Liquid staking allows users to earn rewards while retaining the ability to trade or use their staked assets, enhancing liquidity and flexibility compared to traditional staking. Traditional staking typically involves locking assets for a fixed period, limiting access but often providing more straightforward, lower-risk rewards. Explore how these staking methods impact your investment strategy and optimize yield potential.

Why it is important

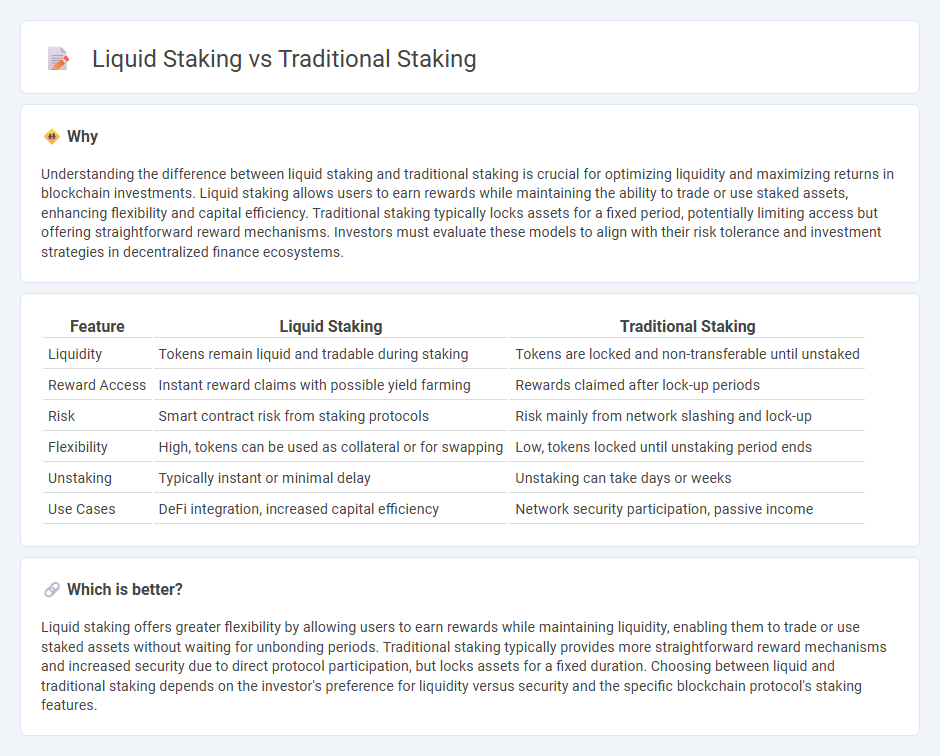

Understanding the difference between liquid staking and traditional staking is crucial for optimizing liquidity and maximizing returns in blockchain investments. Liquid staking allows users to earn rewards while maintaining the ability to trade or use staked assets, enhancing flexibility and capital efficiency. Traditional staking typically locks assets for a fixed period, potentially limiting access but offering straightforward reward mechanisms. Investors must evaluate these models to align with their risk tolerance and investment strategies in decentralized finance ecosystems.

Comparison Table

| Feature | Liquid Staking | Traditional Staking |

|---|---|---|

| Liquidity | Tokens remain liquid and tradable during staking | Tokens are locked and non-transferable until unstaked |

| Reward Access | Instant reward claims with possible yield farming | Rewards claimed after lock-up periods |

| Risk | Smart contract risk from staking protocols | Risk mainly from network slashing and lock-up |

| Flexibility | High, tokens can be used as collateral or for swapping | Low, tokens locked until unstaking period ends |

| Unstaking | Typically instant or minimal delay | Unstaking can take days or weeks |

| Use Cases | DeFi integration, increased capital efficiency | Network security participation, passive income |

Which is better?

Liquid staking offers greater flexibility by allowing users to earn rewards while maintaining liquidity, enabling them to trade or use staked assets without waiting for unbonding periods. Traditional staking typically provides more straightforward reward mechanisms and increased security due to direct protocol participation, but locks assets for a fixed duration. Choosing between liquid and traditional staking depends on the investor's preference for liquidity versus security and the specific blockchain protocol's staking features.

Connection

Liquid staking and traditional staking are connected through their role in securing blockchain networks and earning rewards by locking cryptocurrency assets. While traditional staking involves locking tokens directly on a blockchain to support network operations, liquid staking allows users to stake assets while maintaining liquidity by receiving tradable derivative tokens. Both methods contribute to network security and yield generation but differ in flexibility and asset accessibility.

Key Terms

Lock-up period

Traditional staking requires locking up tokens for a fixed period, restricting liquidity and access to funds until the lock-up ends. Liquid staking allows users to stake assets while receiving tokenized derivatives that maintain liquidity and can be traded or used in DeFi platforms. Explore how these options impact your staking strategy and liquidity needs.

Liquidity

Traditional staking requires locking up tokens for a fixed period, resulting in reduced liquidity and limited access to capital. Liquid staking enables users to stake assets while receiving tradable tokens, preserving liquidity and allowing seamless participation in DeFi activities. Explore how liquid staking can enhance your crypto portfolio's flexibility and capital efficiency.

Derivative tokens

Traditional staking locks cryptocurrency assets to secure blockchain networks, earning rewards but limiting liquidity. Liquid staking issues derivative tokens representing staked assets, enabling users to trade or utilize these tokens in DeFi protocols while still receiving staking rewards. Explore the advantages and mechanics of derivative tokens in liquid staking to optimize your crypto portfolio.

Source and External Links

Liquid Staking vs Traditional Staking vs Pool Staking: Which One is ... - Traditional staking involves locking up cryptocurrency in a wallet to support blockchain operations, earning rewards while requiring a minimum stake, technical expertise, and facing lock-up periods with risks like slashing penalties.

Liquid Staking vs Traditional Staking vs Pool Staking: which one is ... - Traditional staking on PoS blockchains can be done by setting up a validator node or delegating assets, and while it offers higher rewards, it demands technical skill and locks assets without liquidity.

What is the Difference Between Crypto Staking and Traditional ... - Traditional staking differs from conventional interest accounts by offering potentially higher returns through locking crypto assets with limited liquidity and higher risks tied to crypto volatility and network behavior.

dowidth.com

dowidth.com