Decentralized Autonomous Organization (DAO) treasuries operate using blockchain technology to enable transparent, community-controlled fund management, ensuring real-time accountability and direct stakeholder participation. Investment trusts pool capital to be managed by professional fund managers aiming for diversified portfolio growth and income generation, often subject to regulatory oversight and traditional financial frameworks. Explore the distinct advantages and operational mechanisms of DAO treasuries versus investment trusts to deepen your understanding of modern financial management.

Why it is important

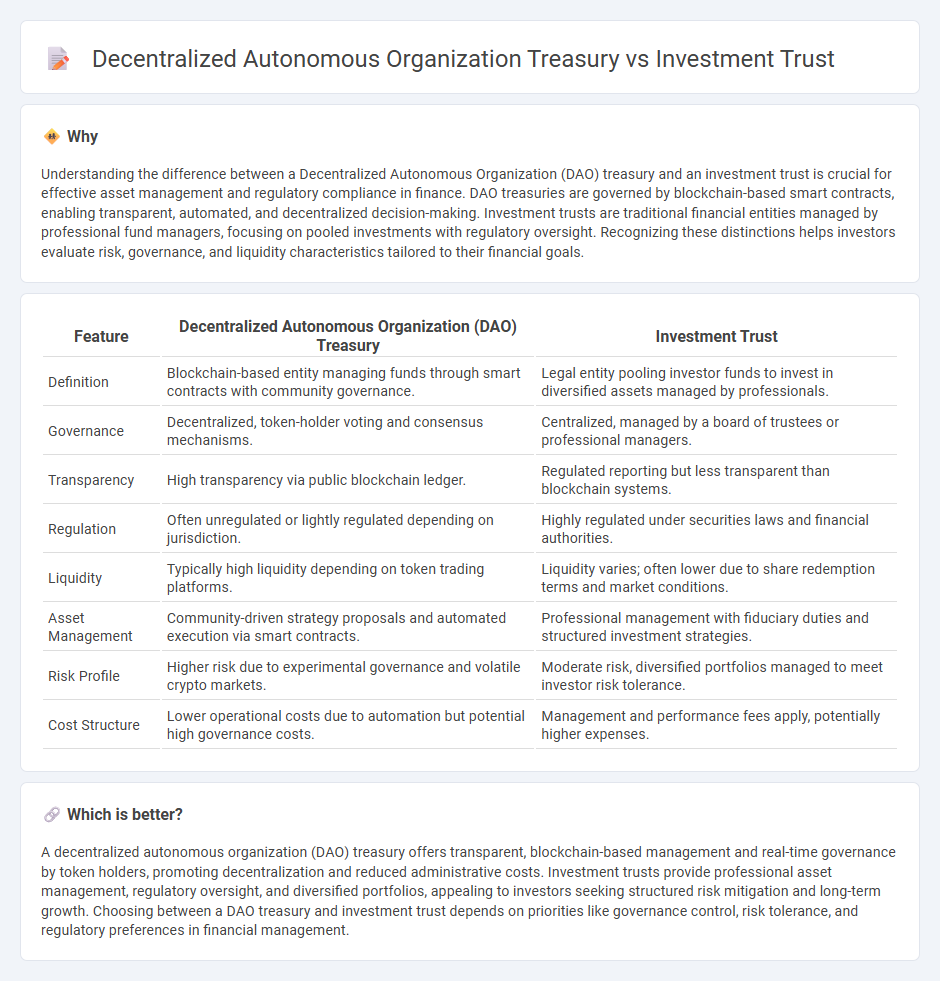

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and an investment trust is crucial for effective asset management and regulatory compliance in finance. DAO treasuries are governed by blockchain-based smart contracts, enabling transparent, automated, and decentralized decision-making. Investment trusts are traditional financial entities managed by professional fund managers, focusing on pooled investments with regulatory oversight. Recognizing these distinctions helps investors evaluate risk, governance, and liquidity characteristics tailored to their financial goals.

Comparison Table

| Feature | Decentralized Autonomous Organization (DAO) Treasury | Investment Trust |

|---|---|---|

| Definition | Blockchain-based entity managing funds through smart contracts with community governance. | Legal entity pooling investor funds to invest in diversified assets managed by professionals. |

| Governance | Decentralized, token-holder voting and consensus mechanisms. | Centralized, managed by a board of trustees or professional managers. |

| Transparency | High transparency via public blockchain ledger. | Regulated reporting but less transparent than blockchain systems. |

| Regulation | Often unregulated or lightly regulated depending on jurisdiction. | Highly regulated under securities laws and financial authorities. |

| Liquidity | Typically high liquidity depending on token trading platforms. | Liquidity varies; often lower due to share redemption terms and market conditions. |

| Asset Management | Community-driven strategy proposals and automated execution via smart contracts. | Professional management with fiduciary duties and structured investment strategies. |

| Risk Profile | Higher risk due to experimental governance and volatile crypto markets. | Moderate risk, diversified portfolios managed to meet investor risk tolerance. |

| Cost Structure | Lower operational costs due to automation but potential high governance costs. | Management and performance fees apply, potentially higher expenses. |

Which is better?

A decentralized autonomous organization (DAO) treasury offers transparent, blockchain-based management and real-time governance by token holders, promoting decentralization and reduced administrative costs. Investment trusts provide professional asset management, regulatory oversight, and diversified portfolios, appealing to investors seeking structured risk mitigation and long-term growth. Choosing between a DAO treasury and investment trust depends on priorities like governance control, risk tolerance, and regulatory preferences in financial management.

Connection

Decentralized Autonomous Organization (DAO) treasuries manage digital assets through smart contracts, enabling transparent and automated governance of funds. Investment trusts allocate pooled resources into diversified portfolios, often including blockchain-based assets that DAOs hold for growth. Both structures intersect by optimizing collective investment strategies, leveraging decentralized finance (DeFi) to enhance asset management efficiency and liquidity.

Key Terms

Governance

Investment trusts operate with centralized governance structures typically overseen by a board of directors responsible for fiduciary decisions and fund management, ensuring regulatory compliance and investor protection. In contrast, decentralized autonomous organizations (DAOs) utilize blockchain-based governance, enabling token holders to participate directly in decision-making through voting mechanisms, promoting transparency and democratized control. Explore the nuances of governance models to understand how each structure impacts accountability and operational efficiency.

Asset Management

Investment trusts manage pooled assets under professional oversight, utilizing diversified portfolios to maximize returns while adhering to regulatory frameworks. Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology for transparent, community-governed asset management, enabling real-time decision-making and decentralized control. Explore the intricacies of asset management strategies within investment trusts and DAO treasuries to understand their unique advantages and governance models.

Transparency

Investment trusts offer structured transparency through regulated financial reporting and third-party audits, ensuring investors have clear visibility of assets and performance. Decentralized Autonomous Organization (DAO) treasuries utilize blockchain technology to provide real-time, immutable transaction records accessible to all stakeholders, enhancing direct transparency and trust in fund management. Explore the nuances of each model to understand their transparency frameworks in depth.

Source and External Links

Understanding Investment Trusts BlackRock - An investment trust is a public limited company that invests in other companies, issuing a fixed number of shares and managed by professional portfolio managers, with potential higher returns due to leverage but also higher risk.

Investment trust - Wikipedia - Investment trusts are closed-ended public limited companies mainly found in the UK and Japan, created to diversify investments and managed by boards of directors, originally established to spread risk over multiple stocks.

What is an Investment Trust? - Investment trusts are closed-ended funds traded on the London Stock Exchange, offering diversified long-term investments with shareholder voting rights, low costs, income smoothing, and borrowing abilities to potentially enhance returns.

dowidth.com

dowidth.com