Tokenization allows real-world assets to be represented as digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity. Exchange-Traded Funds (ETFs) pool multiple securities into a single tradable instrument on stock exchanges, offering diversification and ease of access. Explore how tokenization and ETFs reshape investment strategies and asset accessibility.

Why it is important

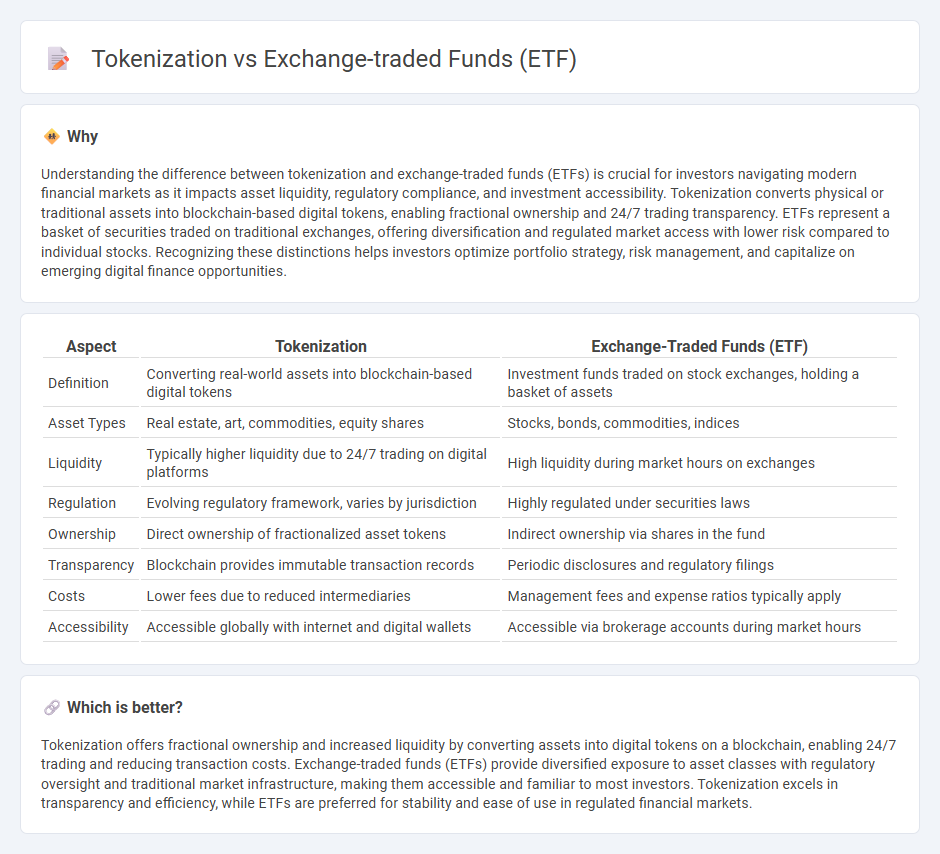

Understanding the difference between tokenization and exchange-traded funds (ETFs) is crucial for investors navigating modern financial markets as it impacts asset liquidity, regulatory compliance, and investment accessibility. Tokenization converts physical or traditional assets into blockchain-based digital tokens, enabling fractional ownership and 24/7 trading transparency. ETFs represent a basket of securities traded on traditional exchanges, offering diversification and regulated market access with lower risk compared to individual stocks. Recognizing these distinctions helps investors optimize portfolio strategy, risk management, and capitalize on emerging digital finance opportunities.

Comparison Table

| Aspect | Tokenization | Exchange-Traded Funds (ETF) |

|---|---|---|

| Definition | Converting real-world assets into blockchain-based digital tokens | Investment funds traded on stock exchanges, holding a basket of assets |

| Asset Types | Real estate, art, commodities, equity shares | Stocks, bonds, commodities, indices |

| Liquidity | Typically higher liquidity due to 24/7 trading on digital platforms | High liquidity during market hours on exchanges |

| Regulation | Evolving regulatory framework, varies by jurisdiction | Highly regulated under securities laws |

| Ownership | Direct ownership of fractionalized asset tokens | Indirect ownership via shares in the fund |

| Transparency | Blockchain provides immutable transaction records | Periodic disclosures and regulatory filings |

| Costs | Lower fees due to reduced intermediaries | Management fees and expense ratios typically apply |

| Accessibility | Accessible globally with internet and digital wallets | Accessible via brokerage accounts during market hours |

Which is better?

Tokenization offers fractional ownership and increased liquidity by converting assets into digital tokens on a blockchain, enabling 24/7 trading and reducing transaction costs. Exchange-traded funds (ETFs) provide diversified exposure to asset classes with regulatory oversight and traditional market infrastructure, making them accessible and familiar to most investors. Tokenization excels in transparency and efficiency, while ETFs are preferred for stability and ease of use in regulated financial markets.

Connection

Tokenization in finance involves converting assets into digital tokens, enhancing liquidity and accessibility, while exchange-traded funds (ETFs) benefit from this innovation by enabling fractional ownership and easier trading of diverse asset baskets. Tokenized ETFs offer increased transparency, reduced costs, and faster settlement times compared to traditional ETFs. This synergy fosters broader market participation and accelerates the evolution of asset management strategies in the digital economy.

Key Terms

Liquidity

Exchange-traded funds (ETFs) provide high liquidity through established stock exchanges, allowing investors to buy and sell shares quickly with transparent pricing. Tokenization introduces enhanced liquidity by enabling fractional ownership and 24/7 trading on blockchain platforms, reducing traditional market barriers and settlement times. Explore how these liquidity advantages impact your investment strategies in dynamic markets.

Fractional Ownership

Fractional ownership through exchange-traded funds (ETFs) allows investors to buy shares representing segments of diversified portfolios, offering liquidity and regulatory oversight. Tokenization leverages blockchain technology to create digital tokens representing fractional stakes in assets, enabling greater accessibility and customizable investment fractions beyond traditional market constraints. Explore how these innovative approaches redefine asset ownership and investment strategies.

Regulation

Exchange-traded funds (ETFs) operate under well-established regulatory frameworks set by entities like the SEC, ensuring investor protection and market transparency through standardized compliance requirements. Tokenization, involving digital assets on blockchain technology, faces evolving regulatory landscapes with varied jurisdictions addressing issues such as securities classification, anti-money laundering (AML), and investor safeguards. Explore further to understand how regulation shapes the future of investment vehicles and digital asset innovation.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are investment products that trade on exchanges like stocks, pool money from many investors to buy a portfolio of assets, and are managed by SEC-registered advisers, offering similar diversification to mutual funds but with intraday trading and potential tax efficiencies.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification of mutual funds, track indexes or sectors, and typically have lower costs and greater tax efficiency compared to actively managed mutual funds.

Exchange-Traded Funds and Products | FINRA.org - ETFs are pooled investment vehicles traded on exchanges, use a unique creation/redemption process involving authorized participants, and can be either passively managed to track an index or actively managed by a fund manager.

dowidth.com

dowidth.com