Special Purpose Acquisition Companies (SPACs) offer a faster and often less regulated path to public markets compared to traditional Initial Public Offerings (IPOs), attracting companies seeking quicker access to capital. While IPOs provide transparent price discovery and established market credibility, SPACs enable private firms to go public through a merger, potentially reducing underwriting costs and market uncertainties. Explore the nuanced benefits and risks of SPACs versus IPOs to determine the best strategy for your investment goals.

Why it is important

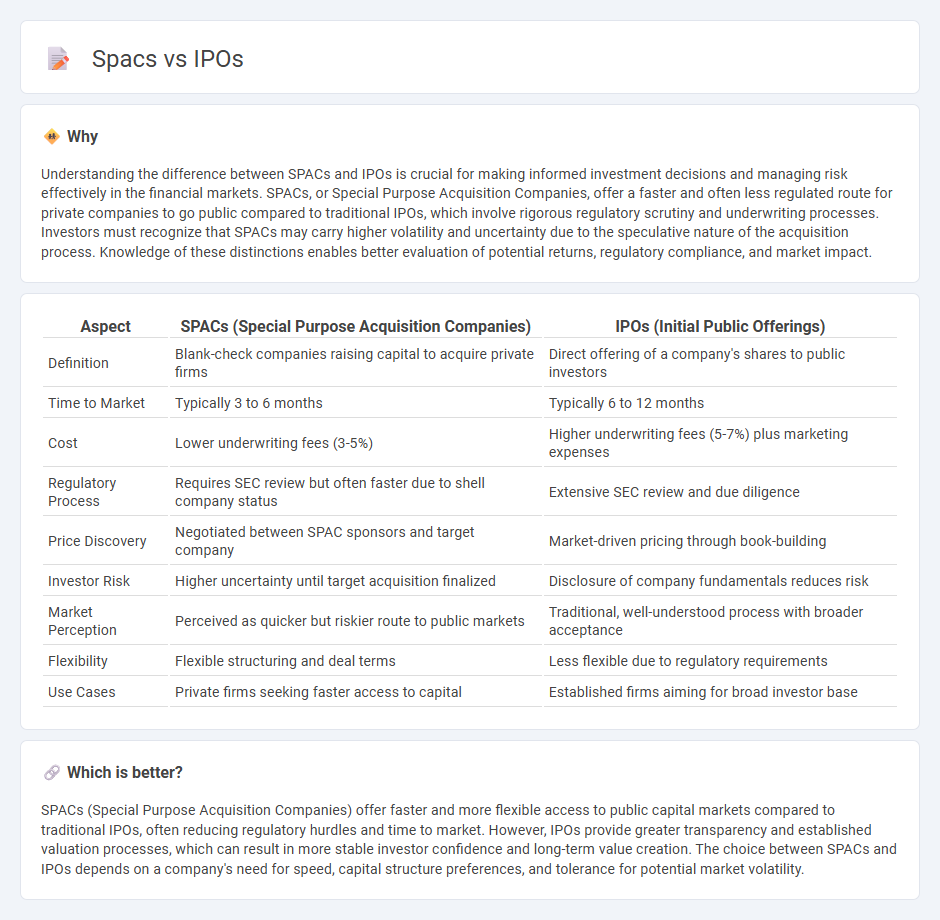

Understanding the difference between SPACs and IPOs is crucial for making informed investment decisions and managing risk effectively in the financial markets. SPACs, or Special Purpose Acquisition Companies, offer a faster and often less regulated route for private companies to go public compared to traditional IPOs, which involve rigorous regulatory scrutiny and underwriting processes. Investors must recognize that SPACs may carry higher volatility and uncertainty due to the speculative nature of the acquisition process. Knowledge of these distinctions enables better evaluation of potential returns, regulatory compliance, and market impact.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | IPOs (Initial Public Offerings) |

|---|---|---|

| Definition | Blank-check companies raising capital to acquire private firms | Direct offering of a company's shares to public investors |

| Time to Market | Typically 3 to 6 months | Typically 6 to 12 months |

| Cost | Lower underwriting fees (3-5%) | Higher underwriting fees (5-7%) plus marketing expenses |

| Regulatory Process | Requires SEC review but often faster due to shell company status | Extensive SEC review and due diligence |

| Price Discovery | Negotiated between SPAC sponsors and target company | Market-driven pricing through book-building |

| Investor Risk | Higher uncertainty until target acquisition finalized | Disclosure of company fundamentals reduces risk |

| Market Perception | Perceived as quicker but riskier route to public markets | Traditional, well-understood process with broader acceptance |

| Flexibility | Flexible structuring and deal terms | Less flexible due to regulatory requirements |

| Use Cases | Private firms seeking faster access to capital | Established firms aiming for broad investor base |

Which is better?

SPACs (Special Purpose Acquisition Companies) offer faster and more flexible access to public capital markets compared to traditional IPOs, often reducing regulatory hurdles and time to market. However, IPOs provide greater transparency and established valuation processes, which can result in more stable investor confidence and long-term value creation. The choice between SPACs and IPOs depends on a company's need for speed, capital structure preferences, and tolerance for potential market volatility.

Connection

Special Purpose Acquisition Companies (SPACs) offer an alternative route to traditional Initial Public Offerings (IPOs) by allowing private companies to go public through a merger with an already-listed shell company. Both SPACs and IPOs serve as mechanisms for raising capital and providing liquidity to company shareholders, but SPACs often expedite the process by bypassing some regulatory complexities associated with conventional IPOs. Investors evaluate both methods based on factors such as market conditions, valuation transparency, and capital-raising efficiency.

Key Terms

Underwriting

Traditional IPOs involve underwriters who conduct due diligence, price the offering, and stabilize the stock post-launch, providing a level of investor confidence and market support. SPACs, or Special Purpose Acquisition Companies, typically bypass extensive underwriting processes, leading to faster public listings but potentially higher risk due to less rigorous initial scrutiny. Explore more about the underwriting dynamics and implications of IPOs versus SPACs for informed investment decisions.

De-SPAC

De-SPAC transactions mark the critical phase where a Special Purpose Acquisition Company (SPAC) merges with a private company to facilitate public market entry, distinguishing this process from traditional Initial Public Offerings (IPOs) that involve direct equity issuance. The De-SPAC route offers private companies quicker access to capital markets and potential valuation benefits, while IPOs are characterized by regulatory scrutiny and longer timelines. Explore how De-SPACs reshape public listings and investment strategies by delving deeper into their operational and financial implications.

Prospectus

A traditional IPO requires a detailed prospectus that provides extensive financial information, risk factors, and business strategies, ensuring regulatory compliance and investor transparency. SPACs, in contrast, initially file a simpler prospectus focusing on the shell company's purpose, with comprehensive disclosures occurring after the business combination announcement. Explore the key differences in prospectus requirements to understand how each method impacts investor insight and regulatory scrutiny.

Source and External Links

Initial public offering - Wikipedia - An initial public offering (IPO) is when a private company offers its shares to the public for the first time, raising capital and transitioning to public ownership under regulated procedures that vary by country.

What Is An IPO? - Fidelity Investments - Companies use IPOs to raise funds, pay off debt, grow their business, or provide liquidity for insiders, with the process managed by lead underwriters who coordinate the sale of shares to both institutional and retail investors.

All 2024 IPOs - A Complete List - Stock Analysis - In 2024, there were 225 IPOs on the US stock market, representing a 46% increase compared to the previous year, with a wide variety of companies going public and showing significant price movements on their first trading days.

dowidth.com

dowidth.com