Insurtech revolutionizes the insurance industry by leveraging technology to improve underwriting, claims processing, and customer experiences, while fintech encompasses a broader range of financial services including banking, payments, and investment management through digital solutions. Both sectors drive innovation by utilizing artificial intelligence, blockchain, and big data to enhance efficiency and accessibility. Explore how these technologies shape the future of financial services and customer engagement.

Why it is important

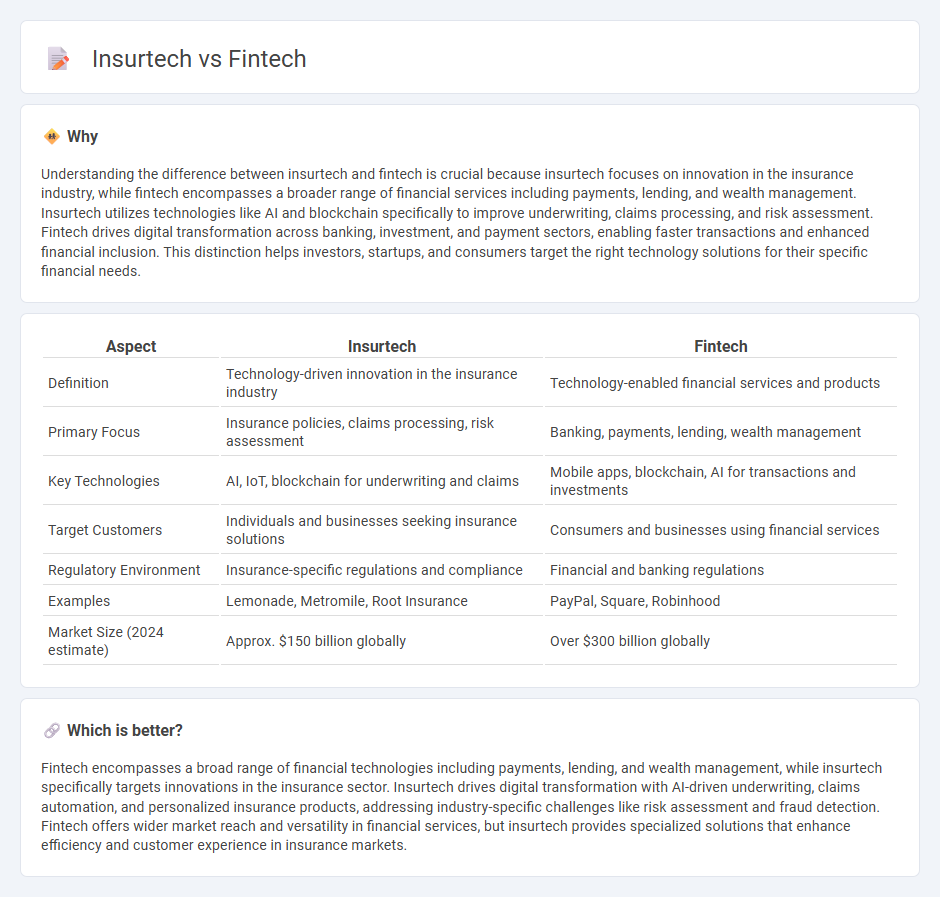

Understanding the difference between insurtech and fintech is crucial because insurtech focuses on innovation in the insurance industry, while fintech encompasses a broader range of financial services including payments, lending, and wealth management. Insurtech utilizes technologies like AI and blockchain specifically to improve underwriting, claims processing, and risk assessment. Fintech drives digital transformation across banking, investment, and payment sectors, enabling faster transactions and enhanced financial inclusion. This distinction helps investors, startups, and consumers target the right technology solutions for their specific financial needs.

Comparison Table

| Aspect | Insurtech | Fintech |

|---|---|---|

| Definition | Technology-driven innovation in the insurance industry | Technology-enabled financial services and products |

| Primary Focus | Insurance policies, claims processing, risk assessment | Banking, payments, lending, wealth management |

| Key Technologies | AI, IoT, blockchain for underwriting and claims | Mobile apps, blockchain, AI for transactions and investments |

| Target Customers | Individuals and businesses seeking insurance solutions | Consumers and businesses using financial services |

| Regulatory Environment | Insurance-specific regulations and compliance | Financial and banking regulations |

| Examples | Lemonade, Metromile, Root Insurance | PayPal, Square, Robinhood |

| Market Size (2024 estimate) | Approx. $150 billion globally | Over $300 billion globally |

Which is better?

Fintech encompasses a broad range of financial technologies including payments, lending, and wealth management, while insurtech specifically targets innovations in the insurance sector. Insurtech drives digital transformation with AI-driven underwriting, claims automation, and personalized insurance products, addressing industry-specific challenges like risk assessment and fraud detection. Fintech offers wider market reach and versatility in financial services, but insurtech provides specialized solutions that enhance efficiency and customer experience in insurance markets.

Connection

Insurtech and fintech are interconnected through their shared goal of leveraging technology to revolutionize financial services and insurance industries. Both sectors use data analytics, artificial intelligence, and blockchain to enhance customer experience, streamline operations, and improve risk assessment. Integration of insurtech solutions within fintech platforms enables more efficient policy management, faster claims processing, and personalized financial products.

Key Terms

Digital Payments

Fintech revolutionizes digital payments by enabling seamless, real-time transactions through mobile wallets, peer-to-peer transfers, and blockchain technology, enhancing accessibility and security. Insurtech leverages digital payment solutions to streamline premium collections, claims disbursements, and microinsurance models, improving efficiency and customer experience in the insurance sector. Explore how these innovations transform financial and insurance ecosystems by embracing the latest trends in digital payments.

Risk Assessment

Fintech leverages big data analytics and AI algorithms to enhance credit scoring and fraud detection, optimizing financial risk assessment. Insurtech applies similar technologies to evaluate underwriting risks, using telematics and IoT devices to provide real-time data for personalized insurance pricing. Explore how these innovations transform risk assessment strategies across finance and insurance sectors.

Regulatory Compliance

Fintech and insurtech sectors both navigate complex regulatory landscapes to ensure compliance with financial and insurance laws, including data protection and anti-money laundering regulations. While fintech prioritizes compliance with banking and payments regulations such as PSD2 and GDPR, insurtech must address insurance-specific rules like Solvency II and risk management standards. Explore more to understand how these industries adapt regulatory frameworks to innovate securely.

Source and External Links

What is Fintech? | IBM - Fintech refers to technology, including AI and machine learning, that enables mobile apps and software for personal finance, investing, and lending services, allowing users to manage money, trade stocks, or apply for loans digitally.

What is fintech? 6 main types of fintech and how they work - Plaid - Fintech includes digital banking (neobanks), payments, and other financial services leveraging technology for faster, cheaper, and more accessible money management and transactions for consumers and businesses.

Financial technology - Wikipedia - Fintech encompasses a broad industry with categories such as digital banking, payments, lending, wealth management, blockchain, regtech, and infrastructure, driven by innovations that improve financial services and products.

dowidth.com

dowidth.com