Tokenized treasuries represent government debt issued as digital tokens on a blockchain, enhancing liquidity and transparency compared to traditional bonds. Digital securities, encompassing a broader range of asset classes including equity and debt, leverage blockchain technology to simplify issuance, compliance, and trading processes. Explore how these innovations are reshaping financial markets and investment strategies.

Why it is important

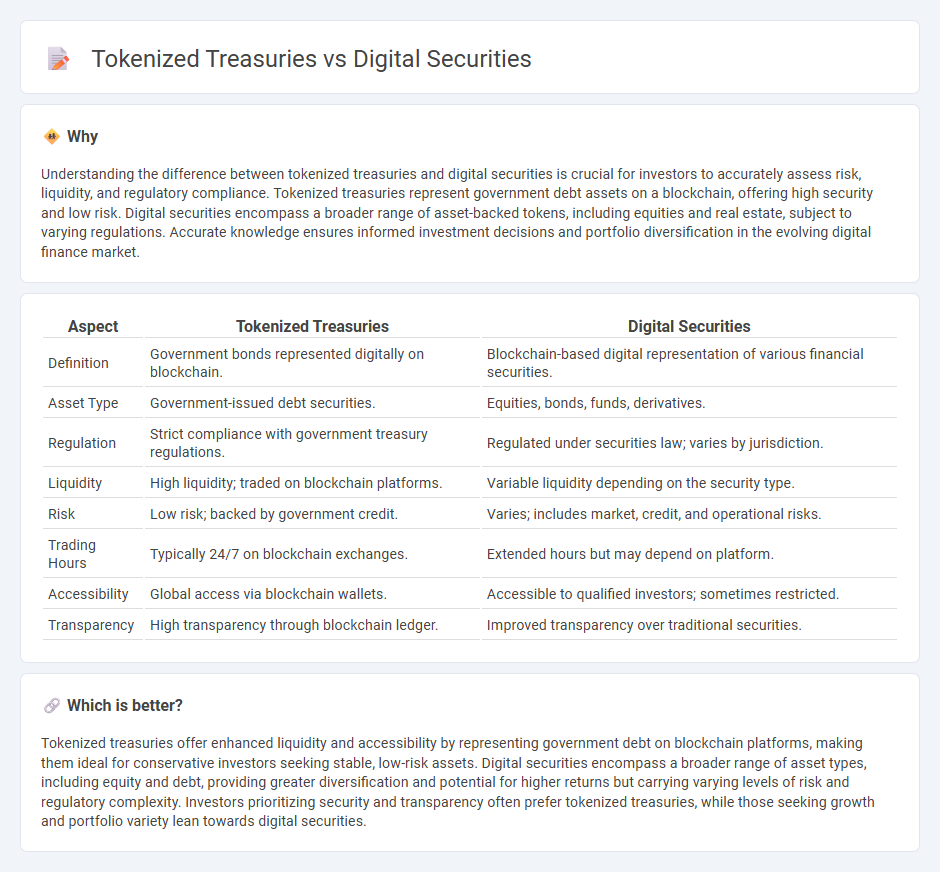

Understanding the difference between tokenized treasuries and digital securities is crucial for investors to accurately assess risk, liquidity, and regulatory compliance. Tokenized treasuries represent government debt assets on a blockchain, offering high security and low risk. Digital securities encompass a broader range of asset-backed tokens, including equities and real estate, subject to varying regulations. Accurate knowledge ensures informed investment decisions and portfolio diversification in the evolving digital finance market.

Comparison Table

| Aspect | Tokenized Treasuries | Digital Securities |

|---|---|---|

| Definition | Government bonds represented digitally on blockchain. | Blockchain-based digital representation of various financial securities. |

| Asset Type | Government-issued debt securities. | Equities, bonds, funds, derivatives. |

| Regulation | Strict compliance with government treasury regulations. | Regulated under securities law; varies by jurisdiction. |

| Liquidity | High liquidity; traded on blockchain platforms. | Variable liquidity depending on the security type. |

| Risk | Low risk; backed by government credit. | Varies; includes market, credit, and operational risks. |

| Trading Hours | Typically 24/7 on blockchain exchanges. | Extended hours but may depend on platform. |

| Accessibility | Global access via blockchain wallets. | Accessible to qualified investors; sometimes restricted. |

| Transparency | High transparency through blockchain ledger. | Improved transparency over traditional securities. |

Which is better?

Tokenized treasuries offer enhanced liquidity and accessibility by representing government debt on blockchain platforms, making them ideal for conservative investors seeking stable, low-risk assets. Digital securities encompass a broader range of asset types, including equity and debt, providing greater diversification and potential for higher returns but carrying varying levels of risk and regulatory complexity. Investors prioritizing security and transparency often prefer tokenized treasuries, while those seeking growth and portfolio variety lean towards digital securities.

Connection

Tokenized treasuries and digital securities utilize blockchain technology to enhance liquidity and transparency in financial markets. Tokenized treasuries represent government debt instruments in digital form, allowing fractional ownership, while digital securities encompass a broader range of assets issued and traded on blockchain platforms. Both enable faster settlement, reduced intermediaries, and improved accessibility for investors through programmable and secure digital tokens.

Key Terms

Blockchain

Digital securities leverage blockchain technology to enhance transparency, security, and efficiency in the issuance and trading of traditional financial assets. Tokenized treasuries represent government debt instruments on blockchain, enabling fractional ownership, faster settlement, and broader market access. Explore how these innovations are transforming the global financial infrastructure and investment landscape.

Compliance

Digital securities are regulated financial instruments issued on a blockchain, ensuring compliance with securities laws through immutable records and smart contracts, while tokenized treasuries represent government bonds or debt digitally issued to enhance liquidity and accessibility under strict regulatory frameworks. Both leverage blockchain technology for transparency and auditability but differ in issuer type and compliance complexities, with digital securities often facing rigorous KYC/AML requirements compared to tokenized treasuries that align with sovereign regulation. Explore deeper insights on how compliance shapes the evolving landscape of digital asset issuance and management.

Liquidity

Digital securities enhance liquidity by enabling fractional ownership and 24/7 trading on blockchain platforms, reducing settlement times significantly compared to traditional markets. Tokenized treasuries provide liquidity through real-time, secure, and transparent transactions of government debt instruments, often with lower entry barriers and instant settlement. Explore the evolving landscape of these innovative financial instruments to understand their impact on market liquidity and investment opportunities.

Source and External Links

Digital securities - Glossary - Blockstream - Digital securities, or security tokens, represent digitized real-world assets like stocks or real estate managed on blockchain, providing increased liquidity, fractional ownership, and regulatory-compliant investor rights such as dividends and voting.

SDX: The World's Leading Exchange for Digital Assets - SDX offers a blockchain-based platform for issuing, trading, and settling digital securities with regulatory compliance under FINMA, improving liquidity and lowering costs by automating and streamlining financial market processes.

Digital Securities Sandbox (DSS) - The FCA's Digital Securities Sandbox allows legally established UK firms to issue, trade, and settle real digital securities with similar uses and regulatory oversight as traditional securities, including equities and bonds.

dowidth.com

dowidth.com