Basis trading exploits price differences between futures contracts and their underlying assets to capture riskless profits, primarily in commodity and fixed income markets. Fixed income arbitrage focuses on exploiting price inefficiencies between related fixed income securities, such as bonds and interest rate derivatives, aiming to benefit from interest rate movements and credit spreads. Explore deeper insights into these strategies to enhance your investment approach and risk management.

Why it is important

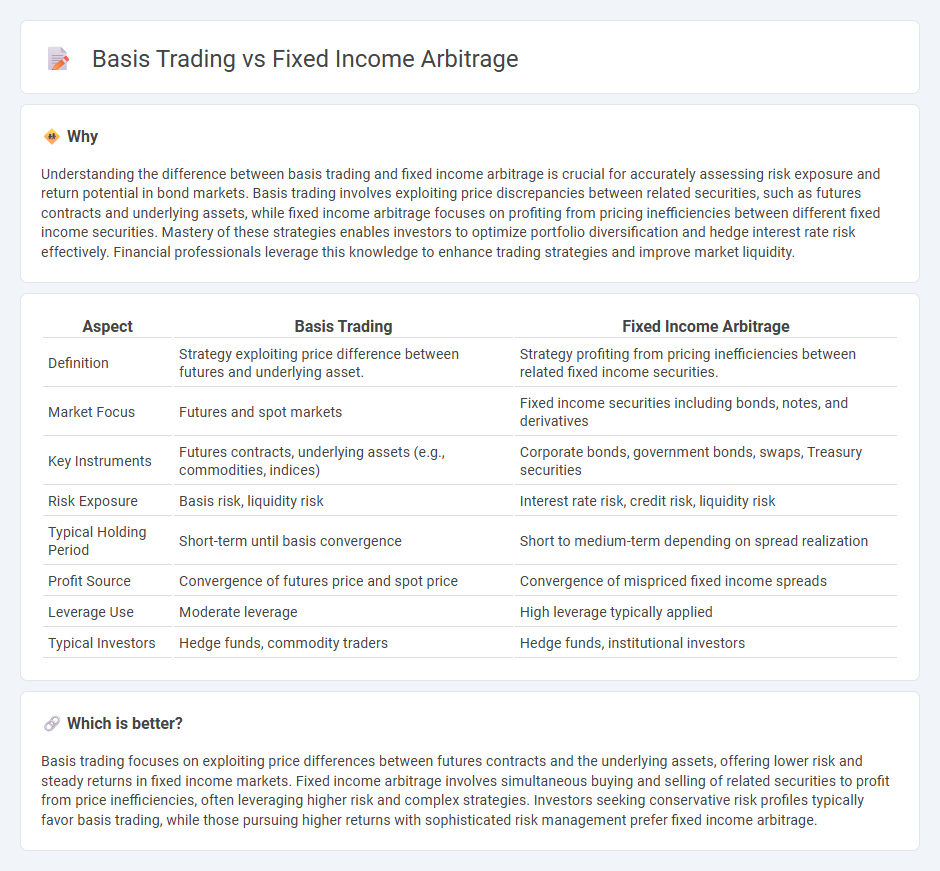

Understanding the difference between basis trading and fixed income arbitrage is crucial for accurately assessing risk exposure and return potential in bond markets. Basis trading involves exploiting price discrepancies between related securities, such as futures contracts and underlying assets, while fixed income arbitrage focuses on profiting from pricing inefficiencies between different fixed income securities. Mastery of these strategies enables investors to optimize portfolio diversification and hedge interest rate risk effectively. Financial professionals leverage this knowledge to enhance trading strategies and improve market liquidity.

Comparison Table

| Aspect | Basis Trading | Fixed Income Arbitrage |

|---|---|---|

| Definition | Strategy exploiting price difference between futures and underlying asset. | Strategy profiting from pricing inefficiencies between related fixed income securities. |

| Market Focus | Futures and spot markets | Fixed income securities including bonds, notes, and derivatives |

| Key Instruments | Futures contracts, underlying assets (e.g., commodities, indices) | Corporate bonds, government bonds, swaps, Treasury securities |

| Risk Exposure | Basis risk, liquidity risk | Interest rate risk, credit risk, liquidity risk |

| Typical Holding Period | Short-term until basis convergence | Short to medium-term depending on spread realization |

| Profit Source | Convergence of futures price and spot price | Convergence of mispriced fixed income spreads |

| Leverage Use | Moderate leverage | High leverage typically applied |

| Typical Investors | Hedge funds, commodity traders | Hedge funds, institutional investors |

Which is better?

Basis trading focuses on exploiting price differences between futures contracts and the underlying assets, offering lower risk and steady returns in fixed income markets. Fixed income arbitrage involves simultaneous buying and selling of related securities to profit from price inefficiencies, often leveraging higher risk and complex strategies. Investors seeking conservative risk profiles typically favor basis trading, while those pursuing higher returns with sophisticated risk management prefer fixed income arbitrage.

Connection

Basis trading and fixed income arbitrage are interconnected strategies in finance that exploit pricing inefficiencies between related fixed income securities. Basis trading focuses on the price differential between a cash bond and its corresponding futures contract, aiming to profit from the convergence of their spreads. Fixed income arbitrage broadens this approach by leveraging interest rate differentials, yield curve shifts, and credit spreads to generate risk-adjusted returns in bond markets.

Key Terms

Yield Spread

Fixed income arbitrage involves exploiting price inefficiencies between related bonds to earn risk-adjusted returns, often focusing on narrowing yield spreads between securities with similar credit qualities and maturities. Basis trading primarily targets temporary discrepancies between the cash bond yield and its corresponding futures contract, capitalizing on convergence of the basis spread over time. Explore deeper insights into yield spread dynamics and strategies to optimize fixed income returns.

Duration

Fixed income arbitrage seeks to profit from pricing inefficiencies between related bonds or fixed income securities by exploiting differences in yield spreads and durations. Basis trading specifically targets the spread between a bond and its corresponding futures contract, leveraging duration mismatches to capture gains from convergence. Explore more about how duration plays a critical role in maximizing returns in these fixed income strategies.

Convergence

Fixed income arbitrage exploits pricing inefficiencies between related debt securities, aiming for convergence as price discrepancies narrow over time. Basis trading specifically targets the spread between a futures contract and its underlying bond, profiting when the basis converges to its historical norm. Explore the nuances of convergence strategies to enhance your fixed income trading expertise.

Source and External Links

Fixed income arbitrage - Wikipedia - Fixed-income arbitrage is a market-neutral investment strategy focused on exploiting differences in interest rates among fixed-income securities or contracts by going long and short to profit from price discrepancies, commonly used by investment banks and hedge funds.

Fixed Income Arbitrage- What is its Strategy & Example - Fixed-income arbitrage involves taking simultaneous long and short positions in similar fixed-income securities to exploit temporary price differences, requiring liquidity and minimal differences between securities, and aims to be market-neutral.

Relative Value Strategies: Fixed-Income Arbitrage - Fixed-income arbitrage utilizes strategies like yield curve and carry trades to profit from pricing inefficiencies between debt securities, often involving high leverage to amplify small mispricings while managing risks such as liquidity and spread widening.

dowidth.com

dowidth.com