Structured credit involves complex financial instruments backed by collateral assets, offering higher yields but with increased risk profiles compared to unsecured debt, which lacks collateral and relies solely on the borrower's creditworthiness. Investors often weigh the enhanced credit enhancement features and risk tranching in structured credit against the straightforward risk exposure found in unsecured debt. Explore the key distinctions and benefits of structured credit versus unsecured debt to optimize your investment strategy.

Why it is important

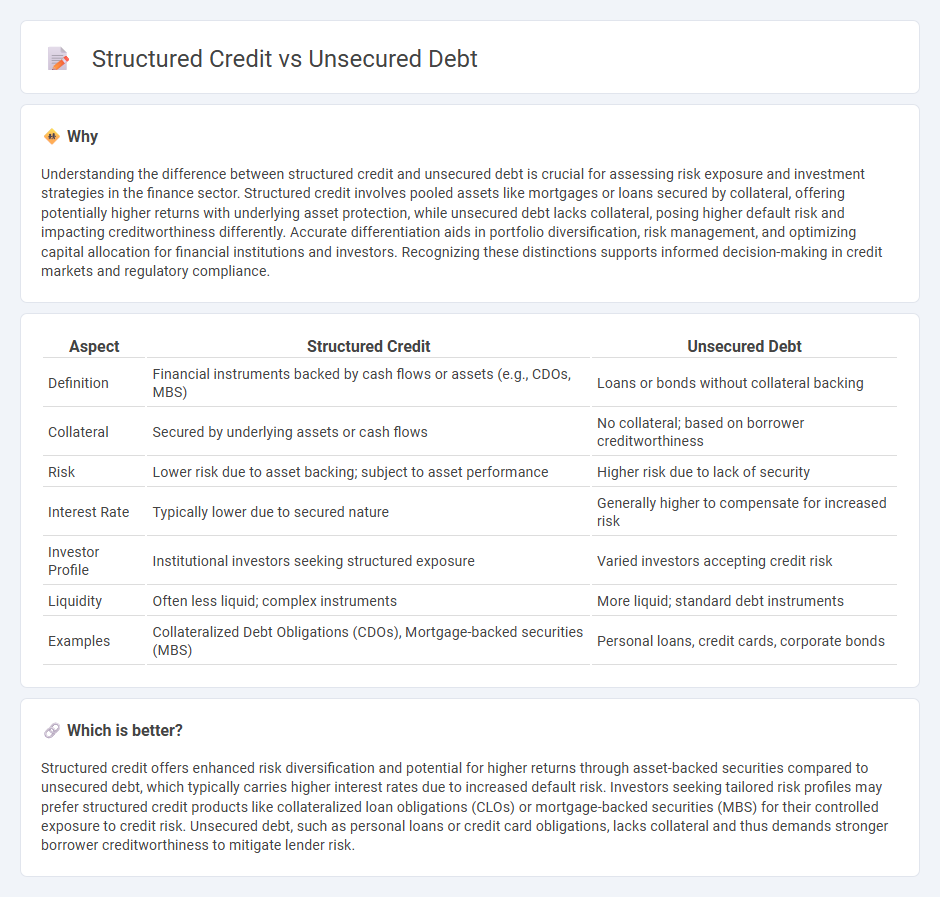

Understanding the difference between structured credit and unsecured debt is crucial for assessing risk exposure and investment strategies in the finance sector. Structured credit involves pooled assets like mortgages or loans secured by collateral, offering potentially higher returns with underlying asset protection, while unsecured debt lacks collateral, posing higher default risk and impacting creditworthiness differently. Accurate differentiation aids in portfolio diversification, risk management, and optimizing capital allocation for financial institutions and investors. Recognizing these distinctions supports informed decision-making in credit markets and regulatory compliance.

Comparison Table

| Aspect | Structured Credit | Unsecured Debt |

|---|---|---|

| Definition | Financial instruments backed by cash flows or assets (e.g., CDOs, MBS) | Loans or bonds without collateral backing |

| Collateral | Secured by underlying assets or cash flows | No collateral; based on borrower creditworthiness |

| Risk | Lower risk due to asset backing; subject to asset performance | Higher risk due to lack of security |

| Interest Rate | Typically lower due to secured nature | Generally higher to compensate for increased risk |

| Investor Profile | Institutional investors seeking structured exposure | Varied investors accepting credit risk |

| Liquidity | Often less liquid; complex instruments | More liquid; standard debt instruments |

| Examples | Collateralized Debt Obligations (CDOs), Mortgage-backed securities (MBS) | Personal loans, credit cards, corporate bonds |

Which is better?

Structured credit offers enhanced risk diversification and potential for higher returns through asset-backed securities compared to unsecured debt, which typically carries higher interest rates due to increased default risk. Investors seeking tailored risk profiles may prefer structured credit products like collateralized loan obligations (CLOs) or mortgage-backed securities (MBS) for their controlled exposure to credit risk. Unsecured debt, such as personal loans or credit card obligations, lacks collateral and thus demands stronger borrower creditworthiness to mitigate lender risk.

Connection

Structured credit products often include pools of unsecured debt instruments such as credit card receivables and personal loans, which are repackaged into asset-backed securities to diversify risk and improve liquidity. The performance of these securities is directly linked to the repayment behavior of the underlying unsecured debt, influencing credit spreads and investor yields. Thus, fluctuations in unsecured debt quality significantly impact the valuation and risk assessment of structured credit portfolios.

Key Terms

Collateral

Unsecured debt carries no collateral, exposing lenders to higher risk and typically resulting in higher interest rates. Structured credit involves pooling various debt instruments, often secured by collateral such as mortgages or loans, reducing risk through asset backing and tranching. Explore further to understand how collateral impacts credit risk and investment strategies.

Tranching

Unsecured debt lacks collateral, posing higher credit risk and typically offering higher yields compared to structured credit, which involves pooling assets and splitting cash flows into tranches with varying risk and return profiles. Tranching in structured credit enables investors to choose between senior, mezzanine, and equity tranches, each with distinct priority in payment and loss absorption. Explore more about how tranching enhances risk management and investment flexibility in structured credit.

Credit risk

Unsecured debt exposes lenders to higher credit risk as it lacks collateral, relying solely on the borrower's creditworthiness and cash flow for repayment, leading to increased default probabilities. Structured credit instruments, such as collateralized loan obligations (CLOs), mitigate credit risk by pooling assets and tranching cash flows, allowing risk distribution across different seniority levels and enhancing investor protection. Explore more about credit risk management strategies in unsecured debt and structured credit to deepen your understanding.

Source and External Links

Unsecured debt - Wikipedia - Unsecured debt is any type of debt not protected by collateral or a guarantor, where creditors have a general claim on assets after secured creditors in bankruptcy, usually resulting in higher interest rates due to increased risk to the lender.

What is Unsecured Debt? Definition and Examples | LendingTree - Unsecured debt refers to loans or credit not backed by collateral like a home or vehicle, including personal loans, student loans, and credit cards, often harder to qualify for and with higher interest rates since lenders assume greater risk.

What Is Unsecured Debt? | Bankrate - Unsecured debt does not require collateral and typically carries higher interest rates and stricter approval standards due to higher lender risk, with common types being personal loans, credit cards, and student loans.

dowidth.com

dowidth.com