Altcoins staking offers cryptocurrency holders the opportunity to earn passive income by locking their tokens within specific blockchain networks, enhancing network security and liquidity. Cross-chain bridges enable seamless asset transfers and interoperability between distinct blockchain ecosystems, facilitating broader DeFi participation and expanding user access. Explore the advantages and risks of both to optimize your decentralized finance strategy.

Why it is important

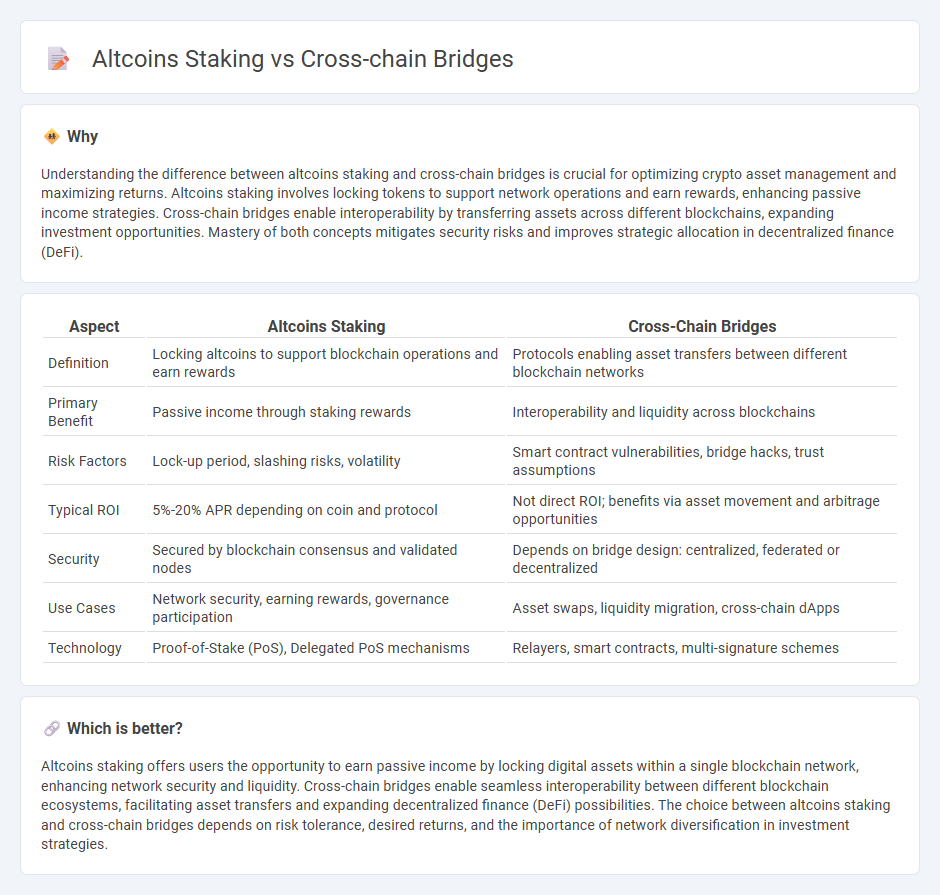

Understanding the difference between altcoins staking and cross-chain bridges is crucial for optimizing crypto asset management and maximizing returns. Altcoins staking involves locking tokens to support network operations and earn rewards, enhancing passive income strategies. Cross-chain bridges enable interoperability by transferring assets across different blockchains, expanding investment opportunities. Mastery of both concepts mitigates security risks and improves strategic allocation in decentralized finance (DeFi).

Comparison Table

| Aspect | Altcoins Staking | Cross-Chain Bridges |

|---|---|---|

| Definition | Locking altcoins to support blockchain operations and earn rewards | Protocols enabling asset transfers between different blockchain networks |

| Primary Benefit | Passive income through staking rewards | Interoperability and liquidity across blockchains |

| Risk Factors | Lock-up period, slashing risks, volatility | Smart contract vulnerabilities, bridge hacks, trust assumptions |

| Typical ROI | 5%-20% APR depending on coin and protocol | Not direct ROI; benefits via asset movement and arbitrage opportunities |

| Security | Secured by blockchain consensus and validated nodes | Depends on bridge design: centralized, federated or decentralized |

| Use Cases | Network security, earning rewards, governance participation | Asset swaps, liquidity migration, cross-chain dApps |

| Technology | Proof-of-Stake (PoS), Delegated PoS mechanisms | Relayers, smart contracts, multi-signature schemes |

Which is better?

Altcoins staking offers users the opportunity to earn passive income by locking digital assets within a single blockchain network, enhancing network security and liquidity. Cross-chain bridges enable seamless interoperability between different blockchain ecosystems, facilitating asset transfers and expanding decentralized finance (DeFi) possibilities. The choice between altcoins staking and cross-chain bridges depends on risk tolerance, desired returns, and the importance of network diversification in investment strategies.

Connection

Altcoins staking enables users to lock up their cryptocurrency assets to earn rewards, enhancing liquidity and network security within specific blockchain ecosystems. Cross-chain bridges facilitate the transfer of staked assets or tokens between different blockchain networks, promoting interoperability and expanding staking opportunities across multiple platforms. This connection allows investors to maximize yield potential by leveraging assets across diverse blockchain environments without sacrificing control or security.

Key Terms

Interoperability

Cross-chain bridges enable seamless asset transfers across multiple blockchain networks, enhancing interoperability by connecting otherwise isolated ecosystems. Altcoins staking primarily secures individual networks and earns rewards but offers limited cross-network integration. Explore how interoperability breakthroughs are reshaping blockchain through cross-chain bridges and alternative staking models.

Yield

Cross-chain bridges enable seamless token transfer across distinct blockchain networks, enhancing liquidity and access to diverse staking opportunities. Altcoin staking offers yield generation by locking native tokens in a blockchain network to support operations and security, often providing competitive annual percentage rates (APRs). Explore detailed comparisons and strategies to maximize yield in the evolving decentralized finance ecosystem.

Liquidity

Cross-chain bridges enhance liquidity by enabling seamless asset transfers across multiple blockchain networks, thereby expanding market access and reducing fragmentation. Altcoin staking locks tokens within a single network to support operations and earn rewards, which can limit immediate liquidity but incentivize long-term holding. Explore how leveraging both strategies can optimize liquidity and maximize your crypto portfolio's potential.

Source and External Links

What Is A Cross Chain Bridge? | Chainlink - A cross-chain bridge is a decentralized application allowing asset transfer between blockchains, using mechanisms like lock and mint, burn and mint, or lock and unlock, sometimes combined with arbitrary data messaging for complex cross-chain functions.

Introduction to Cross-Chain Bridges - Chainalysis - Cross-chain bridges enable blockchains to share data and assets securely, enhancing interoperability and expanding DeFi opportunities by allowing users to move assets across different networks.

6 best cross-chain bridges in 2023 - TechTarget - Cross-chain bridges facilitate the exchange of tokens and NFTs between blockchain networks using wrapped tokens or liquidity pools to enable interoperability across otherwise siloed chains.

dowidth.com

dowidth.com