Alternative data scraping collects unconventional datasets such as satellite imagery, social media activity, and transactional records to identify investment opportunities beyond traditional financial metrics. Market sentiment analysis evaluates public opinion and emotional tone from news, social media, and analyst reports to gauge investor behavior and predict market movements. Explore how integrating these innovative techniques can enhance financial decision-making strategies.

Why it is important

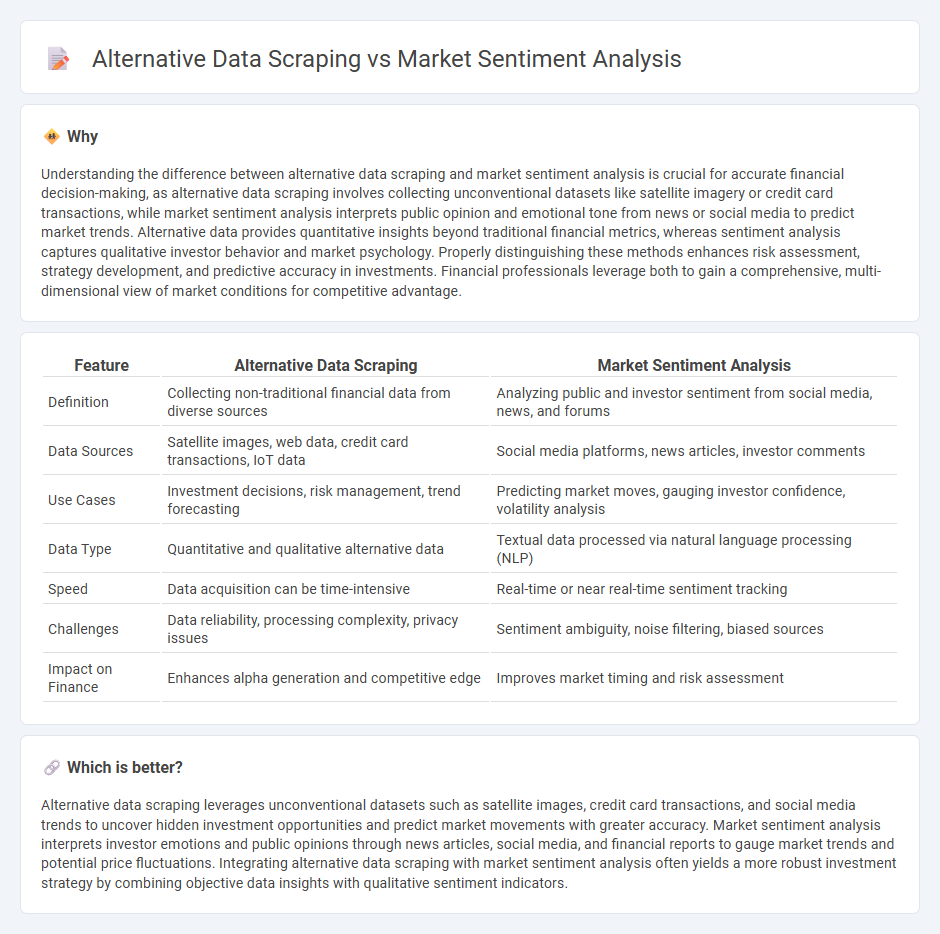

Understanding the difference between alternative data scraping and market sentiment analysis is crucial for accurate financial decision-making, as alternative data scraping involves collecting unconventional datasets like satellite imagery or credit card transactions, while market sentiment analysis interprets public opinion and emotional tone from news or social media to predict market trends. Alternative data provides quantitative insights beyond traditional financial metrics, whereas sentiment analysis captures qualitative investor behavior and market psychology. Properly distinguishing these methods enhances risk assessment, strategy development, and predictive accuracy in investments. Financial professionals leverage both to gain a comprehensive, multi-dimensional view of market conditions for competitive advantage.

Comparison Table

| Feature | Alternative Data Scraping | Market Sentiment Analysis |

|---|---|---|

| Definition | Collecting non-traditional financial data from diverse sources | Analyzing public and investor sentiment from social media, news, and forums |

| Data Sources | Satellite images, web data, credit card transactions, IoT data | Social media platforms, news articles, investor comments |

| Use Cases | Investment decisions, risk management, trend forecasting | Predicting market moves, gauging investor confidence, volatility analysis |

| Data Type | Quantitative and qualitative alternative data | Textual data processed via natural language processing (NLP) |

| Speed | Data acquisition can be time-intensive | Real-time or near real-time sentiment tracking |

| Challenges | Data reliability, processing complexity, privacy issues | Sentiment ambiguity, noise filtering, biased sources |

| Impact on Finance | Enhances alpha generation and competitive edge | Improves market timing and risk assessment |

Which is better?

Alternative data scraping leverages unconventional datasets such as satellite images, credit card transactions, and social media trends to uncover hidden investment opportunities and predict market movements with greater accuracy. Market sentiment analysis interprets investor emotions and public opinions through news articles, social media, and financial reports to gauge market trends and potential price fluctuations. Integrating alternative data scraping with market sentiment analysis often yields a more robust investment strategy by combining objective data insights with qualitative sentiment indicators.

Connection

Alternative data scraping gathers unconventional financial information such as social media trends, satellite images, and web traffic, providing real-time insights into market behavior. Market sentiment analysis interprets this alternative data to gauge investor emotions and predict asset price movements with greater accuracy. The integration of alternative data scraping and sentiment analysis enhances decision-making by identifying patterns often missed by traditional financial metrics.

Key Terms

Market sentiment analysis:

Market sentiment analysis leverages natural language processing and machine learning algorithms to interpret investor emotions and trends from social media, news, and financial reports, providing real-time insights into market dynamics. This technique enhances predictive accuracy by evaluating the collective mood, which often precedes price movements and trading volumes. Explore how advanced sentiment analysis can transform your investment strategies and risk management.

Sentiment score

Market sentiment analysis uses natural language processing to quantify investor emotions into sentiment scores derived from news, social media, and financial reports. Alternative data scraping collects unconventional datasets such as web traffic, satellite images, and transactional data, which can be transformed into sentiment scores for enhanced predictive insights. Discover how integrating sentiment score methodologies from both approaches can improve investment strategies.

Natural language processing (NLP)

Market sentiment analysis leverages Natural Language Processing (NLP) to interpret and quantify emotions expressed in financial news, social media, and earnings reports, providing valuable insights into investor behavior and market trends. Alternative data scraping captures non-traditional datasets such as satellite images, web traffic, and consumer reviews, enhancing predictive accuracy when paired with advanced NLP techniques to extract actionable information. Explore how integrating NLP in both approaches can revolutionize your investment strategies and market forecasting precision.

Source and External Links

AAII Investor Sentiment Survey - This weekly survey measures the percentage of individual investors who feel bullish, bearish, or neutral about the stock market, providing a quantitative snapshot of short-term expectations.

Market Sentiment - Definition, Indicator Types, Strategies - Market sentiment refers to the overall optimism or pessimism of investors towards the market, typically reflected in price trends and influenced by psychological biases.

The power of news sentiment in modern financial analysis - Sentiment analysis leverages news and online content to detect shifts in investor mood, improving risk management and predictive power by flagging potential market-moving events.

dowidth.com

dowidth.com