Liquidity staking offers the advantage of earning staking rewards while maintaining asset flexibility, contrasting with direct crypto holding where assets remain idle but fully accessible. By participating in liquidity staking, investors can enhance capital efficiency and reduce opportunity costs tied to non-yielding holdings. Explore deeper insights to understand which strategy maximizes returns and risk management in crypto finance.

Why it is important

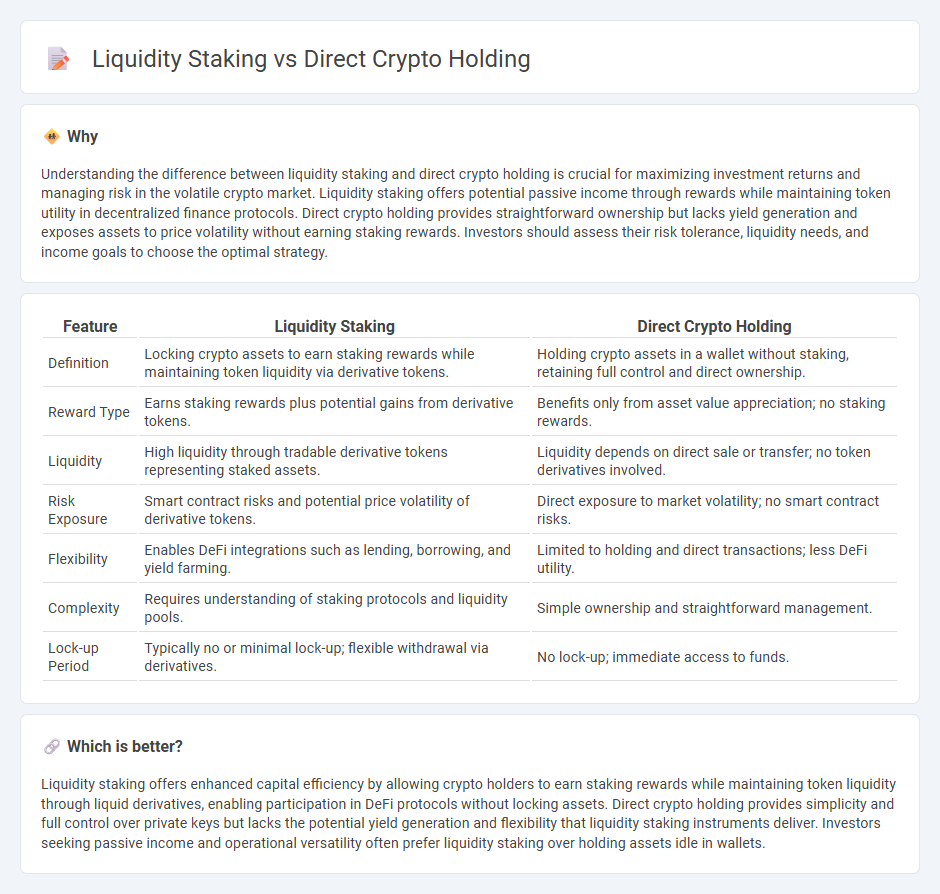

Understanding the difference between liquidity staking and direct crypto holding is crucial for maximizing investment returns and managing risk in the volatile crypto market. Liquidity staking offers potential passive income through rewards while maintaining token utility in decentralized finance protocols. Direct crypto holding provides straightforward ownership but lacks yield generation and exposes assets to price volatility without earning staking rewards. Investors should assess their risk tolerance, liquidity needs, and income goals to choose the optimal strategy.

Comparison Table

| Feature | Liquidity Staking | Direct Crypto Holding |

|---|---|---|

| Definition | Locking crypto assets to earn staking rewards while maintaining token liquidity via derivative tokens. | Holding crypto assets in a wallet without staking, retaining full control and direct ownership. |

| Reward Type | Earns staking rewards plus potential gains from derivative tokens. | Benefits only from asset value appreciation; no staking rewards. |

| Liquidity | High liquidity through tradable derivative tokens representing staked assets. | Liquidity depends on direct sale or transfer; no token derivatives involved. |

| Risk Exposure | Smart contract risks and potential price volatility of derivative tokens. | Direct exposure to market volatility; no smart contract risks. |

| Flexibility | Enables DeFi integrations such as lending, borrowing, and yield farming. | Limited to holding and direct transactions; less DeFi utility. |

| Complexity | Requires understanding of staking protocols and liquidity pools. | Simple ownership and straightforward management. |

| Lock-up Period | Typically no or minimal lock-up; flexible withdrawal via derivatives. | No lock-up; immediate access to funds. |

Which is better?

Liquidity staking offers enhanced capital efficiency by allowing crypto holders to earn staking rewards while maintaining token liquidity through liquid derivatives, enabling participation in DeFi protocols without locking assets. Direct crypto holding provides simplicity and full control over private keys but lacks the potential yield generation and flexibility that liquidity staking instruments deliver. Investors seeking passive income and operational versatility often prefer liquidity staking over holding assets idle in wallets.

Connection

Liquidity staking enhances capital efficiency by allowing crypto holders to earn rewards while maintaining asset liquidity, bridging the gap between direct crypto holding and decentralized finance protocols. Direct crypto holding involves retaining full control over private keys, whereas liquidity staking delegates these assets to staking pools, enabling participation in consensus mechanisms without forfeiting ownership. This connection fosters increased network security and yield generation, optimizing returns in the evolving blockchain ecosystem.

Key Terms

Custody

Direct crypto holding involves private key ownership, granting full control and responsibility for asset security, whereas liquidity staking uses custodial services to delegate tokens for network validation while earning rewards. Custody in direct holding demands robust personal security measures to prevent theft, while liquidity staking providers offer managed custody solutions that streamline asset management but require trust in third parties. Explore the nuances of crypto custody to choose the optimal method for your investment strategy.

Yield

Direct crypto holding offers yield through price appreciation and potential rewards from network incentives, yet it lacks the passive income streams present in liquidity staking. Liquidity staking generates consistent yield by locking assets in decentralized finance (DeFi) protocols, benefiting from transaction fees and staking rewards that often surpass traditional holding yields. Explore the nuances of these strategies to optimize your crypto investment returns effectively.

Liquidity

Liquidity staking allows crypto holders to earn rewards while maintaining asset liquidity, unlike direct crypto holding where assets remain static and less accessible. By staking tokens in a liquidity pool, users can benefit from higher capital efficiency and real-time trading opportunities. Explore more about optimizing your crypto portfolio with liquidity staking strategies.

Source and External Links

Which Banks Own Bitcoin: Welcome to Institutional Adoption - PlasBit - Direct crypto holding means owning the actual cryptocurrency asset directly, allowing institutions like banks to maintain full control and responsibility for its secure storage and risks, unlike indirect investment methods such as ETFs.

Crypto Funds - Fidelity Investments - Direct ownership of cryptocurrency ("spot crypto") means the investor owns the actual assets and must securely custody them, enabling 24/7 trading and transfer on the blockchain, as opposed to indirect crypto exposure through exchange-traded products (ETPs) that trade on stock exchanges.

Cryptocurrency ETFs - TD Direct Investing - Unlike holding cryptocurrency directly which requires storage in digital wallets and responsibility for private keys, cryptocurrency ETFs provide indirect exposure without actual ownership, offering convenience and potentially lower risks but with possible fees and less transparency.

dowidth.com

dowidth.com