Direct indexing offers personalized portfolio customization and potential tax benefits by allowing investors to own individual securities directly, unlike mutual funds which pool assets for collective investment management. Unlike mutual funds, direct indexing enables precise control over tax-loss harvesting and alignment with specific investment goals. Discover how direct indexing can enhance portfolio efficiency compared to traditional mutual funds.

Why it is important

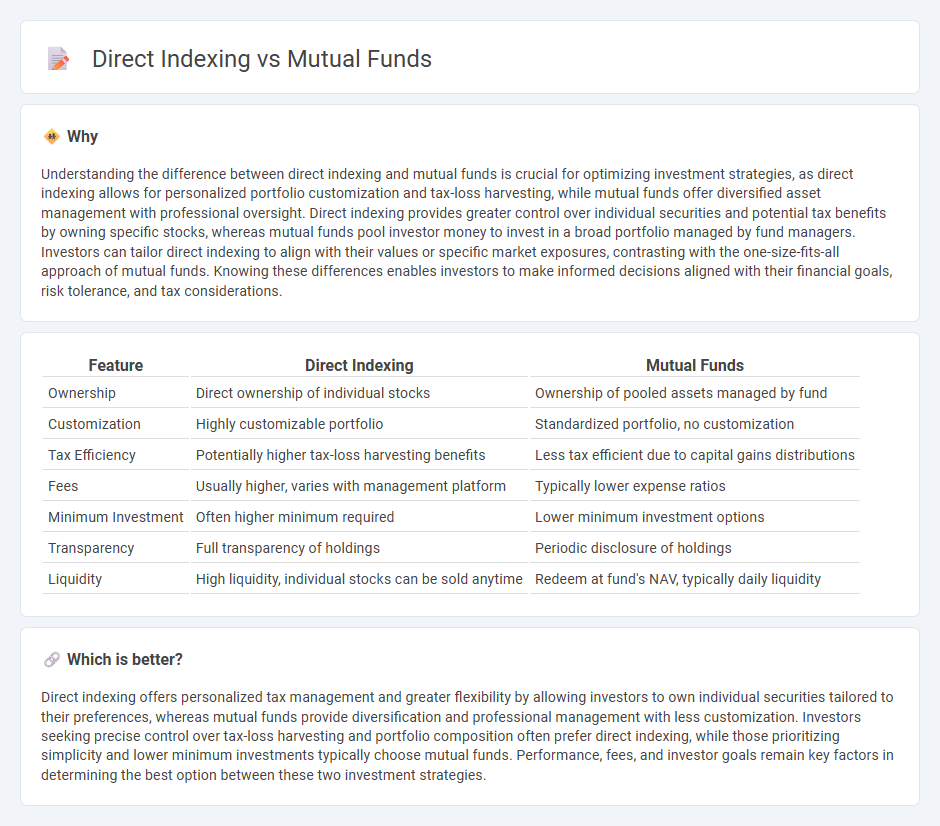

Understanding the difference between direct indexing and mutual funds is crucial for optimizing investment strategies, as direct indexing allows for personalized portfolio customization and tax-loss harvesting, while mutual funds offer diversified asset management with professional oversight. Direct indexing provides greater control over individual securities and potential tax benefits by owning specific stocks, whereas mutual funds pool investor money to invest in a broad portfolio managed by fund managers. Investors can tailor direct indexing to align with their values or specific market exposures, contrasting with the one-size-fits-all approach of mutual funds. Knowing these differences enables investors to make informed decisions aligned with their financial goals, risk tolerance, and tax considerations.

Comparison Table

| Feature | Direct Indexing | Mutual Funds |

|---|---|---|

| Ownership | Direct ownership of individual stocks | Ownership of pooled assets managed by fund |

| Customization | Highly customizable portfolio | Standardized portfolio, no customization |

| Tax Efficiency | Potentially higher tax-loss harvesting benefits | Less tax efficient due to capital gains distributions |

| Fees | Usually higher, varies with management platform | Typically lower expense ratios |

| Minimum Investment | Often higher minimum required | Lower minimum investment options |

| Transparency | Full transparency of holdings | Periodic disclosure of holdings |

| Liquidity | High liquidity, individual stocks can be sold anytime | Redeem at fund's NAV, typically daily liquidity |

Which is better?

Direct indexing offers personalized tax management and greater flexibility by allowing investors to own individual securities tailored to their preferences, whereas mutual funds provide diversification and professional management with less customization. Investors seeking precise control over tax-loss harvesting and portfolio composition often prefer direct indexing, while those prioritizing simplicity and lower minimum investments typically choose mutual funds. Performance, fees, and investor goals remain key factors in determining the best option between these two investment strategies.

Connection

Direct indexing and mutual funds both allow investors to achieve diversified portfolios, but direct indexing offers personalized stock selection by tracking an index through individual securities. Mutual funds pool investor capital to buy a broad range of assets managed by professionals, while direct indexing grants greater tax efficiency and customization by holding actual shares. Both strategies aim to replicate market performance, yet direct indexing enhances control over holdings and tax-loss harvesting opportunities compared to traditional mutual funds.

Key Terms

Diversification

Mutual funds offer instant diversification by pooling investments across a wide range of assets, reducing risk through broad market exposure. Direct indexing allows customized diversification by directly owning individual stocks that replicate an index, enabling tailored tax management and personal preferences. Explore the advantages of each approach to optimize your investment diversification strategy.

Expense Ratio

Mutual funds typically have higher expense ratios ranging from 0.50% to 1.50%, covering management fees and operational costs, whereas direct indexing tends to offer lower expense ratios around 0.20% to 0.40% due to reduced overhead and personalized portfolio management. Lower expense ratios in direct indexing can lead to significant long-term cost savings and enhanced tax efficiency through customized tax-loss harvesting. Explore the detailed comparison between mutual funds and direct indexing to optimize investment strategies effectively.

Tax Efficiency

Tax efficiency in mutual funds is often limited due to capital gains distributions triggered by frequent portfolio rebalancing and redemptions. Direct indexing allows investors to customize their portfolios and utilize tax-loss harvesting strategies more effectively, minimizing taxable events. Explore how direct indexing could enhance your after-tax returns compared to mutual funds.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered investment company pooling money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed by a professional adviser, offering benefits like diversification, professional management, liquidity, and low minimum investments.

Mutual fund - Wikipedia - Mutual funds pool investors' money to buy securities and are classified as money market, bond, equity, or hybrid funds, and may be actively or passively managed; they offer diversification, liquidity, and professional management but involve fees and expenses.

Understanding mutual funds - Charles Schwab - Mutual funds allow investors to pool money to buy a broad range of stocks, bonds, and other assets managed professionally, providing diversification, lower costs, and convenience.

dowidth.com

dowidth.com