Regenerative finance focuses on creating sustainable economic systems that restore and enhance environmental and social capital, emphasizing long-term value and resilience. Community finance prioritizes localized financial solutions that empower underserved populations through shared resources and collaborative investment models. Explore the key differences and benefits of regenerative finance versus community finance to understand their impact on economic sustainability.

Why it is important

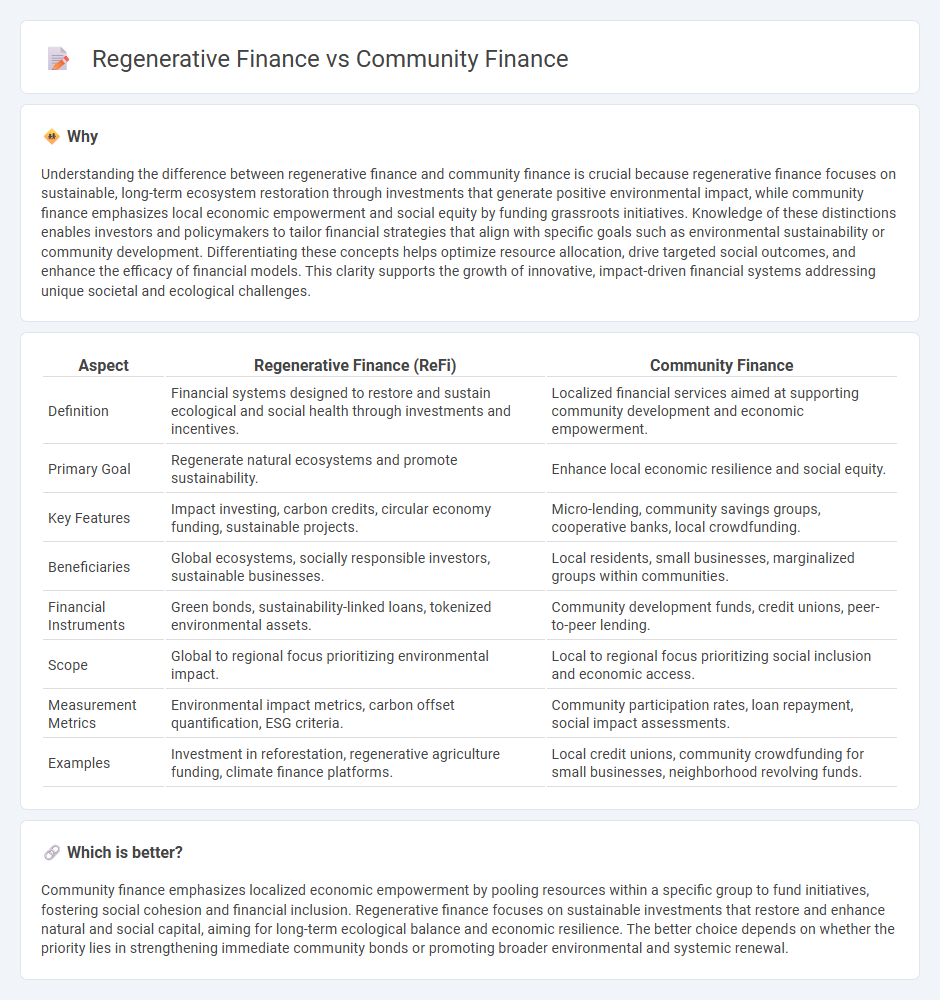

Understanding the difference between regenerative finance and community finance is crucial because regenerative finance focuses on sustainable, long-term ecosystem restoration through investments that generate positive environmental impact, while community finance emphasizes local economic empowerment and social equity by funding grassroots initiatives. Knowledge of these distinctions enables investors and policymakers to tailor financial strategies that align with specific goals such as environmental sustainability or community development. Differentiating these concepts helps optimize resource allocation, drive targeted social outcomes, and enhance the efficacy of financial models. This clarity supports the growth of innovative, impact-driven financial systems addressing unique societal and ecological challenges.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Community Finance |

|---|---|---|

| Definition | Financial systems designed to restore and sustain ecological and social health through investments and incentives. | Localized financial services aimed at supporting community development and economic empowerment. |

| Primary Goal | Regenerate natural ecosystems and promote sustainability. | Enhance local economic resilience and social equity. |

| Key Features | Impact investing, carbon credits, circular economy funding, sustainable projects. | Micro-lending, community savings groups, cooperative banks, local crowdfunding. |

| Beneficiaries | Global ecosystems, socially responsible investors, sustainable businesses. | Local residents, small businesses, marginalized groups within communities. |

| Financial Instruments | Green bonds, sustainability-linked loans, tokenized environmental assets. | Community development funds, credit unions, peer-to-peer lending. |

| Scope | Global to regional focus prioritizing environmental impact. | Local to regional focus prioritizing social inclusion and economic access. |

| Measurement Metrics | Environmental impact metrics, carbon offset quantification, ESG criteria. | Community participation rates, loan repayment, social impact assessments. |

| Examples | Investment in reforestation, regenerative agriculture funding, climate finance platforms. | Local credit unions, community crowdfunding for small businesses, neighborhood revolving funds. |

Which is better?

Community finance emphasizes localized economic empowerment by pooling resources within a specific group to fund initiatives, fostering social cohesion and financial inclusion. Regenerative finance focuses on sustainable investments that restore and enhance natural and social capital, aiming for long-term ecological balance and economic resilience. The better choice depends on whether the priority lies in strengthening immediate community bonds or promoting broader environmental and systemic renewal.

Connection

Regenerative finance (ReFi) and community finance both prioritize sustainable economic models that empower local stakeholders and promote environmental stewardship. ReFi integrates ecological restoration with financial incentives, while community finance focuses on localized funding mechanisms like credit unions and cooperative investments. Their connection lies in fostering resilient economies that support social equity and ecological health through decentralized, impact-driven capital flows.

Key Terms

Collective Ownership

Community finance emphasizes collective ownership by pooling resources from local members to fund projects that benefit the entire community, promoting shared responsibility and equitable distribution of profits. Regenerative finance goes beyond by integrating sustainable practices that restore ecosystems and support long-term social well-being, embedding ecological health within financial returns. Explore how collective ownership models in both frameworks drive inclusive economic empowerment and environmental resilience.

Impact Investing

Impact investing in community finance channels capital to local businesses and social enterprises that create measurable social and economic benefits, emphasizing inclusivity and empowerment. Regenerative finance expands this approach by integrating environmental restoration and circular economic principles to ensure long-term ecological resilience alongside financial returns. Explore the nuances and benefits of both to enhance your approach to sustainable impact investing.

Resource Circulation

Community finance emphasizes local resource pooling and mutual aid to support small-scale economic activities, fostering resilience through direct stakeholder participation. Regenerative finance prioritizes sustainable resource circulation by integrating ecological restoration and social equity, aiming to create systems that replenish natural and human capital. Explore how both models innovate resource circulation to drive lasting economic and environmental impact.

Source and External Links

Community Finance Innovation Fund - Citi Foundation - The fund supports nonprofit community finance organizations and CDFIs to provide responsible financial products and services that promote financial inclusion and health in low-income U.S. communities.

Community Development Financial Institutions Fund: Home - The CDFI Fund invests federal resources and private capital into mission-driven financial institutions that serve economically distressed communities, facilitating economic growth and opportunity.

Community Finance: Home - A European initiative focused on developing ecosystems for financing social and community businesses using alternative finance mechanisms like crowdfunding and public engagement.

dowidth.com

dowidth.com