Decentralized Autonomous Organization (DAO) treasuries operate on blockchain technology, enabling transparent, community-driven management of digital assets without centralized control. Hedge funds are traditional investment vehicles managed by professional portfolio managers who use various strategies to maximize returns for accredited investors. Explore the evolving dynamics between DAO treasuries and hedge funds to understand their impact on modern finance.

Why it is important

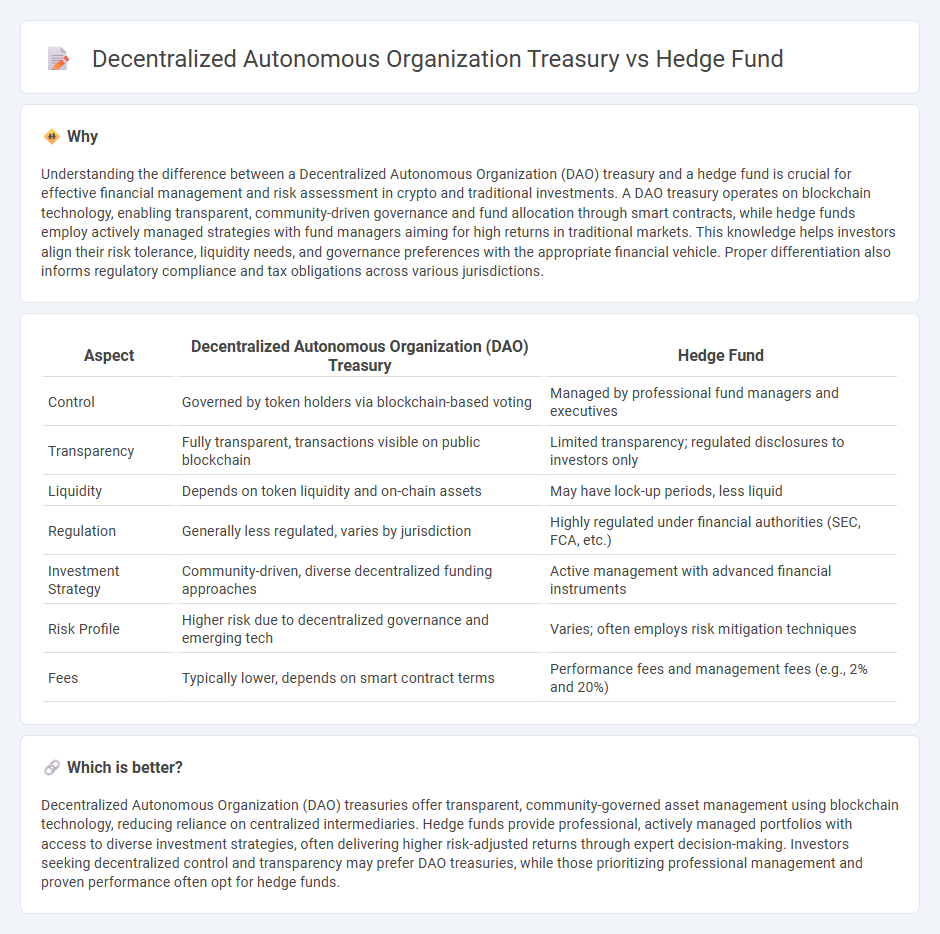

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a hedge fund is crucial for effective financial management and risk assessment in crypto and traditional investments. A DAO treasury operates on blockchain technology, enabling transparent, community-driven governance and fund allocation through smart contracts, while hedge funds employ actively managed strategies with fund managers aiming for high returns in traditional markets. This knowledge helps investors align their risk tolerance, liquidity needs, and governance preferences with the appropriate financial vehicle. Proper differentiation also informs regulatory compliance and tax obligations across various jurisdictions.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) Treasury | Hedge Fund |

|---|---|---|

| Control | Governed by token holders via blockchain-based voting | Managed by professional fund managers and executives |

| Transparency | Fully transparent, transactions visible on public blockchain | Limited transparency; regulated disclosures to investors only |

| Liquidity | Depends on token liquidity and on-chain assets | May have lock-up periods, less liquid |

| Regulation | Generally less regulated, varies by jurisdiction | Highly regulated under financial authorities (SEC, FCA, etc.) |

| Investment Strategy | Community-driven, diverse decentralized funding approaches | Active management with advanced financial instruments |

| Risk Profile | Higher risk due to decentralized governance and emerging tech | Varies; often employs risk mitigation techniques |

| Fees | Typically lower, depends on smart contract terms | Performance fees and management fees (e.g., 2% and 20%) |

Which is better?

Decentralized Autonomous Organization (DAO) treasuries offer transparent, community-governed asset management using blockchain technology, reducing reliance on centralized intermediaries. Hedge funds provide professional, actively managed portfolios with access to diverse investment strategies, often delivering higher risk-adjusted returns through expert decision-making. Investors seeking decentralized control and transparency may prefer DAO treasuries, while those prioritizing professional management and proven performance often opt for hedge funds.

Connection

Decentralized Autonomous Organization (DAO) treasuries manage digital assets through blockchain-based smart contracts, enabling transparent and autonomous fund allocation. Hedge funds increasingly invest in or collaborate with DAOs to leverage decentralized governance for innovative asset management and exposure to emerging digital markets. This synergy enhances liquidity, risk diversification, and access to novel investment opportunities within decentralized finance ecosystems.

Key Terms

Asset Management

Hedge funds utilize centralized strategies and professional managers to optimize asset allocation, risk management, and liquidity for high-net-worth investors. Decentralized autonomous organization (DAO) treasuries operate through blockchain-based governance, offering transparent, community-driven decisions on asset management and fund deployment. Explore how each approach impacts investment efficiency and governance models in asset management.

Smart Contracts

Hedge fund treasuries rely on centralized management and traditional contracts, whereas decentralized autonomous organization (DAO) treasuries utilize smart contracts on blockchain networks for automated, transparent, and tamper-proof financial operations. Smart contracts enable DAOs to execute governance decisions, manage assets, and distribute funds without intermediaries, enhancing efficiency and security compared to hedge funds. Explore the detailed mechanisms behind smart contract integration in DAOs to understand their transformative impact on treasury management.

Risk Governance

Hedge fund risk governance relies on centralized management structures, employing rigorous due diligence, regulatory compliance, and active portfolio monitoring to mitigate financial risks. Decentralized Autonomous Organization (DAO) treasuries utilize blockchain-based smart contracts and community voting to enforce transparent, democratized decision-making, but face challenges in rapid risk response and regulatory clarity. Explore detailed comparisons and strategies for optimizing risk governance in both models to understand their impact on asset security and investor confidence.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - A hedge fund is an investment firm that raises capital from accredited investors and uses diverse strategies like short-selling and derivatives to seek absolute returns by beating market performance or reducing risk.

Hedge fund - Wikipedia - A hedge fund is a pooled investment vehicle managed by an investment manager, often structured as a corporation or limited partnership, which employs complex trading and risk management techniques and relies on prime brokers and administrators for operations.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds pooling money from accredited investors to pursue flexible strategies aiming for positive returns, typically with higher risk and fewer regulations than mutual funds or ETFs.

dowidth.com

dowidth.com