Basis trading exploits discrepancies between spot and futures prices to capture riskless profits, focusing on convergence of these prices at contract maturity. Carry trade involves borrowing in low-interest-rate currencies to invest in higher-yielding assets, profiting from interest rate differentials and currency movements. Explore detailed strategies and risk factors behind basis trading and carry trade for optimized investment decisions.

Why it is important

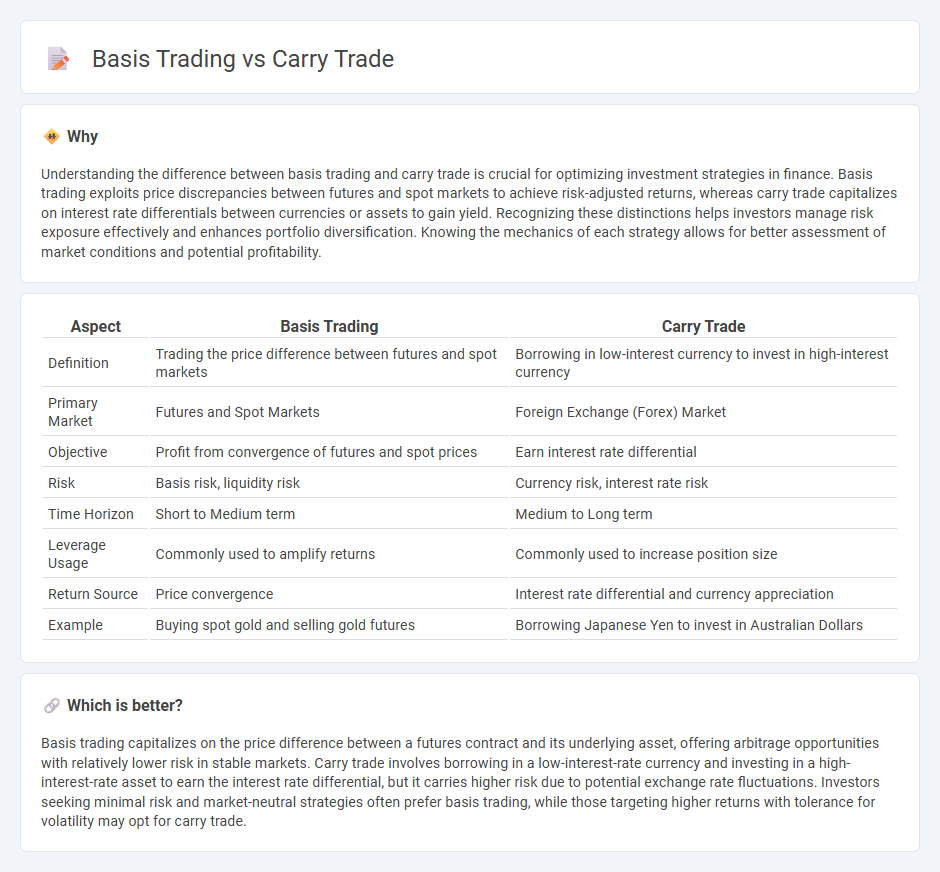

Understanding the difference between basis trading and carry trade is crucial for optimizing investment strategies in finance. Basis trading exploits price discrepancies between futures and spot markets to achieve risk-adjusted returns, whereas carry trade capitalizes on interest rate differentials between currencies or assets to gain yield. Recognizing these distinctions helps investors manage risk exposure effectively and enhances portfolio diversification. Knowing the mechanics of each strategy allows for better assessment of market conditions and potential profitability.

Comparison Table

| Aspect | Basis Trading | Carry Trade |

|---|---|---|

| Definition | Trading the price difference between futures and spot markets | Borrowing in low-interest currency to invest in high-interest currency |

| Primary Market | Futures and Spot Markets | Foreign Exchange (Forex) Market |

| Objective | Profit from convergence of futures and spot prices | Earn interest rate differential |

| Risk | Basis risk, liquidity risk | Currency risk, interest rate risk |

| Time Horizon | Short to Medium term | Medium to Long term |

| Leverage Usage | Commonly used to amplify returns | Commonly used to increase position size |

| Return Source | Price convergence | Interest rate differential and currency appreciation |

| Example | Buying spot gold and selling gold futures | Borrowing Japanese Yen to invest in Australian Dollars |

Which is better?

Basis trading capitalizes on the price difference between a futures contract and its underlying asset, offering arbitrage opportunities with relatively lower risk in stable markets. Carry trade involves borrowing in a low-interest-rate currency and investing in a high-interest-rate asset to earn the interest rate differential, but it carries higher risk due to potential exchange rate fluctuations. Investors seeking minimal risk and market-neutral strategies often prefer basis trading, while those targeting higher returns with tolerance for volatility may opt for carry trade.

Connection

Basis trading and carry trade are connected through their exploitation of price differentials in financial markets. Basis trading involves taking advantage of the spread between futures prices and spot prices, while carry trade focuses on profiting from interest rate differentials between two currencies. Both strategies rely on market inefficiencies and leverage to generate returns from asset price convergence or interest rate gaps.

Key Terms

Interest Rate Differential

Carry trade exploits interest rate differentials by borrowing in low-rate currencies and investing in high-rate ones to capture positive yields. Basis trading targets the price difference between a security's spot price and its futures price, often reflecting interest rate spreads indirectly through basis points. Explore deeper insights on interest rate differentials and their impact on carry trade and basis trading strategies here.

Spot-Futures Spread

Carry trade exploits interest rate differentials between currencies to earn returns, often involving borrowing in low-yield currencies and investing in high-yield ones, while basis trading centers on the spot-futures spread, aiming to profit from price discrepancies between the spot market and futures contracts. The spot-futures spread reflects the cost-of-carry, including interest rates, dividends, and storage costs, and traders look for mispricings to execute basis trades effectively. To understand how these strategies differ and their market implications, explore detailed analyses on spot-futures dynamics and carry trade mechanics.

Currency Risk

Carry trade involves borrowing in a low-interest-rate currency and investing in a high-interest-rate currency, exposing traders to currency risk from exchange rate fluctuations. Basis trading focuses on exploiting the difference between spot and futures prices, often using currency forwards to hedge or take advantage of currency risk. Explore detailed strategies and risk management techniques to optimize currency risk exposure in both carry trade and basis trading.

Source and External Links

Understanding Carry Trades and How They Can Be Used - A carry trade is a financial strategy where an investor borrows money in a currency with low interest rates and invests it in a currency with higher interest rates to profit from the interest rate differential, but it carries risks such as currency fluctuations and market volatility.

What is a carry trade? -- Manulife John Hancock Investments - The strategy involves borrowing in a low-interest-rate currency, like the Japanese yen, and investing in a higher-yielding currency or asset, aiming to earn the interest rate spread while managing substantial risks related to currency and market conditions.

Carry (investment) - Wikipedia - Carry trades are not pure arbitrages; they profit if market conditions remain favorable by earning the spread between borrowing a low carry asset and lending a higher carry asset, but they risk losses if conditions shift against the trade.

dowidth.com

dowidth.com