Buy now pay later (BNPL) integration offers immediate consumer credit solutions that enhance purchasing power and boost sales conversion rates, while cryptocurrency payment integration provides decentralized, secure, and borderless transaction capabilities appealing to tech-savvy customers. BNPL leverages traditional credit systems with real-time risk assessment, whereas cryptocurrency payments reduce transaction fees and eliminate chargebacks through blockchain technology. Explore the unique benefits and challenges of these payment innovations to optimize your financial strategy.

Why it is important

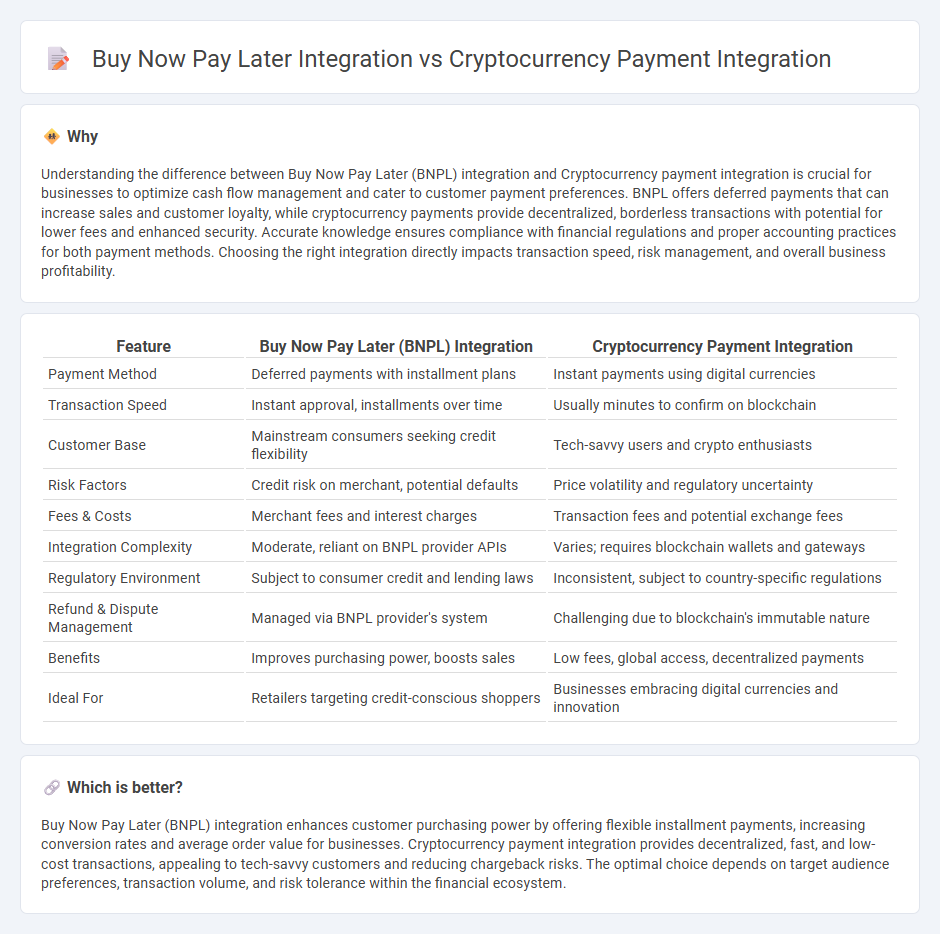

Understanding the difference between Buy Now Pay Later (BNPL) integration and Cryptocurrency payment integration is crucial for businesses to optimize cash flow management and cater to customer payment preferences. BNPL offers deferred payments that can increase sales and customer loyalty, while cryptocurrency payments provide decentralized, borderless transactions with potential for lower fees and enhanced security. Accurate knowledge ensures compliance with financial regulations and proper accounting practices for both payment methods. Choosing the right integration directly impacts transaction speed, risk management, and overall business profitability.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) Integration | Cryptocurrency Payment Integration |

|---|---|---|

| Payment Method | Deferred payments with installment plans | Instant payments using digital currencies |

| Transaction Speed | Instant approval, installments over time | Usually minutes to confirm on blockchain |

| Customer Base | Mainstream consumers seeking credit flexibility | Tech-savvy users and crypto enthusiasts |

| Risk Factors | Credit risk on merchant, potential defaults | Price volatility and regulatory uncertainty |

| Fees & Costs | Merchant fees and interest charges | Transaction fees and potential exchange fees |

| Integration Complexity | Moderate, reliant on BNPL provider APIs | Varies; requires blockchain wallets and gateways |

| Regulatory Environment | Subject to consumer credit and lending laws | Inconsistent, subject to country-specific regulations |

| Refund & Dispute Management | Managed via BNPL provider's system | Challenging due to blockchain's immutable nature |

| Benefits | Improves purchasing power, boosts sales | Low fees, global access, decentralized payments |

| Ideal For | Retailers targeting credit-conscious shoppers | Businesses embracing digital currencies and innovation |

Which is better?

Buy Now Pay Later (BNPL) integration enhances customer purchasing power by offering flexible installment payments, increasing conversion rates and average order value for businesses. Cryptocurrency payment integration provides decentralized, fast, and low-cost transactions, appealing to tech-savvy customers and reducing chargeback risks. The optimal choice depends on target audience preferences, transaction volume, and risk tolerance within the financial ecosystem.

Connection

Buy now pay later (BNPL) integration and cryptocurrency payment integration intersect through their shared goal of enhancing payment flexibility and accessibility in digital commerce. Both systems leverage blockchain technology and decentralized finance (DeFi) principles to offer seamless, secure, and transparent transactions. Combining BNPL with cryptocurrency payments enables merchants to tap into a broader customer base by facilitating instant credit options and enabling payments in multiple digital assets.

Key Terms

**Cryptocurrency payment integration:**

Cryptocurrency payment integration enables businesses to accept digital currencies like Bitcoin and Ethereum directly from customers, offering lower transaction fees and faster cross-border payments compared to traditional methods. This payment method boosts security through blockchain technology and provides access to a growing user base invested in decentralized finance. Explore detailed benefits and implementation strategies to enhance your online payment systems.

Blockchain

Cryptocurrency payment integration leverages blockchain technology for secure, transparent transactions with reduced intermediaries, enabling instant cross-border payments and enhanced privacy. Buy now pay later integration, while often relying on traditional financial systems, can integrate blockchain to improve credit verification and fraud prevention through immutable ledgers. Explore how blockchain-driven innovations transform payment methods and enhance user experience.

Wallet Address

Cryptocurrency payment integration relies on secure wallet addresses to facilitate direct peer-to-peer transactions using blockchain technology, ensuring transparency and immutability. In contrast, buy now pay later integration involves traditional payment gateways and consumer credit checks without the need for wallet addresses, focusing instead on installment-based payment tracking. Explore more to understand the key differences in transaction security and user experience between these payment methods.

Source and External Links

Best Crypto Payment Gateway & Processor | Accept Crypto Payments - CoinGate offers a versatile crypto payment gateway that enables businesses to accept Bitcoin, stablecoins, and multiple cryptocurrencies with easy integration options like API, e-commerce plugins (Wix, WooCommerce), payment buttons, and email invoicing, including instant crypto-to-fiat conversion and payouts to bank accounts.

Global payment solutions for Web3 - Stripe - Stripe provides a robust crypto payment infrastructure allowing businesses to process stablecoin and crypto payments globally via a single integration, featuring crypto wallet top-ups, crypto-to-fiat settlements, fraud prevention, and expanding reach with stablecoin financial accounts and Visa-backed crypto card issuing.

8 Best Crypto Payment Gateways in 2024 - Digital Commerce 360 - Top crypto payment gateways include PayPal with stablecoin support and extensive merchant acceptance, and BitPay offering crypto debit cards, direct bill payments, secure wallets, and user-friendly interfaces focusing on security and immediate conversions for businesses and consumers alike.

dowidth.com

dowidth.com