Thematic ETFs focus on specific sectors, industries, or trends such as technology, clean energy, or artificial intelligence, offering targeted exposure and capital growth potential. Dividend ETFs invest in companies with a track record of paying consistent and high dividends, aiming to provide steady income streams alongside potential capital appreciation. Explore how these distinct strategies align with your investment goals and risk tolerance.

Why it is important

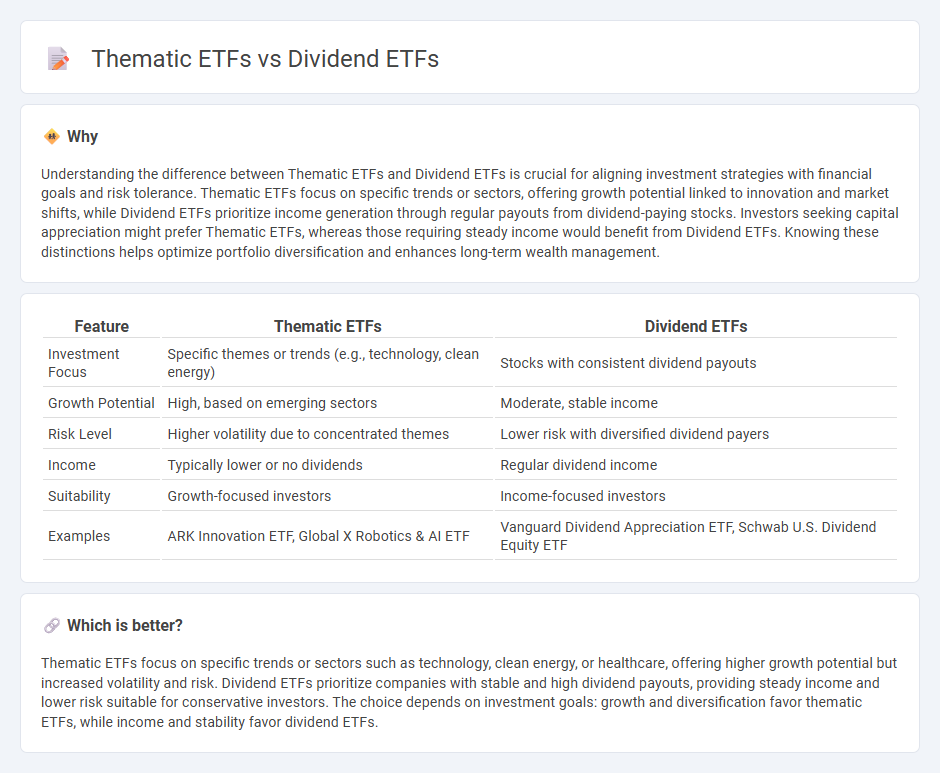

Understanding the difference between Thematic ETFs and Dividend ETFs is crucial for aligning investment strategies with financial goals and risk tolerance. Thematic ETFs focus on specific trends or sectors, offering growth potential linked to innovation and market shifts, while Dividend ETFs prioritize income generation through regular payouts from dividend-paying stocks. Investors seeking capital appreciation might prefer Thematic ETFs, whereas those requiring steady income would benefit from Dividend ETFs. Knowing these distinctions helps optimize portfolio diversification and enhances long-term wealth management.

Comparison Table

| Feature | Thematic ETFs | Dividend ETFs |

|---|---|---|

| Investment Focus | Specific themes or trends (e.g., technology, clean energy) | Stocks with consistent dividend payouts |

| Growth Potential | High, based on emerging sectors | Moderate, stable income |

| Risk Level | Higher volatility due to concentrated themes | Lower risk with diversified dividend payers |

| Income | Typically lower or no dividends | Regular dividend income |

| Suitability | Growth-focused investors | Income-focused investors |

| Examples | ARK Innovation ETF, Global X Robotics & AI ETF | Vanguard Dividend Appreciation ETF, Schwab U.S. Dividend Equity ETF |

Which is better?

Thematic ETFs focus on specific trends or sectors such as technology, clean energy, or healthcare, offering higher growth potential but increased volatility and risk. Dividend ETFs prioritize companies with stable and high dividend payouts, providing steady income and lower risk suitable for conservative investors. The choice depends on investment goals: growth and diversification favor thematic ETFs, while income and stability favor dividend ETFs.

Connection

Thematic ETFs focus on specific sectors or trends, such as technology or clean energy, while Dividend ETFs concentrate on stocks with consistent dividend payouts. Both ETF types offer targeted investment strategies that cater to different investor goals but can overlap when thematic ETFs emphasize high-dividend sectors like utilities or consumer staples. This intersection allows investors to leverage sector-specific growth potential alongside steady income streams from dividends.

Key Terms

Yield

Dividend ETFs prioritize steady income by investing in companies with consistent dividend payouts, targeting investors seeking reliable cash flow. Thematic ETFs focus on growth opportunities by investing in sectors or trends, often sacrificing immediate yield for potential capital appreciation. Explore more to understand which ETF aligns best with your yield and growth objectives.

Sector Exposure

Dividend ETFs primarily invest in companies with a strong history of paying consistent dividends, often concentrated in sectors like utilities, consumer staples, and financials, providing steady income and lower volatility. Thematic ETFs target specific trends or sectors, such as technology, clean energy, or healthcare innovation, offering growth potential tied to evolving market themes but with higher volatility. Explore the detailed distinctions and sector exposures to optimize your investment strategy effectively.

Diversification

Dividend ETFs target stable income through companies with strong dividend histories, offering diversification across sectors with a focus on reliability and cash flow. Thematic ETFs concentrate investments based on specific trends or industries like technology or clean energy, providing exposure to growth areas but often with higher volatility. Explore the nuances of these ETF types to optimize your portfolio diversification strategy and risk management.

Source and External Links

7 Top High-Dividend ETFs by Yield for July 2025 - NerdWallet - Dividend ETFs offer a way to generate income, with top options like Invesco KBW Premium Yield Equity REIT ETF (KBWY) yielding 9.73%, but investors should carefully assess risk and components before investing.

These 3 Dividend Plays (SCHD, DIVO, MAIN) Should Be Your Passive Income Foundation This July - ETFs like Schwab U.S. Dividend ETF (SCHD) provide a balanced foundation for dividend income portfolios by combining steady yield, dividend growth, and lower volatility.

Do ETFs Pay Dividends? - Fidelity Investments - Dividend ETFs distribute dividends to investors from the underlying stocks, typically on a monthly or quarterly basis, and these dividends can be qualified or non-qualified for tax purposes.

dowidth.com

dowidth.com