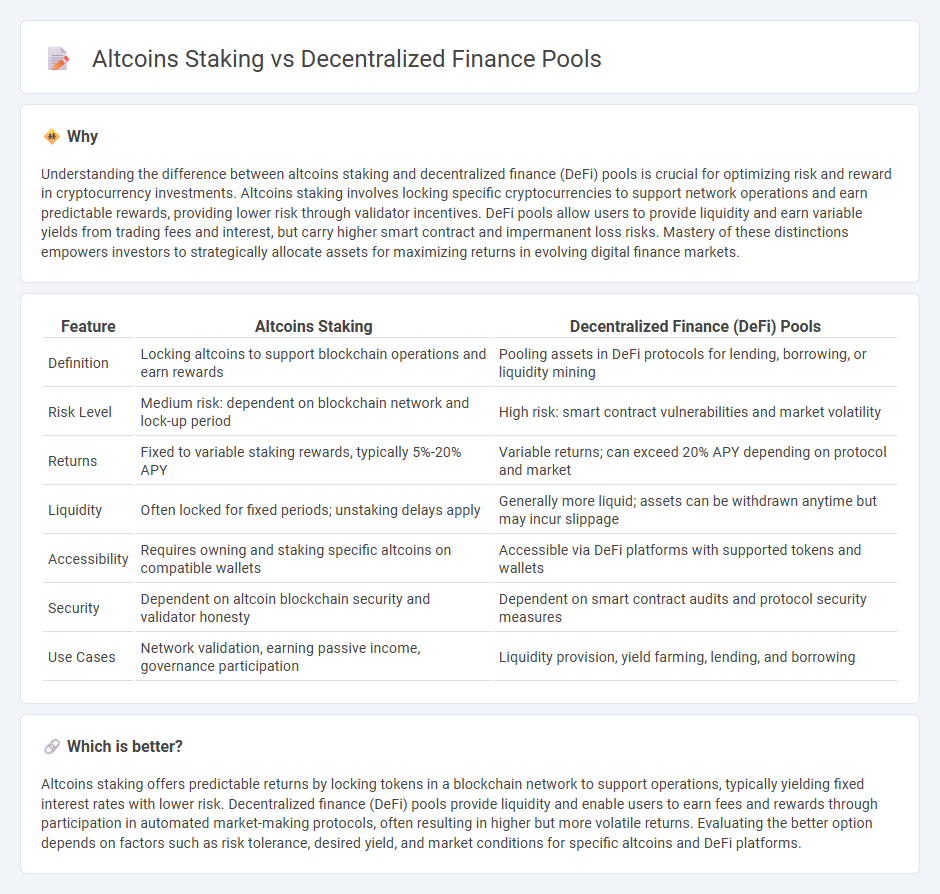

Understanding the difference between altcoins staking and decentralized finance (DeFi) pools is crucial for optimizing risk and reward in cryptocurrency investments. Altcoins staking involves locking specific cryptocurrencies to support network operations and earn predictable rewards, providing lower risk through validator incentives. DeFi pools allow users to provide liquidity and earn variable yields from trading fees and interest, but carry higher smart contract and impermanent loss risks. Mastery of these distinctions empowers investors to strategically allocate assets for maximizing returns in evolving digital finance markets.

Comparison Table

| Feature | Altcoins Staking | Decentralized Finance (DeFi) Pools |

|---|---|---|

| Definition | Locking altcoins to support blockchain operations and earn rewards | Pooling assets in DeFi protocols for lending, borrowing, or liquidity mining |

| Risk Level | Medium risk: dependent on blockchain network and lock-up period | High risk: smart contract vulnerabilities and market volatility |

| Returns | Fixed to variable staking rewards, typically 5%-20% APY | Variable returns; can exceed 20% APY depending on protocol and market |

| Liquidity | Often locked for fixed periods; unstaking delays apply | Generally more liquid; assets can be withdrawn anytime but may incur slippage |

| Accessibility | Requires owning and staking specific altcoins on compatible wallets | Accessible via DeFi platforms with supported tokens and wallets |

| Security | Dependent on altcoin blockchain security and validator honesty | Dependent on smart contract audits and protocol security measures |

| Use Cases | Network validation, earning passive income, governance participation | Liquidity provision, yield farming, lending, and borrowing |

Which is better?

Altcoins staking offers predictable returns by locking tokens in a blockchain network to support operations, typically yielding fixed interest rates with lower risk. Decentralized finance (DeFi) pools provide liquidity and enable users to earn fees and rewards through participation in automated market-making protocols, often resulting in higher but more volatile returns. Evaluating the better option depends on factors such as risk tolerance, desired yield, and market conditions for specific altcoins and DeFi platforms.

Connection

Altcoins staking and decentralized finance (DeFi) pools are interconnected through the shared mechanism of liquidity provision and yield generation on blockchain networks. Staking altcoins involves locking tokens to support network operations and earn rewards, while DeFi pools aggregate crypto assets to facilitate decentralized lending, borrowing, and trading, enhancing liquidity and user incentives. This synergy boosts both network security and capital efficiency, driving growth in decentralized financial ecosystems.

Key Terms

Liquidity Pools

Liquidity pools in decentralized finance (DeFi) enable users to provide assets to facilitate trading and earn fees, offering higher capital efficiency compared to staking altcoins, which typically locks tokens to secure a network and receive rewards. Unlike altcoin staking, liquidity pools promote continuous market activity and better asset utilization by enabling instant swaps within automated market maker (AMM) protocols such as Uniswap and SushiSwap. Explore the advantages and mechanisms of liquidity pools to enhance your DeFi strategy.

Yield Farming

Yield farming in decentralized finance (DeFi) pools involves providing liquidity to smart contracts in exchange for multiple token rewards, often resulting in higher yields compared to staking altcoins. Altcoin staking typically locks tokens to support blockchain operations and earns rewards based on network consensus, with generally lower, more stable returns. Explore detailed comparisons to optimize your strategy between yield farming and altcoin staking.

Token Staking

Token staking in decentralized finance (DeFi) pools involves users locking tokens to provide liquidity and earn rewards through transaction fees, enhancing network security and liquidity depth. In contrast, altcoin staking typically supports protocol consensus mechanisms like Proof of Stake, rewarding participants with new tokens for validating transactions and securing the blockchain. Explore further to understand which token staking method aligns best with your investment goals and risk tolerance.

Source and External Links

Liquidity Pools Explained: Simplifying DeFi for Beginners - BitPay - Liquidity pools in decentralized finance (DeFi) are smart contract-based pools of funds that enable transactions without traditional intermediaries, offering rewards to liquidity providers and facilitating activities like trading and lending.

Liquidity Pools for Beginners: DeFi 101 - tastycrypto - Liquidity pools consist of paired cryptocurrencies contributed by users who receive liquidity tokens in return, enabling decentralized trading and earning fees from trades, thus supporting DeFi's inclusive financial system.

What are liquidity pools? Providing liquidity in DeFi - MoonPay - Liquidity pools are essential for decentralized exchanges, using Automated Market Makers (AMMs) to facilitate peer-to-peer trading by allowing users to deposit assets into smart contracts and trade tokens without intermediaries.

dowidth.com

dowidth.com