Altcoins staking allows investors to earn rewards by locking their digital assets within a blockchain network, enhancing liquidity and network security, whereas wrapped tokens represent cryptocurrencies pegged to the value of another asset, enabling cross-chain compatibility and broader market access. Both strategies offer unique advantages in yield generation and portfolio diversification within decentralized finance ecosystems. Explore our comprehensive guide to understand the benefits and risks of altcoins staking compared to wrapped tokens.

Why it is important

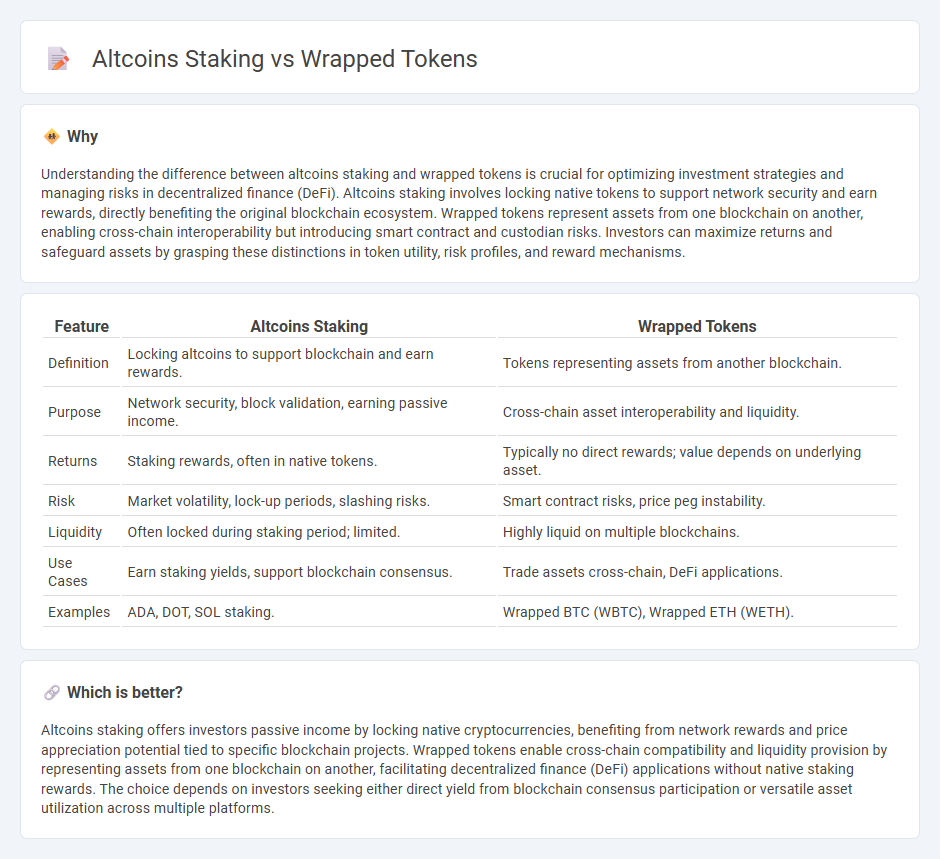

Understanding the difference between altcoins staking and wrapped tokens is crucial for optimizing investment strategies and managing risks in decentralized finance (DeFi). Altcoins staking involves locking native tokens to support network security and earn rewards, directly benefiting the original blockchain ecosystem. Wrapped tokens represent assets from one blockchain on another, enabling cross-chain interoperability but introducing smart contract and custodian risks. Investors can maximize returns and safeguard assets by grasping these distinctions in token utility, risk profiles, and reward mechanisms.

Comparison Table

| Feature | Altcoins Staking | Wrapped Tokens |

|---|---|---|

| Definition | Locking altcoins to support blockchain and earn rewards. | Tokens representing assets from another blockchain. |

| Purpose | Network security, block validation, earning passive income. | Cross-chain asset interoperability and liquidity. |

| Returns | Staking rewards, often in native tokens. | Typically no direct rewards; value depends on underlying asset. |

| Risk | Market volatility, lock-up periods, slashing risks. | Smart contract risks, price peg instability. |

| Liquidity | Often locked during staking period; limited. | Highly liquid on multiple blockchains. |

| Use Cases | Earn staking yields, support blockchain consensus. | Trade assets cross-chain, DeFi applications. |

| Examples | ADA, DOT, SOL staking. | Wrapped BTC (WBTC), Wrapped ETH (WETH). |

Which is better?

Altcoins staking offers investors passive income by locking native cryptocurrencies, benefiting from network rewards and price appreciation potential tied to specific blockchain projects. Wrapped tokens enable cross-chain compatibility and liquidity provision by representing assets from one blockchain on another, facilitating decentralized finance (DeFi) applications without native staking rewards. The choice depends on investors seeking either direct yield from blockchain consensus participation or versatile asset utilization across multiple platforms.

Connection

Altcoins staking allows investors to earn rewards by locking up their alternative cryptocurrencies, enhancing liquidity and network security. Wrapped tokens represent these altcoins on different blockchains, enabling seamless cross-chain transactions and broader access to DeFi protocols. This connection amplifies staking utility by facilitating token interoperability and expanding earning opportunities across multiple blockchain ecosystems.

Key Terms

Tokenization

Wrapped tokens represent tokenized versions of assets from one blockchain on another, enabling cross-chain compatibility and liquidity. Altcoins staking involves locking alternative cryptocurrency tokens to support network operations and earn rewards, reflecting proof-of-stake mechanisms. Explore how tokenization bridges asset ecosystems and enhances decentralized finance opportunities for deeper insights.

Yield

Wrapped tokens enable users to earn yield by staking assets pegged to cryptocurrencies like Bitcoin or Ethereum on decentralized finance platforms, often offering liquidity and interoperability benefits. Altcoins staking involves locking native coins of a blockchain to support network operations and receive rewards, with variable yields influenced by the coin's inflation rate and network demand. Explore deeper insights into staking strategies and yield optimization to maximize your crypto earnings.

Interoperability

Wrapped tokens enable interoperability by representing assets from one blockchain on another, facilitating seamless cross-chain transactions and liquidity sharing. Altcoins staking typically provides network security and rewards within a single blockchain ecosystem, with limited cross-chain interaction. Explore how wrapped tokens enhance blockchain interoperability compared to staking to optimize your crypto strategy.

Source and External Links

What are wrapped tokens? - Robinhood - Wrapped tokens allow cryptocurrencies from one blockchain (e.g., Bitcoin) to be used on another blockchain (e.g., Ethereum) by locking the original coin and minting an equivalent token on the target blockchain via a smart contract system.

What is a Wrapped Token? - OSL - Wrapped tokens represent cryptocurrencies on different blockchains, enabling interoperability, enhanced liquidity, and access to DeFi applications by locking the original asset and minting an equivalent wrapped token on the new blockchain.

What are Wrapped Tokens? - Zerocap - Wrapped tokens act as a one-to-one pegged equivalent of a cryptocurrency from one blockchain on another blockchain, unlocking cross-chain usage and increasing liquidity and capital efficiency in decentralized finance (DeFi) platforms.

dowidth.com

dowidth.com