Thematic ETFs focus on investing in companies aligned with specific trends or themes such as clean energy, artificial intelligence, or healthcare innovation, providing targeted exposure to evolving market sectors. Factor ETFs, on the other hand, target specific investment factors like value, momentum, low volatility, or quality to enhance risk-adjusted returns by capitalizing on systematic market anomalies. Explore the distinct advantages and strategies behind Thematic and Factor ETFs to optimize your investment portfolio.

Why it is important

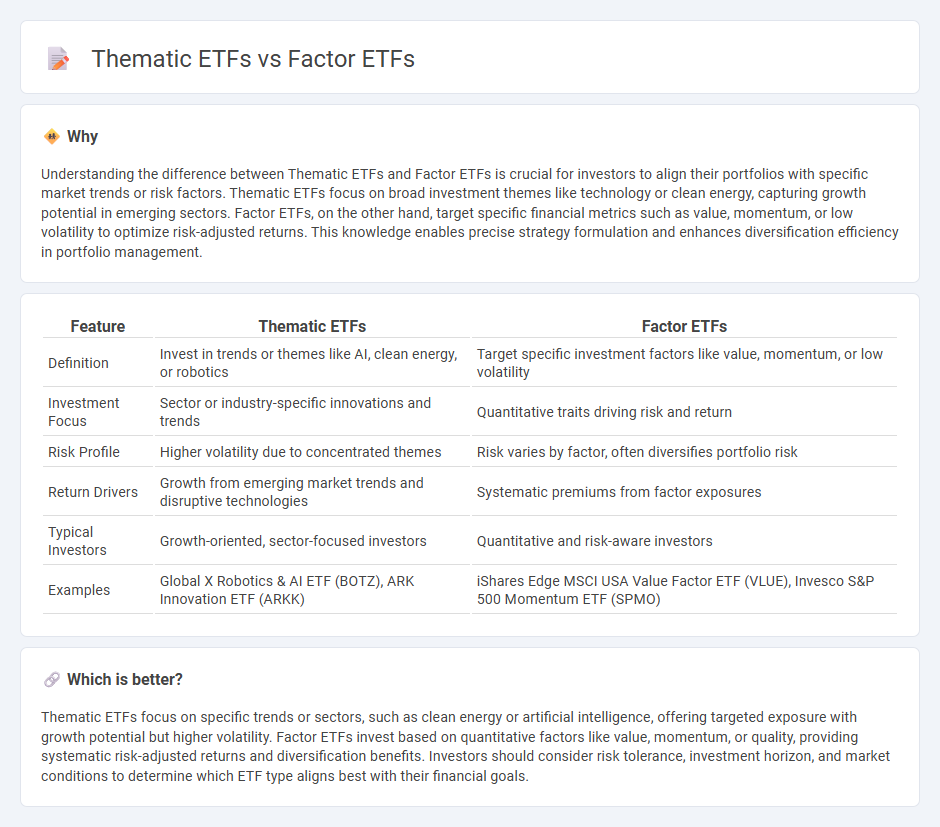

Understanding the difference between Thematic ETFs and Factor ETFs is crucial for investors to align their portfolios with specific market trends or risk factors. Thematic ETFs focus on broad investment themes like technology or clean energy, capturing growth potential in emerging sectors. Factor ETFs, on the other hand, target specific financial metrics such as value, momentum, or low volatility to optimize risk-adjusted returns. This knowledge enables precise strategy formulation and enhances diversification efficiency in portfolio management.

Comparison Table

| Feature | Thematic ETFs | Factor ETFs |

|---|---|---|

| Definition | Invest in trends or themes like AI, clean energy, or robotics | Target specific investment factors like value, momentum, or low volatility |

| Investment Focus | Sector or industry-specific innovations and trends | Quantitative traits driving risk and return |

| Risk Profile | Higher volatility due to concentrated themes | Risk varies by factor, often diversifies portfolio risk |

| Return Drivers | Growth from emerging market trends and disruptive technologies | Systematic premiums from factor exposures |

| Typical Investors | Growth-oriented, sector-focused investors | Quantitative and risk-aware investors |

| Examples | Global X Robotics & AI ETF (BOTZ), ARK Innovation ETF (ARKK) | iShares Edge MSCI USA Value Factor ETF (VLUE), Invesco S&P 500 Momentum ETF (SPMO) |

Which is better?

Thematic ETFs focus on specific trends or sectors, such as clean energy or artificial intelligence, offering targeted exposure with growth potential but higher volatility. Factor ETFs invest based on quantitative factors like value, momentum, or quality, providing systematic risk-adjusted returns and diversification benefits. Investors should consider risk tolerance, investment horizon, and market conditions to determine which ETF type aligns best with their financial goals.

Connection

Thematic ETFs focus on specific investment themes such as clean energy or artificial intelligence, capturing broad trends driving market growth, while Factor ETFs target stocks based on fundamental characteristics like value, momentum, or quality. Both ETF types use systematic strategies to harness market inefficiencies, with thematic ETFs often incorporating factor-based screening to enhance portfolio returns. This connection allows investors to combine high-conviction themes with proven factor premiums for diversified, targeted exposure in the financial markets.

Key Terms

Risk Premia

Factor ETFs target specific risk premia such as value, momentum, and quality by systematically capturing persistent drivers of returns across various asset classes. Thematic ETFs concentrate on long-term structural trends like clean energy, technology innovation, or demographic shifts, often exhibiting higher volatility and thematic risk exposures. Explore detailed analyses to understand how these investment vehicles align with your portfolio's risk and return objectives.

Theme Exposure

Factor ETFs concentrate on specific investment styles such as value, momentum, or quality, optimizing portfolio risk and return based on underlying financial metrics. Thematic ETFs offer targeted exposure to broader trends like clean energy, technology innovation, or demographic shifts, aligning investments with evolving market themes. Explore our detailed analysis to understand which ETF type aligns best with your investment goals and risk tolerance.

Diversification

Factor ETFs concentrate on specific investment factors such as value, momentum, or low volatility to provide diversification across multiple sectors and asset classes. Thematic ETFs, on the other hand, target emerging trends or industries like renewable energy or artificial intelligence, offering diversification within rapidly growing market segments. Explore the differences between these ETF types to optimize your portfolio diversification strategy.

Source and External Links

Factor ETFs are a modern twist on active management - Envestnet - Factor ETFs use systematic factor-based strategies such as Value, Momentum, Low Volatility, Quality, and Size to seek alpha, blending characteristics of active and passive investing with flexibility and tax efficiency, currently holding about $950 billion in assets.

Factor ETFs | BMO Global Asset Management - Factor ETFs, also called smart beta ETFs, specifically target return drivers like low volatility, quality, dividends, equal weight, and value, aiming to enhance portfolio returns and manage risk through rules-based strategies aligned with investors' goals.

What is Factor Investing? | Pacer ETFs - Factor ETFs allow investors to gain exposure to stock characteristics such as quality or low volatility through single or blended factor funds that use index-based rules, making factor investing accessible and diversifying risk across multiple factors.

dowidth.com

dowidth.com