Zero day options expire on the same day they are traded, offering traders the chance for rapid gains or losses within hours. Weekly options, in contrast, have expirations set every week, providing more flexibility and strategic opportunities over a longer timeframe. Explore the key differences and benefits of zero day options versus weekly options to enhance your trading strategies.

Why it is important

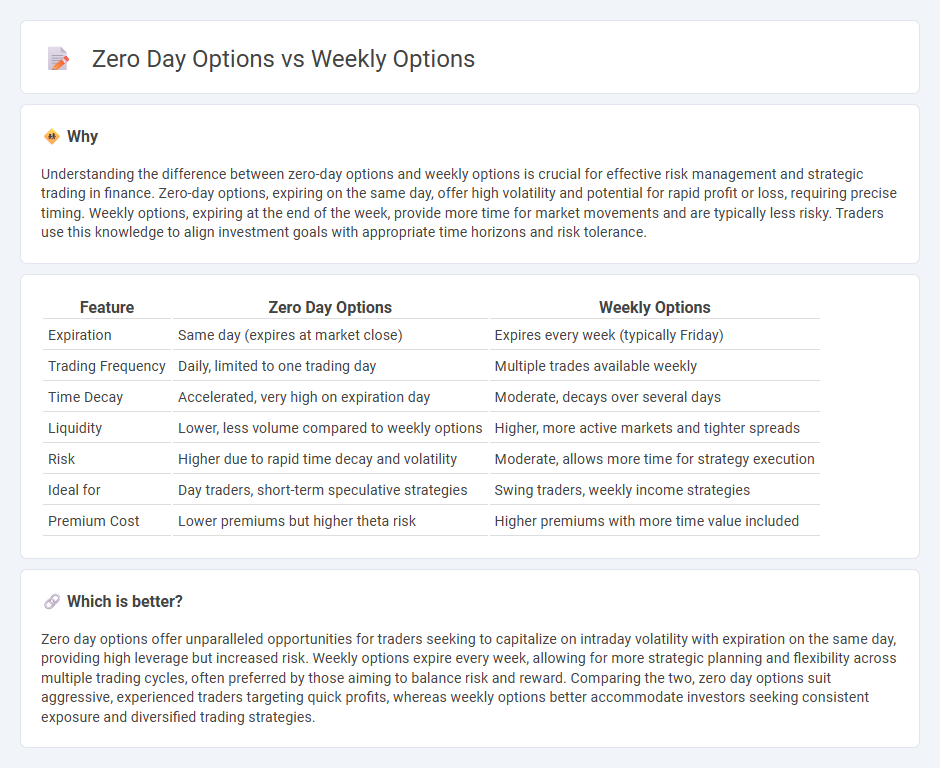

Understanding the difference between zero-day options and weekly options is crucial for effective risk management and strategic trading in finance. Zero-day options, expiring on the same day, offer high volatility and potential for rapid profit or loss, requiring precise timing. Weekly options, expiring at the end of the week, provide more time for market movements and are typically less risky. Traders use this knowledge to align investment goals with appropriate time horizons and risk tolerance.

Comparison Table

| Feature | Zero Day Options | Weekly Options |

|---|---|---|

| Expiration | Same day (expires at market close) | Expires every week (typically Friday) |

| Trading Frequency | Daily, limited to one trading day | Multiple trades available weekly |

| Time Decay | Accelerated, very high on expiration day | Moderate, decays over several days |

| Liquidity | Lower, less volume compared to weekly options | Higher, more active markets and tighter spreads |

| Risk | Higher due to rapid time decay and volatility | Moderate, allows more time for strategy execution |

| Ideal for | Day traders, short-term speculative strategies | Swing traders, weekly income strategies |

| Premium Cost | Lower premiums but higher theta risk | Higher premiums with more time value included |

Which is better?

Zero day options offer unparalleled opportunities for traders seeking to capitalize on intraday volatility with expiration on the same day, providing high leverage but increased risk. Weekly options expire every week, allowing for more strategic planning and flexibility across multiple trading cycles, often preferred by those aiming to balance risk and reward. Comparing the two, zero day options suit aggressive, experienced traders targeting quick profits, whereas weekly options better accommodate investors seeking consistent exposure and diversified trading strategies.

Connection

Zero day options and weekly options are interconnected through their short-term expiration cycles, with zero day options expiring on the same day they are traded and weekly options expiring every week, typically on Fridays. Both types of options offer traders opportunities to capitalize on rapid price movements and volatility within tight timeframes, enhancing strategies such as day trading and hedging. Their high liquidity and time decay dynamics make them popular instruments for managing risk and speculation in financial markets.

Key Terms

Expiration Date

Weekly options typically expire every Friday, offering traders frequent opportunities to manage risk and leverage short-term market movements, while zero day options expire on the same day they are traded, providing intense, high-risk, and high-reward scenarios. The expiration date critically affects option pricing, volatility, and time decay, with zero day options exhibiting the fastest rate of theta decay due to their immediate expiration. Explore more about the strategic implications of expiration dates to enhance your options trading portfolio.

Time Decay

Weekly options experience faster time decay compared to monthly options, which accelerates as expiration approaches, significantly impacting their premium value. Zero day options, expiring the same day they are traded, showcase the highest rate of time decay, rapidly diminishing their value within hours. Explore more to understand how time decay influences trading strategies between weekly and zero day options.

Volatility

Weekly options typically exhibit higher implied volatility compared to standard monthly options due to their shorter time frames, leading to rapid price movements and greater trading opportunities. Zero day options, expiring on the same day they are traded, experience extreme volatility spikes as traders react to intraday events, making them highly sensitive to market fluctuations. Explore the dynamics of volatility in weekly and zero day options strategies to optimize your trading decisions.

Source and External Links

How to Use Weekly Stock Options | Charles Schwab - Weekly options are short-term contracts that expire every week, allowing traders to target specific market events like earnings or economic data with strategies that can focus on expected stock moves or premium decay (theta) through buying calls/puts, straddles, or selling spreads such as iron condors.

Weekly Options - OCC - Weekly options are short-term options that have the same specifications as standard monthly contracts but typically expire every week and cover equities, ETFs, or indexes, with standard units of 100 shares or $100 times the index level for index options.

Trading with Weekly Options - RJO Futures - Weekly options on futures provide more frequent expirations (usually weekly Fridays), offering flexibility and precision for strategies by allowing traders to better target short-term market moves compared to traditional monthly expirations.

dowidth.com

dowidth.com