Finfluencers leverage social media platforms to offer accessible financial tips and market insights, often targeting younger audiences with simplified advice. Registered Investment Advisors (RIAs) provide personalized, fiduciary financial planning services regulated by securities authorities, ensuring tailored strategies that prioritize client interests. Explore the distinct roles and benefits of finfluencers and RIAs to make informed financial decisions.

Why it is important

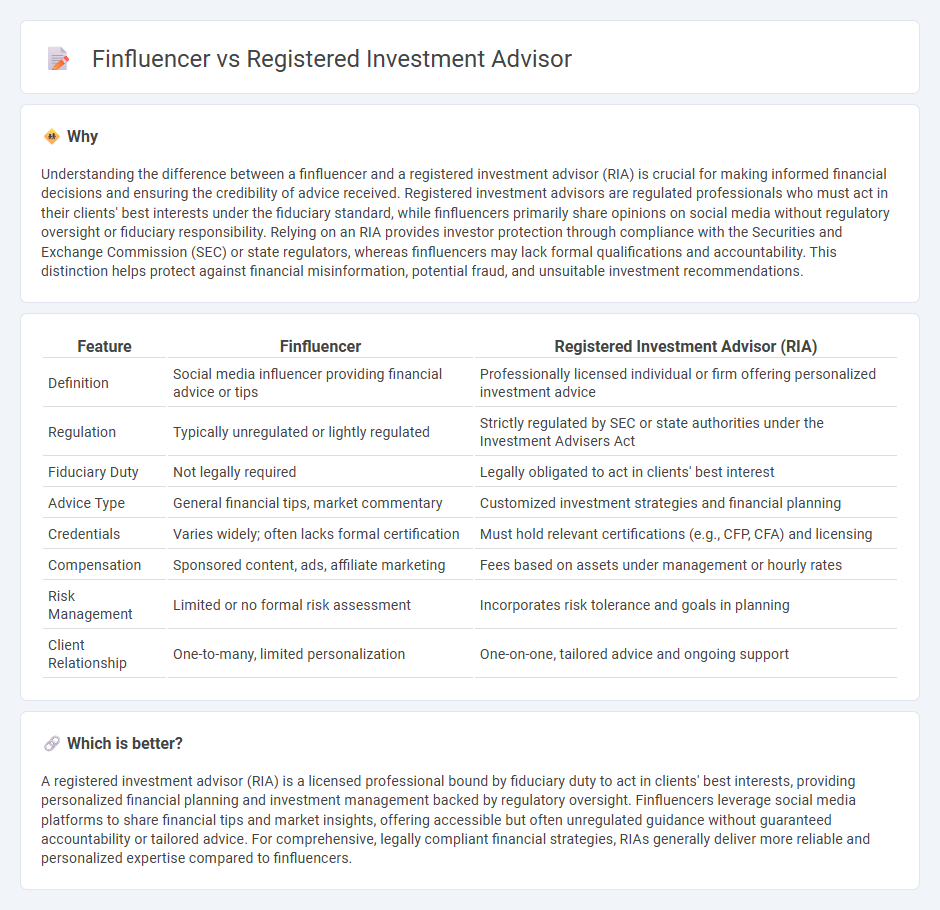

Understanding the difference between a finfluencer and a registered investment advisor (RIA) is crucial for making informed financial decisions and ensuring the credibility of advice received. Registered investment advisors are regulated professionals who must act in their clients' best interests under the fiduciary standard, while finfluencers primarily share opinions on social media without regulatory oversight or fiduciary responsibility. Relying on an RIA provides investor protection through compliance with the Securities and Exchange Commission (SEC) or state regulators, whereas finfluencers may lack formal qualifications and accountability. This distinction helps protect against financial misinformation, potential fraud, and unsuitable investment recommendations.

Comparison Table

| Feature | Finfluencer | Registered Investment Advisor (RIA) |

|---|---|---|

| Definition | Social media influencer providing financial advice or tips | Professionally licensed individual or firm offering personalized investment advice |

| Regulation | Typically unregulated or lightly regulated | Strictly regulated by SEC or state authorities under the Investment Advisers Act |

| Fiduciary Duty | Not legally required | Legally obligated to act in clients' best interest |

| Advice Type | General financial tips, market commentary | Customized investment strategies and financial planning |

| Credentials | Varies widely; often lacks formal certification | Must hold relevant certifications (e.g., CFP, CFA) and licensing |

| Compensation | Sponsored content, ads, affiliate marketing | Fees based on assets under management or hourly rates |

| Risk Management | Limited or no formal risk assessment | Incorporates risk tolerance and goals in planning |

| Client Relationship | One-to-many, limited personalization | One-on-one, tailored advice and ongoing support |

Which is better?

A registered investment advisor (RIA) is a licensed professional bound by fiduciary duty to act in clients' best interests, providing personalized financial planning and investment management backed by regulatory oversight. Finfluencers leverage social media platforms to share financial tips and market insights, offering accessible but often unregulated guidance without guaranteed accountability or tailored advice. For comprehensive, legally compliant financial strategies, RIAs generally deliver more reliable and personalized expertise compared to finfluencers.

Connection

Finfluencers leverage social media platforms to disseminate financial insights, often shaping public investment behaviors and market trends. Registered Investment Advisors (RIAs) offer personalized, fiduciary financial planning and investment management services regulated by the SEC or state authorities. The connection lies in the potential collaboration where finfluencers amplify RIAs' expertise to a broader audience, enhancing client acquisition and financial literacy awareness.

Key Terms

Fiduciary Duty

Registered Investment Advisors (RIAs) legally uphold Fiduciary Duty, mandating them to act in clients' best interests with full transparency and ethical standards. Finfluencers primarily share financial information on social media without legally binding fiduciary responsibilities, which may lead to potential biases or conflicts of interest. Explore the critical distinctions between RIAs and finfluencers to make informed financial decisions.

Licensing & Regulation

Registered investment advisors (RIAs) operate under strict licensing and regulatory frameworks governed by the Securities and Exchange Commission (SEC) or state regulators, requiring fiduciary duty, disclosures, and compliance with the Investment Advisers Act of 1940. Finfluencers, often unaffiliated with formal financial institutions, lack mandatory licensing and regulation, which impacts the credibility and legal accountability of their financial advice. Explore licensing requirements and regulatory standards to understand the critical differences between RIAs and finfluencers.

Disclosure Requirements

Registered investment advisors are legally required to file Form ADV with the SEC, providing detailed disclosures about their business practices, fees, and potential conflicts of interest to ensure transparency and investor protection. Finfluencers, on the other hand, are subject to fewer regulatory disclosure obligations, often only needing to disclose sponsored content or paid promotions under FTC guidelines, which may lead to less comprehensive transparency. To understand the full implications of these disclosure requirements for investors, explore deeper insights on compliance and transparency in financial advice.

Source and External Links

Registered investment adviser - Wikipedia - A registered investment adviser (RIA) is a US firm registered with the SEC or state securities agency that provides investment advice for fees and acts as a fiduciary, differing from broker-dealers who work on commission and are not fiduciaries by default.

Registered Investment Adviser (RIA): Definition & Requirements - RIAs are fiduciaries required to act in clients' best interests, provide detailed disclosures about fees and conflicts, and comply with ongoing regulatory oversight and recordkeeping.

Investment Adviser Registration | Investor.gov - Investment advisers are regulated either by state securities authorities or by the SEC depending on their assets under management, with RIAs managing over $100 million typically registering federally with the SEC.

dowidth.com

dowidth.com