Carbon trading enables companies to buy and sell emission allowances within a regulatory cap, promoting cost-effective reductions in greenhouse gases. Emissions offsetting allows organizations to compensate for their carbon footprint by investing in environmental projects that reduce or capture emissions elsewhere. Explore the nuanced differences between these financial mechanisms to better understand their roles in sustainability strategies.

Why it is important

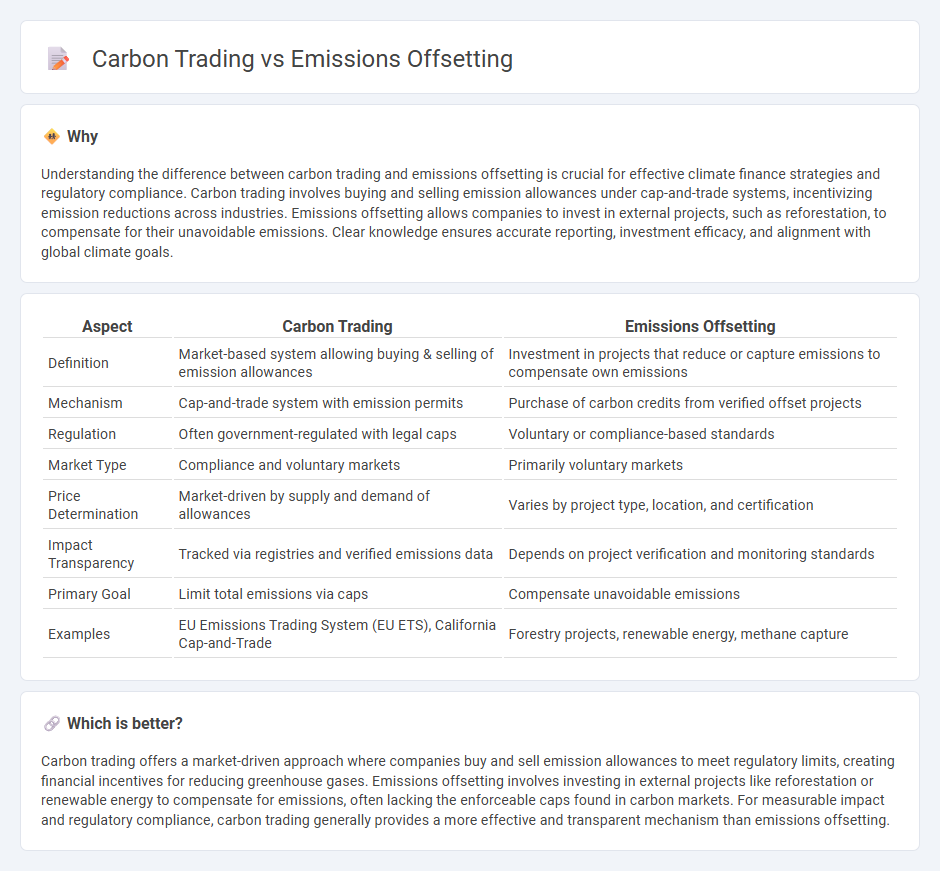

Understanding the difference between carbon trading and emissions offsetting is crucial for effective climate finance strategies and regulatory compliance. Carbon trading involves buying and selling emission allowances under cap-and-trade systems, incentivizing emission reductions across industries. Emissions offsetting allows companies to invest in external projects, such as reforestation, to compensate for their unavoidable emissions. Clear knowledge ensures accurate reporting, investment efficacy, and alignment with global climate goals.

Comparison Table

| Aspect | Carbon Trading | Emissions Offsetting |

|---|---|---|

| Definition | Market-based system allowing buying & selling of emission allowances | Investment in projects that reduce or capture emissions to compensate own emissions |

| Mechanism | Cap-and-trade system with emission permits | Purchase of carbon credits from verified offset projects |

| Regulation | Often government-regulated with legal caps | Voluntary or compliance-based standards |

| Market Type | Compliance and voluntary markets | Primarily voluntary markets |

| Price Determination | Market-driven by supply and demand of allowances | Varies by project type, location, and certification |

| Impact Transparency | Tracked via registries and verified emissions data | Depends on project verification and monitoring standards |

| Primary Goal | Limit total emissions via caps | Compensate unavoidable emissions |

| Examples | EU Emissions Trading System (EU ETS), California Cap-and-Trade | Forestry projects, renewable energy, methane capture |

Which is better?

Carbon trading offers a market-driven approach where companies buy and sell emission allowances to meet regulatory limits, creating financial incentives for reducing greenhouse gases. Emissions offsetting involves investing in external projects like reforestation or renewable energy to compensate for emissions, often lacking the enforceable caps found in carbon markets. For measurable impact and regulatory compliance, carbon trading generally provides a more effective and transparent mechanism than emissions offsetting.

Connection

Carbon trading allows companies to buy and sell emission allowances to meet regulatory limits, creating a market-driven approach to reducing greenhouse gases. Emissions offsetting complements this system by enabling organizations to invest in projects that reduce or capture emissions elsewhere, balancing out their carbon footprint. Both mechanisms work together to incentivize lower emissions and support global climate goals by assigning economic value to environmental impact.

Key Terms

Carbon Credits

Carbon credits represent a key mechanism within emissions offsetting and carbon trading frameworks, allowing entities to compensate for their greenhouse gas emissions by investing in verified environmental projects that reduce or remove carbon dioxide from the atmosphere. Emissions offsetting involves generating or purchasing these credits to balance out emissions, whereas carbon trading, also known as cap-and-trade, establishes a market where companies can buy or sell credits to comply with regulatory emission limits. Explore more about how carbon credits drive global climate action and market dynamics.

Cap-and-Trade

Cap-and-trade systems set a maximum limit on greenhouse gas emissions, allowing companies to buy and sell emission allowances to meet these limits efficiently. Emissions offsetting involves purchasing credits from projects that reduce or remove emissions outside the capped sectors to compensate for a company's own emissions. Explore how cap-and-trade markets drive emission reductions and the role of offsets in achieving climate goals.

Verified Emission Reductions (VERs)

Verified Emission Reductions (VERs) represent a voluntary carbon offset mechanism allowing organizations to compensate for their greenhouse gas emissions by purchasing credits from verified projects that reduce or remove emissions. Emissions offsetting involves using VERs to balance out unavoidable emissions, while carbon trading primarily operates through regulated cap-and-trade systems where emissions allowances can be bought and sold in compliance markets. Explore how VERs function within emissions reduction strategies and their growing impact on sustainable business practices.

Source and External Links

Carbon Offsets - MIT Climate Portal - Carbon offsets are tradable certificates linked to activities that reduce or sequester CO2, allowing buyers to compensate their emissions by funding emission-reducing projects like reforestation or renewable energy elsewhere, but require strict verification and standards to ensure actual emission reductions.

What Are Carbon Credits - Offset Guide - Carbon offsetting uses avoided emissions or enhanced removals, represented by carbon credits, to compensate for greenhouse gas emissions, supporting cost-effective climate action worldwide, but quality and rigorous criteria are essential to avoid greenwashing.

Carbon offsets and credits - Wikipedia - Emissions offsetting involves investing in projects such as land use improvement, methane capture, or renewable energy to generate carbon offsets that compensate for greenhouse gas emissions, though eligibility of projects varies by certification program.

dowidth.com

dowidth.com