Altcoin staking allows investors to earn passive income by locking their tokens to support blockchain operations, providing rewards often higher than traditional interest rates. Token buy-and-hold strategies focus on long-term capital appreciation, leveraging market volatility and project development for potential gains. Explore the differences and benefits of each approach to optimize your crypto portfolio.

Why it is important

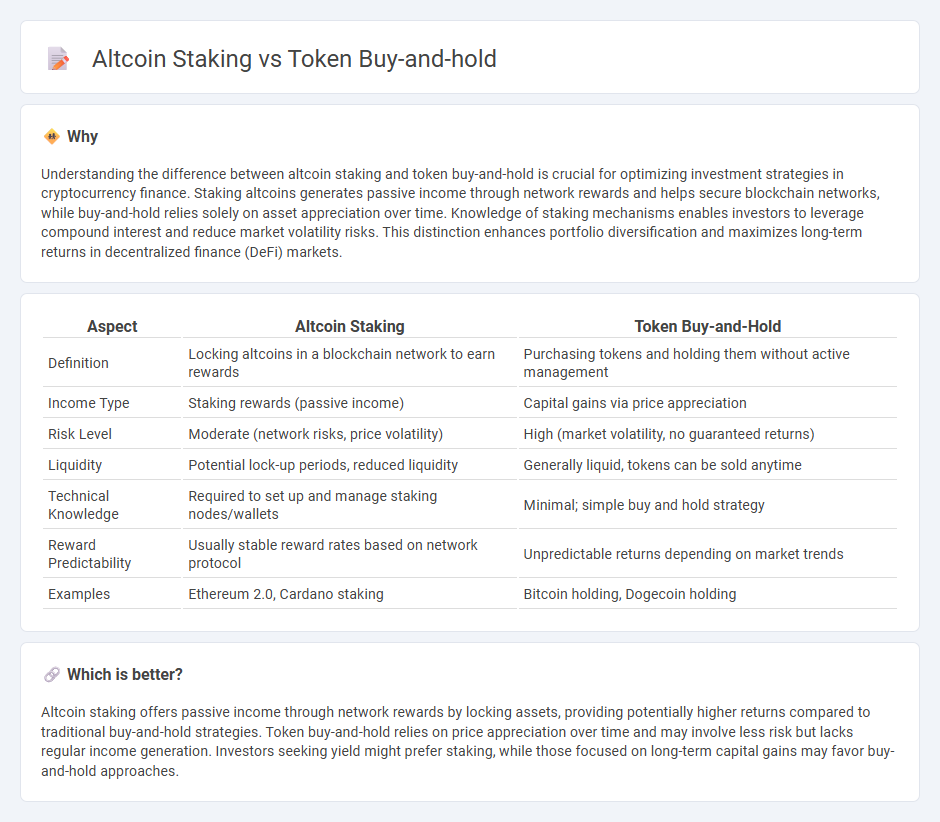

Understanding the difference between altcoin staking and token buy-and-hold is crucial for optimizing investment strategies in cryptocurrency finance. Staking altcoins generates passive income through network rewards and helps secure blockchain networks, while buy-and-hold relies solely on asset appreciation over time. Knowledge of staking mechanisms enables investors to leverage compound interest and reduce market volatility risks. This distinction enhances portfolio diversification and maximizes long-term returns in decentralized finance (DeFi) markets.

Comparison Table

| Aspect | Altcoin Staking | Token Buy-and-Hold |

|---|---|---|

| Definition | Locking altcoins in a blockchain network to earn rewards | Purchasing tokens and holding them without active management |

| Income Type | Staking rewards (passive income) | Capital gains via price appreciation |

| Risk Level | Moderate (network risks, price volatility) | High (market volatility, no guaranteed returns) |

| Liquidity | Potential lock-up periods, reduced liquidity | Generally liquid, tokens can be sold anytime |

| Technical Knowledge | Required to set up and manage staking nodes/wallets | Minimal; simple buy and hold strategy |

| Reward Predictability | Usually stable reward rates based on network protocol | Unpredictable returns depending on market trends |

| Examples | Ethereum 2.0, Cardano staking | Bitcoin holding, Dogecoin holding |

Which is better?

Altcoin staking offers passive income through network rewards by locking assets, providing potentially higher returns compared to traditional buy-and-hold strategies. Token buy-and-hold relies on price appreciation over time and may involve less risk but lacks regular income generation. Investors seeking yield might prefer staking, while those focused on long-term capital gains may favor buy-and-hold approaches.

Connection

Altcoin staking generates passive income by locking tokens in blockchain networks, increasing demand and reducing circulating supply, which positively impacts token prices. Token buy-and-hold strategies benefit from staking rewards and potential price appreciation, aligning investor incentives with network growth. Both methods enhance market stability and liquidity while encouraging long-term commitment to specific cryptocurrency projects.

Key Terms

Capital Appreciation

Token buy-and-hold strategies primarily benefit from capital appreciation driven by market demand and project development milestones. Altcoin staking offers not only potential price gains but also passive income through network rewards, enhancing overall returns. Explore the detailed comparison of these investment approaches to optimize your crypto asset growth.

Yield (Staking Rewards)

Token buy-and-hold involves purchasing cryptocurrencies and retaining them long-term to benefit from potential appreciation, while altcoin staking enables holders to lock tokens in a network to earn yield through staking rewards. Staking rewards vary widely depending on the altcoin's protocol, network demand, and staking duration, often offering higher yields compared to traditional buy-and-hold strategies. Explore the differences in yield potential and risk profiles to determine which method aligns best with your investment goals.

Lock-up Period

Token buy-and-hold strategies often involve minimal lock-up periods, allowing investors quick access to their assets, whereas altcoin staking typically requires locking tokens for a predetermined duration to earn rewards, impacting liquidity. Longer lock-up periods in staking can enhance network security and provide higher yield incentives but limit flexibility compared to buy-and-hold methods. Explore the advantages and trade-offs of lock-up periods in token investment strategies to optimize your portfolio.

Source and External Links

Day trading vs. long-term cryptocurrency hodling - Cointelegraph - Token buy-and-hold, also known as "hodling," is a strategy where investors buy a cryptocurrency and hold it for a long time, often years, to profit from its long-term value appreciation rather than engage in rapid buying and selling.

What is HOLD (EARN)| How To Get & Use HOLD - Bitget - HOLD Token is a cryptocurrency designed for secure, efficient transactions using blockchain technology, and holding such tokens can be part of an investment strategy aiming at long-term gains through usage, anonymous transactions, and reduced fees.

Buying and selling crypto - Robinhood - While Robinhood explains various order types for buying and selling crypto, a buy-and-hold strategy involves purchasing tokens and keeping them without frequent trading, which differs from orders like stop limit or stop price orders used for active trading.

dowidth.com

dowidth.com