Sovereign debt restructuring involves renegotiating existing debt terms to improve a country's fiscal sustainability, often pursued during financial distress or default risks. Eurobond issuance allows governments to raise capital in international markets by selling debt instruments denominated in foreign currencies, enabling access to a broader investor base and favorable financing conditions. Explore the advantages and challenges of these financing strategies to better understand their impact on national economies.

Why it is important

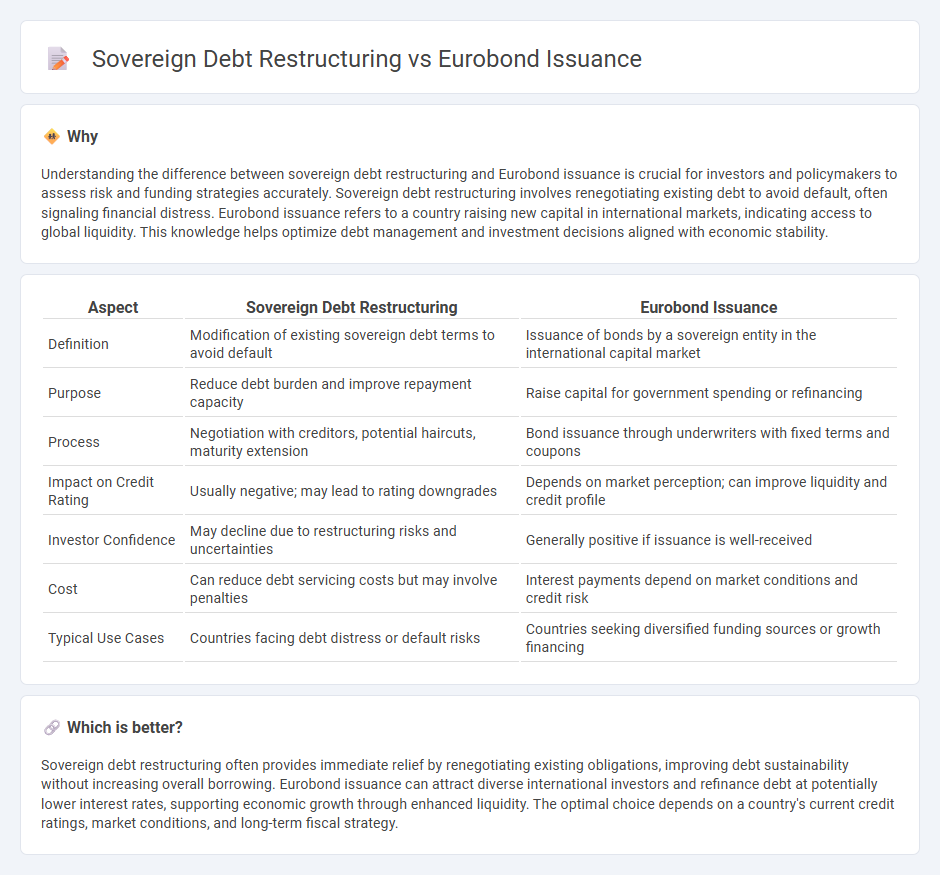

Understanding the difference between sovereign debt restructuring and Eurobond issuance is crucial for investors and policymakers to assess risk and funding strategies accurately. Sovereign debt restructuring involves renegotiating existing debt to avoid default, often signaling financial distress. Eurobond issuance refers to a country raising new capital in international markets, indicating access to global liquidity. This knowledge helps optimize debt management and investment decisions aligned with economic stability.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Eurobond Issuance |

|---|---|---|

| Definition | Modification of existing sovereign debt terms to avoid default | Issuance of bonds by a sovereign entity in the international capital market |

| Purpose | Reduce debt burden and improve repayment capacity | Raise capital for government spending or refinancing |

| Process | Negotiation with creditors, potential haircuts, maturity extension | Bond issuance through underwriters with fixed terms and coupons |

| Impact on Credit Rating | Usually negative; may lead to rating downgrades | Depends on market perception; can improve liquidity and credit profile |

| Investor Confidence | May decline due to restructuring risks and uncertainties | Generally positive if issuance is well-received |

| Cost | Can reduce debt servicing costs but may involve penalties | Interest payments depend on market conditions and credit risk |

| Typical Use Cases | Countries facing debt distress or default risks | Countries seeking diversified funding sources or growth financing |

Which is better?

Sovereign debt restructuring often provides immediate relief by renegotiating existing obligations, improving debt sustainability without increasing overall borrowing. Eurobond issuance can attract diverse international investors and refinance debt at potentially lower interest rates, supporting economic growth through enhanced liquidity. The optimal choice depends on a country's current credit ratings, market conditions, and long-term fiscal strategy.

Connection

Sovereign debt restructuring often involves renegotiating terms to enhance debt sustainability, which can pave the way for issuing Eurobonds as a signal of restored creditworthiness and market confidence. Issuance of Eurobonds provides countries with access to international capital markets, offering longer maturities and diversified investor bases compared to domestic debt. The strategic use of Eurobond issuance after restructuring helps governments manage refinancing risks and reduce borrowing costs while attracting global investors.

Key Terms

Underwriting

Eurobond issuance serves as a method for sovereign governments to raise capital by offering bonds to international investors, relying heavily on underwriting banks to ensure pricing, distribution, and risk management. Sovereign debt restructuring, conversely, involves renegotiating existing debt terms to improve fiscal sustainability, with underwriters playing a crucial role in assessing credit risk and facilitating negotiations with creditors. Explore how underwriting strategies differ in these financial processes and their impact on sovereign debt management.

Collective Action Clauses (CACs)

Eurobond issuance often incorporates Collective Action Clauses (CACs) to facilitate coordinated creditor agreements during sovereign debt restructuring, enabling smoother modifications to bond terms without full unanimous consent. These CACs provide legal mechanisms that help governments restructure debt more efficiently, reducing the risk of holdout creditors and minimizing litigation. Explore the impact of CACs on sovereign debt management and market stability for deeper insights.

Haircut

Eurobond issuance represents a method for countries to raise capital by issuing bonds in foreign markets, often attracting international investors with competitive yields. Sovereign debt restructuring involves renegotiating existing debt terms, frequently including a "haircut," which is a reduction in the principal or interest amount owed to lenders to restore debt sustainability. Explore deeper insights into how haircuts impact national creditworthiness and investor confidence.

Source and External Links

What is the process of issuing a Eurobond? - HowNoww - Issuing a Eurobond involves appointing advisers (bookrunners), preparing an investor presentation, conducting a roadshow for investor meetings, building an orderbook, and finally announcing the issue details including size, yield, and coupon rate after the roadshow.

Eurobond (external bond) - Wikipedia - A Eurobond is an international bond denominated in a currency not native to the country where it is issued, originally created in the 1960s to bypass certain taxes and now commonly traded electronically via central securities depositories.

Understanding Eurobonds: A financial history journey - Euroclear - Eurobonds started in the 1960s to create a global bond market connecting issuers and investors worldwide, with the first issuance being by Italy's Autostrade raising USD 15 million from international investors.

dowidth.com

dowidth.com