Collateralized reinsurance involves the ceding company fully collateralizing the reinsurance contract, ensuring immediate funds availability and reduced counterparty risk. Excess of loss reinsurance provides protection against losses exceeding a specified retained limit, offering a safety net for catastrophic events while balancing cost and risk retention. Explore further to understand how these reinsurance structures optimize financial risk management.

Why it is important

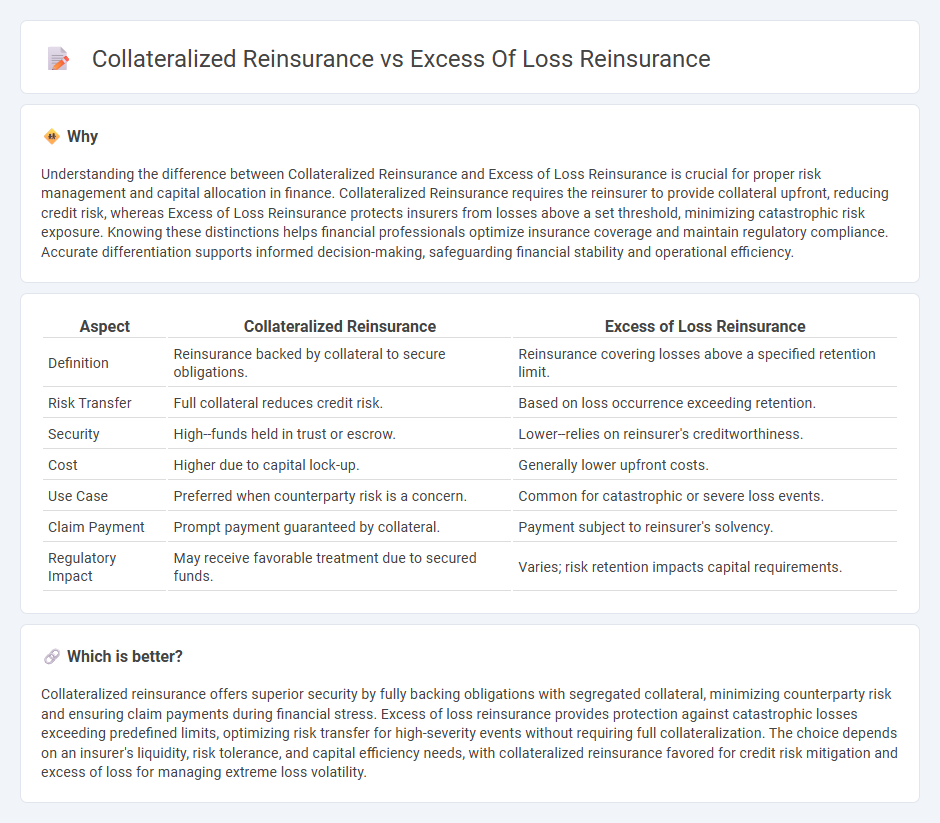

Understanding the difference between Collateralized Reinsurance and Excess of Loss Reinsurance is crucial for proper risk management and capital allocation in finance. Collateralized Reinsurance requires the reinsurer to provide collateral upfront, reducing credit risk, whereas Excess of Loss Reinsurance protects insurers from losses above a set threshold, minimizing catastrophic risk exposure. Knowing these distinctions helps financial professionals optimize insurance coverage and maintain regulatory compliance. Accurate differentiation supports informed decision-making, safeguarding financial stability and operational efficiency.

Comparison Table

| Aspect | Collateralized Reinsurance | Excess of Loss Reinsurance |

|---|---|---|

| Definition | Reinsurance backed by collateral to secure obligations. | Reinsurance covering losses above a specified retention limit. |

| Risk Transfer | Full collateral reduces credit risk. | Based on loss occurrence exceeding retention. |

| Security | High--funds held in trust or escrow. | Lower--relies on reinsurer's creditworthiness. |

| Cost | Higher due to capital lock-up. | Generally lower upfront costs. |

| Use Case | Preferred when counterparty risk is a concern. | Common for catastrophic or severe loss events. |

| Claim Payment | Prompt payment guaranteed by collateral. | Payment subject to reinsurer's solvency. |

| Regulatory Impact | May receive favorable treatment due to secured funds. | Varies; risk retention impacts capital requirements. |

Which is better?

Collateralized reinsurance offers superior security by fully backing obligations with segregated collateral, minimizing counterparty risk and ensuring claim payments during financial stress. Excess of loss reinsurance provides protection against catastrophic losses exceeding predefined limits, optimizing risk transfer for high-severity events without requiring full collateralization. The choice depends on an insurer's liquidity, risk tolerance, and capital efficiency needs, with collateralized reinsurance favored for credit risk mitigation and excess of loss for managing extreme loss volatility.

Connection

Collateralized reinsurance and Excess of Loss reinsurance are interconnected as risk mitigation strategies in the reinsurance market, with collateralized reinsurance providing secured funds upfront to cover potential claims in Excess of Loss contracts. Excess of Loss reinsurance protects ceding insurers from losses exceeding a predefined retention limit, while collateralized arrangements ensure liquidity and creditworthiness to support these high-severity claim payments. This synergy enhances financial stability for insurers by managing catastrophic risks and aligning capital with potential loss exposures.

Key Terms

Retention

Excess of loss reinsurance involves the ceding company retaining a predetermined loss amount before the reinsurer covers losses exceeding that retention, which limits the ceding company's risk exposure to a specific threshold. Collateralized reinsurance typically requires the ceding company to post collateral equivalent to the maximum reinsurer's liability, effectively securing the reinsurer's obligation and influencing retention through the availability of collateral rather than pure risk appetite. Explore detailed comparisons of retention levels, risk transfer mechanisms, and capital implications to understand the strategic benefits of each reinsurance structure.

Collateral

Collateralized reinsurance involves setting aside specific assets as security to guarantee claim payments, enhancing credit protection for the ceding company compared to excess of loss reinsurance. This method reduces counterparty risk by ensuring collateral availability regardless of the reinsurer's financial condition, making it particularly valuable in volatile markets. Explore the benefits and mechanisms of collateralized reinsurance to understand its growing importance in risk management.

Limit

Excess of loss reinsurance offers a predetermined limit where the reinsurer covers losses exceeding a specified retention, often up to a maximum aggregate amount. Collateralized reinsurance involves the ceding insurer providing collateral equal to the limit of coverage, ensuring immediate availability of funds without credit risk concerns. Explore the differences in limit structures and financial security in reinsurance solutions to understand their strategic impacts.

Source and External Links

What Is Excess of Loss Reinsurance? - Excess of loss reinsurance is a type of nonproportional reinsurance where the reinsurer indemnifies the ceding company for losses exceeding a specified limit, covering the amount above that limit rather than sharing all losses proportionally.

Excess of Loss Reinsurance - OnDemand Learning - This agreement limits an insurer's retained risk, with the reinsurer assuming losses above the insurer's retention on a per risk, per occurrence, or aggregate basis.

Excess of Loss Reinsurance | Meaning, Types, Pros, and ... - Excess of loss reinsurance provides protection against catastrophic losses by paying claims exceeding a predetermined retention limit, thereby helping insurers manage large losses and maintain financial stability.

dowidth.com

dowidth.com