Digital asset custody involves trusted third-party institutions securely storing cryptocurrencies and blockchain-based assets to protect against theft and loss, while decentralized custody leverages blockchain technology to empower users with direct control over their private keys, reducing reliance on intermediaries. Traditional custodians often provide enhanced regulatory compliance and insurance coverage, contrasting with decentralized solutions that prioritize user autonomy and reduce centralized failure risks. Explore the advantages and security implications of each custody model to identify the best fit for your digital asset management needs.

Why it is important

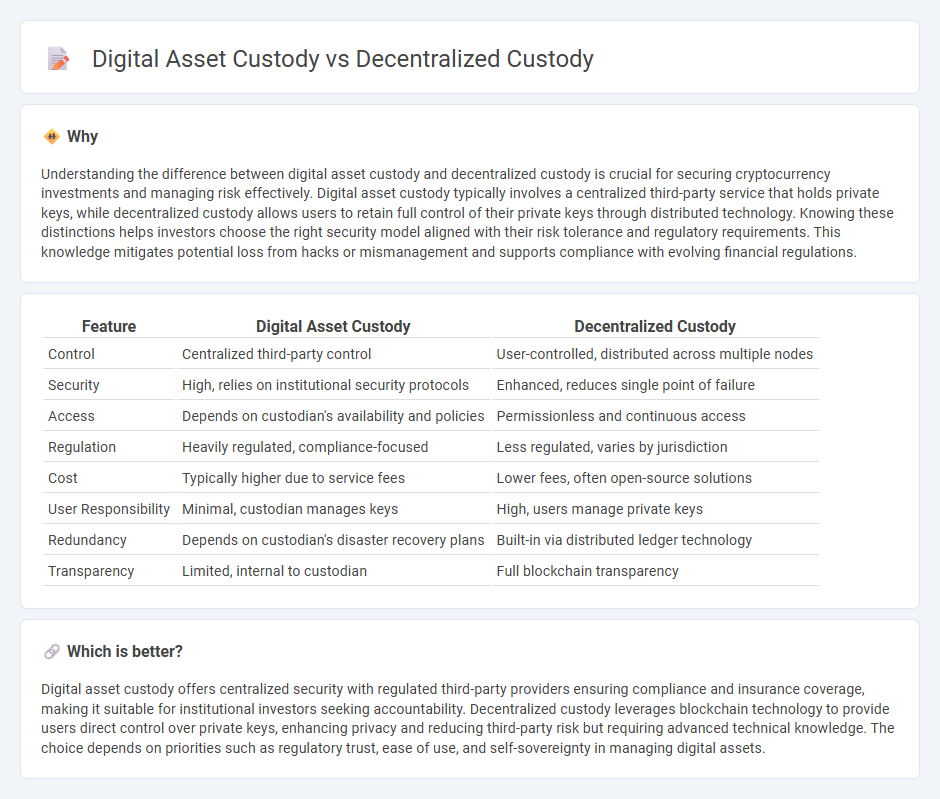

Understanding the difference between digital asset custody and decentralized custody is crucial for securing cryptocurrency investments and managing risk effectively. Digital asset custody typically involves a centralized third-party service that holds private keys, while decentralized custody allows users to retain full control of their private keys through distributed technology. Knowing these distinctions helps investors choose the right security model aligned with their risk tolerance and regulatory requirements. This knowledge mitigates potential loss from hacks or mismanagement and supports compliance with evolving financial regulations.

Comparison Table

| Feature | Digital Asset Custody | Decentralized Custody |

|---|---|---|

| Control | Centralized third-party control | User-controlled, distributed across multiple nodes |

| Security | High, relies on institutional security protocols | Enhanced, reduces single point of failure |

| Access | Depends on custodian's availability and policies | Permissionless and continuous access |

| Regulation | Heavily regulated, compliance-focused | Less regulated, varies by jurisdiction |

| Cost | Typically higher due to service fees | Lower fees, often open-source solutions |

| User Responsibility | Minimal, custodian manages keys | High, users manage private keys |

| Redundancy | Depends on custodian's disaster recovery plans | Built-in via distributed ledger technology |

| Transparency | Limited, internal to custodian | Full blockchain transparency |

Which is better?

Digital asset custody offers centralized security with regulated third-party providers ensuring compliance and insurance coverage, making it suitable for institutional investors seeking accountability. Decentralized custody leverages blockchain technology to provide users direct control over private keys, enhancing privacy and reducing third-party risk but requiring advanced technical knowledge. The choice depends on priorities such as regulatory trust, ease of use, and self-sovereignty in managing digital assets.

Connection

Digital asset custody involves the secure storage and management of cryptocurrencies and blockchain-based assets, ensuring protection against theft and loss. Decentralized custody enhances this by distributing control across multiple independent parties using blockchain technology, reducing reliance on centralized authorities and increasing security. This integrated approach leverages cryptographic security protocols and smart contracts to provide transparent, tamper-resistant asset management solutions in the finance sector.

Key Terms

Private Key Management

Private key management is crucial in decentralized custody, giving users full control and responsibility over their digital assets without intermediaries. Digital asset custody solutions often employ advanced key management systems, including multi-signature wallets and hardware security modules, to enhance security and reduce the risk of theft or loss. Explore the differences in private key management to secure your digital investments effectively.

Third-party Custodian

Third-party custodians play a critical role in digital asset custody by securely managing private keys and safeguarding assets on behalf of clients, contrasting with decentralized custody where users maintain control without intermediaries. These custodians implement robust security measures including multi-signature wallets, cold storage, and compliance with regulatory frameworks to mitigate risks. Explore how third-party custody solutions balance security and convenience for optimal digital asset management.

Self-custody

Decentralized custody involves individuals holding their private keys, ensuring full control and reducing reliance on third-party intermediaries, unlike traditional digital asset custody that entrusts assets to centralized platforms. Self-custody enhances security by preventing single points of failure and supports privacy, making it a preferred choice for blockchain enthusiasts and institutional investors seeking autonomy. Explore the differences and benefits of self-custody solutions to better secure your digital assets.

Source and External Links

Decentralized vs. Centralized Custody - Curvegrid - Decentralized custody means holding your own private keys and full control over your digital assets without intermediaries, enhancing security and user empowerment but requiring careful key management and posing some complexity.

What Is Digital Asset Custody? Solutions, Benefits & Challenges - Fireblocks - Digital asset custody involves methods for storing and protecting owners' cryptographic keys which represent their assets, where decentralized custody removes intermediaries and relies on user-held keys secured through cryptography.

The Network Is the Vault: Why Decentralized Custody Is the Future - Qredo - Decentralized custody uses multi-party computation (MPC) and consensus on blockchain networks to secure assets without relying on single private keys, distributing control among nodes and increasing security by eliminating single points of failure.

dowidth.com

dowidth.com