SPACs (Special Purpose Acquisition Companies) offer a streamlined route for private companies to go public by merging with an already-listed shell company, typically attracting institutional investors and enabling faster access to capital markets. Crowdfunding, on the other hand, allows startups and small businesses to raise funds directly from a broad base of retail investors, democratizing investment opportunities and fostering community engagement. Explore the key differences and benefits of SPACs versus crowdfunding to determine the optimal financing strategy for your venture.

Why it is important

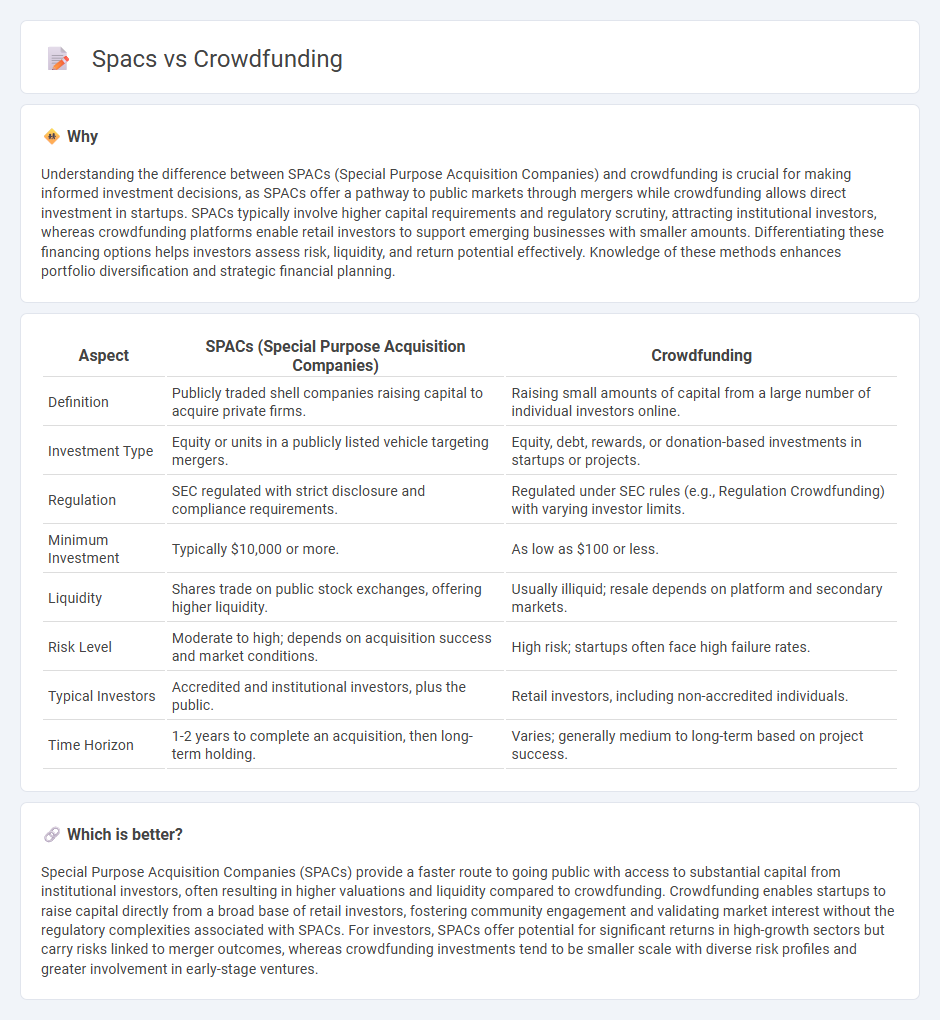

Understanding the difference between SPACs (Special Purpose Acquisition Companies) and crowdfunding is crucial for making informed investment decisions, as SPACs offer a pathway to public markets through mergers while crowdfunding allows direct investment in startups. SPACs typically involve higher capital requirements and regulatory scrutiny, attracting institutional investors, whereas crowdfunding platforms enable retail investors to support emerging businesses with smaller amounts. Differentiating these financing options helps investors assess risk, liquidity, and return potential effectively. Knowledge of these methods enhances portfolio diversification and strategic financial planning.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Crowdfunding |

|---|---|---|

| Definition | Publicly traded shell companies raising capital to acquire private firms. | Raising small amounts of capital from a large number of individual investors online. |

| Investment Type | Equity or units in a publicly listed vehicle targeting mergers. | Equity, debt, rewards, or donation-based investments in startups or projects. |

| Regulation | SEC regulated with strict disclosure and compliance requirements. | Regulated under SEC rules (e.g., Regulation Crowdfunding) with varying investor limits. |

| Minimum Investment | Typically $10,000 or more. | As low as $100 or less. |

| Liquidity | Shares trade on public stock exchanges, offering higher liquidity. | Usually illiquid; resale depends on platform and secondary markets. |

| Risk Level | Moderate to high; depends on acquisition success and market conditions. | High risk; startups often face high failure rates. |

| Typical Investors | Accredited and institutional investors, plus the public. | Retail investors, including non-accredited individuals. |

| Time Horizon | 1-2 years to complete an acquisition, then long-term holding. | Varies; generally medium to long-term based on project success. |

Which is better?

Special Purpose Acquisition Companies (SPACs) provide a faster route to going public with access to substantial capital from institutional investors, often resulting in higher valuations and liquidity compared to crowdfunding. Crowdfunding enables startups to raise capital directly from a broad base of retail investors, fostering community engagement and validating market interest without the regulatory complexities associated with SPACs. For investors, SPACs offer potential for significant returns in high-growth sectors but carry risks linked to merger outcomes, whereas crowdfunding investments tend to be smaller scale with diverse risk profiles and greater involvement in early-stage ventures.

Connection

Special Purpose Acquisition Companies (SPACs) and crowdfunding both offer alternative financing avenues that democratize investment opportunities beyond traditional venture capital. SPACs enable investors to pool capital publicly for acquiring private companies, while crowdfunding platforms allow a broader audience to directly fund startups and projects. Both mechanisms leverage collective investment power to fuel business growth and innovation within the financial ecosystem.

Key Terms

Capital Raising

Crowdfunding platforms enable startups and small businesses to raise capital by attracting numerous small investments from a broad audience, often providing early-stage funding opportunities. SPACs (Special Purpose Acquisition Companies) offer an alternative route for companies to access substantial capital through a merger with a publicly listed shell company, facilitating faster public market entry and larger capital pools. Explore the distinct advantages and mechanisms of crowdfunding and SPACs to determine the best capital raising strategy for your business.

Investor Structure

Crowdfunding platforms enable a diverse pool of individual investors to contribute small amounts, creating a decentralized investor structure, whereas SPACs typically involve institutional investors and accredited individuals with significant equity stakes. The investor structure in crowdfunding offers increased participation and access to early-stage opportunities, while SPACs provide concentrated control and liquidity benefits for larger investors. Explore deeper insights on how investor structures shape funding dynamics in both mechanisms.

Regulatory Oversight

Crowdfunding platforms operate under the regulatory framework established by the SEC and FINRA, specifically the JOBS Act, which imposes limits on fundraising amounts and investor qualifications to protect retail investors. In contrast, Special Purpose Acquisition Companies (SPACs) are subject to more stringent SEC disclosure requirements and corporate governance standards similar to traditional public companies. Explore the differences in regulatory oversight to understand how investor protections and compliance obligations shape these capital-raising mechanisms.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, without standard financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding is a popular way for startups to finance projects and businesses by collecting funds from a broad online audience, ranging from friends and family to strangers, usually through social media and dedicated platforms.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small amounts of money from many individuals, available as donation-based, reward-based, or equity-based models depending on the project or business needs.

dowidth.com

dowidth.com