Finfluencers leverage social media platforms to share personal finance tips, investment insights, and market trends, often reaching a younger audience with accessible content. Financial advisors provide personalized, professional guidance based on comprehensive financial planning, risk assessment, and regulatory standards to help clients achieve long-term financial goals. Explore the key differences and benefits of each to determine the best fit for your financial needs.

Why it is important

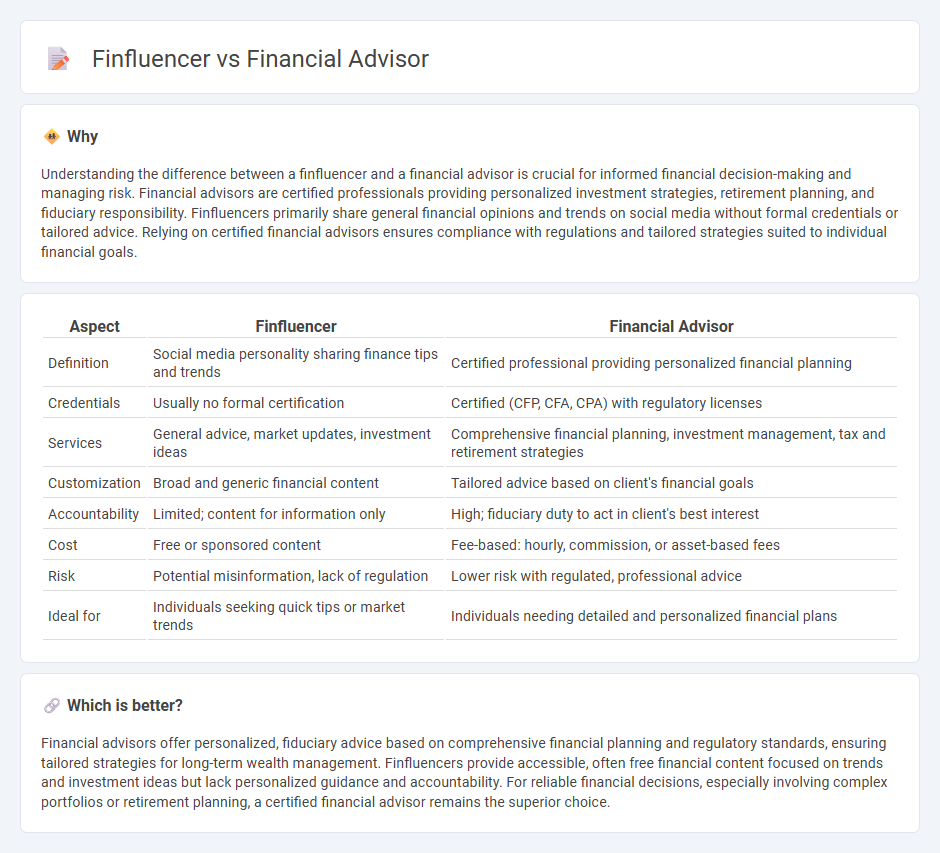

Understanding the difference between a finfluencer and a financial advisor is crucial for informed financial decision-making and managing risk. Financial advisors are certified professionals providing personalized investment strategies, retirement planning, and fiduciary responsibility. Finfluencers primarily share general financial opinions and trends on social media without formal credentials or tailored advice. Relying on certified financial advisors ensures compliance with regulations and tailored strategies suited to individual financial goals.

Comparison Table

| Aspect | Finfluencer | Financial Advisor |

|---|---|---|

| Definition | Social media personality sharing finance tips and trends | Certified professional providing personalized financial planning |

| Credentials | Usually no formal certification | Certified (CFP, CFA, CPA) with regulatory licenses |

| Services | General advice, market updates, investment ideas | Comprehensive financial planning, investment management, tax and retirement strategies |

| Customization | Broad and generic financial content | Tailored advice based on client's financial goals |

| Accountability | Limited; content for information only | High; fiduciary duty to act in client's best interest |

| Cost | Free or sponsored content | Fee-based: hourly, commission, or asset-based fees |

| Risk | Potential misinformation, lack of regulation | Lower risk with regulated, professional advice |

| Ideal for | Individuals seeking quick tips or market trends | Individuals needing detailed and personalized financial plans |

Which is better?

Financial advisors offer personalized, fiduciary advice based on comprehensive financial planning and regulatory standards, ensuring tailored strategies for long-term wealth management. Finfluencers provide accessible, often free financial content focused on trends and investment ideas but lack personalized guidance and accountability. For reliable financial decisions, especially involving complex portfolios or retirement planning, a certified financial advisor remains the superior choice.

Connection

Finfluencers leverage social media platforms to provide accessible financial education and promote investment strategies, often influencing the decisions of a broad audience. Financial advisors offer personalized, regulated advice tailored to individual client needs, ensuring compliance with fiduciary standards and regulatory requirements. Both roles intersect in shaping financial literacy and investment behavior, but financial advisors deliver professional, customized guidance while finfluencers primarily focus on mass communication and trend-driven content.

Key Terms

Fiduciary Duty

Financial advisors are legally bound by a fiduciary duty to act in their clients' best interests, providing tailored investment advice and transparent fee structures. Finfluencers, while influential on social media platforms, often lack this formal obligation and may prioritize brand partnerships or sponsored content over personalized financial guidance. Discover the critical distinctions between fiduciary responsibility and influencer influence for smarter financial decisions.

Disclosure Regulations

Financial advisors are bound by strict disclosure regulations enforced by regulatory bodies such as the SEC and FINRA, mandating transparent reporting of conflicts of interest, fees, and investment risks to protect clients. Finfluencers, often operating on social media platforms, face less stringent disclosure requirements, leading to potential gaps in transparency and investor protection. Explore the detailed regulatory distinctions and their impact on investor trust by learning more about this evolving landscape.

Content Monetization

Financial advisors generate income through personalized financial planning services, client consultations, and management fees, relying on trust and expertise to secure long-term client relationships. Finfluencers monetize content primarily via brand partnerships, sponsored posts, affiliate marketing, and ad revenue on platforms like Instagram and YouTube, leveraging large follower bases and engagement metrics. Explore the distinct monetization strategies to understand how each professional capitalizes on financial knowledge in the digital age.

Source and External Links

Financial Advisor vs. Financial Planner - Explains that a fiduciary financial advisor is legally and ethically obliged to act in the best interest of clients, highlighting the duties of loyalty, care, good faith, full disclosure, and ongoing management; also notes that becoming a Certified Financial Planner (CFP(r)) or Registered Investment Advisor (RIA) involves fiduciary responsibilities.

Financial Advisor Job Description [Updated for 2025] - Indeed - Describes financial advisors as professionals who help clients develop wealth management strategies, including investments, taxes, and estate planning, requiring strong communication, analytical skills, and expertise in finance industry regulations and products.

How to Choose a Financial Advisor - Investing - NerdWallet - Advises to choose financial advisors with fiduciary duty such as Certified Financial Planners (CFP) or Registered Investment Advisors (RIA), emphasizing the importance of credentials and fee structures to ensure client interests are prioritized.

dowidth.com

dowidth.com