Greenium reflects the premium investors pay for environmentally friendly bonds, often resulting in lower yields compared to conventional bonds. Tax-equivalent yield calculates the return on tax-advantaged securities as if they were fully taxable, enabling accurate comparisons across different investment types. Explore more to understand how these metrics influence investment decisions and portfolio strategies.

Why it is important

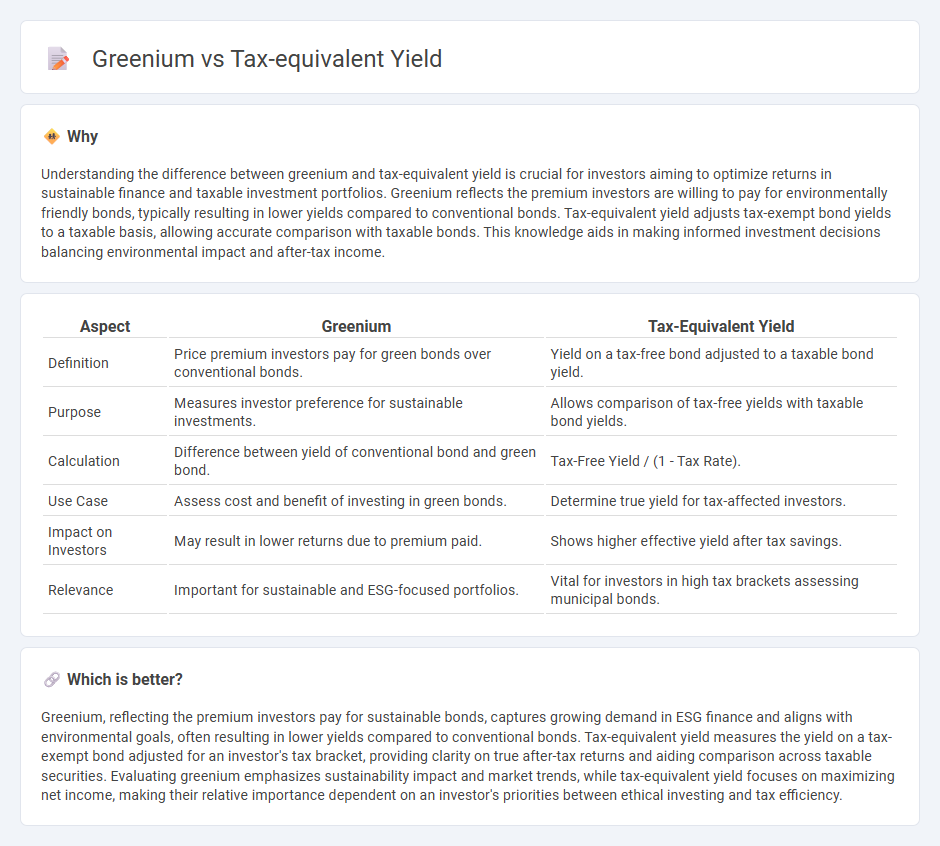

Understanding the difference between greenium and tax-equivalent yield is crucial for investors aiming to optimize returns in sustainable finance and taxable investment portfolios. Greenium reflects the premium investors are willing to pay for environmentally friendly bonds, typically resulting in lower yields compared to conventional bonds. Tax-equivalent yield adjusts tax-exempt bond yields to a taxable basis, allowing accurate comparison with taxable bonds. This knowledge aids in making informed investment decisions balancing environmental impact and after-tax income.

Comparison Table

| Aspect | Greenium | Tax-Equivalent Yield |

|---|---|---|

| Definition | Price premium investors pay for green bonds over conventional bonds. | Yield on a tax-free bond adjusted to a taxable bond yield. |

| Purpose | Measures investor preference for sustainable investments. | Allows comparison of tax-free yields with taxable bond yields. |

| Calculation | Difference between yield of conventional bond and green bond. | Tax-Free Yield / (1 - Tax Rate). |

| Use Case | Assess cost and benefit of investing in green bonds. | Determine true yield for tax-affected investors. |

| Impact on Investors | May result in lower returns due to premium paid. | Shows higher effective yield after tax savings. |

| Relevance | Important for sustainable and ESG-focused portfolios. | Vital for investors in high tax brackets assessing municipal bonds. |

Which is better?

Greenium, reflecting the premium investors pay for sustainable bonds, captures growing demand in ESG finance and aligns with environmental goals, often resulting in lower yields compared to conventional bonds. Tax-equivalent yield measures the yield on a tax-exempt bond adjusted for an investor's tax bracket, providing clarity on true after-tax returns and aiding comparison across taxable securities. Evaluating greenium emphasizes sustainability impact and market trends, while tax-equivalent yield focuses on maximizing net income, making their relative importance dependent on an investor's priorities between ethical investing and tax efficiency.

Connection

Greenium reflects the premium investors pay for green bonds compared to conventional ones, resulting in lower yields due to heightened demand for environmentally friendly investments. Tax-equivalent yield calculates the pre-tax yield an investor needs from a taxable bond to match the after-tax yield of a tax-exempt bond, aiding comparison across bond types. Both metrics help investors evaluate bond returns by adjusting for tax impacts and investor preferences, integrating financial performance with sustainability considerations.

Key Terms

After-tax yield

Tax-equivalent yield calculates the pre-tax yield an investor needs to match the after-tax return of a tax-exempt bond, emphasizing the impact of tax brackets on investment income. Greenium refers to the yield premium or discount associated with green bonds relative to conventional bonds, often reflecting investor demand for sustainable investments which may lower yields. Explore the nuances of after-tax yield to understand how tax-equivalent yield and greenium affect investment decisions in tax-sensitive portfolios.

Green bond premium

The greenium refers to the premium investors are willing to accept on green bonds compared to conventional bonds, often resulting in a lower yield despite similar credit risk. Tax-equivalent yield calculates the yield on municipal bonds adjusted for tax advantages to allow comparison with taxable bonds, but it does not account for the greenium embedded in green bonds. Explore more about how greenium affects investor decisions and bond valuations in sustainable finance.

Tax-exempt interest

Tax-equivalent yield measures the pre-tax return an investor needs from a taxable bond to match the after-tax return of a tax-exempt bond, highlighting the impact of tax benefits on investment returns. Greenium refers to the interest rate premium investors accept for green bonds, often trading at lower yields due to their environmental benefits and tax-exempt interest features. Explore how tax-exempt interest influences both tax-equivalent yield calculations and greenium valuations for a comprehensive investment strategy.

Source and External Links

Understanding tax-equivalent yield (JH Investments) - Tax-equivalent yield is the return a taxable bond would need to generate to match the yield of a comparable tax-exempt bond, calculated as the tax-free yield divided by one minus your federal tax bracket.

The power of tax-equivalent yield (New York Life Investments) - Tax-equivalent yield helps investors fairly compare otherwise incomparable yields between taxable and tax-exempt investments, showing what pretax yield is needed for a taxable security to equal a tax-exempt one.

Tax Equivalent Yield - Definition, Formula, Why It Matters (CFI) - Tax-equivalent yield tells you what yield is required on a taxable bond to provide the same after-tax return as a tax-exempt municipal bond, considering the investor's marginal tax rate.

dowidth.com

dowidth.com