Quantitative tightening (QT) involves the Federal Reserve reducing its balance sheet by selling securities or letting them mature, effectively decreasing the money supply to control inflation. Open market operations (OMO) are short-term buying or selling of government securities to manage liquidity and influence interest rates in the banking system. Explore more to understand how these monetary policy tools impact financial markets and economic stability.

Why it is important

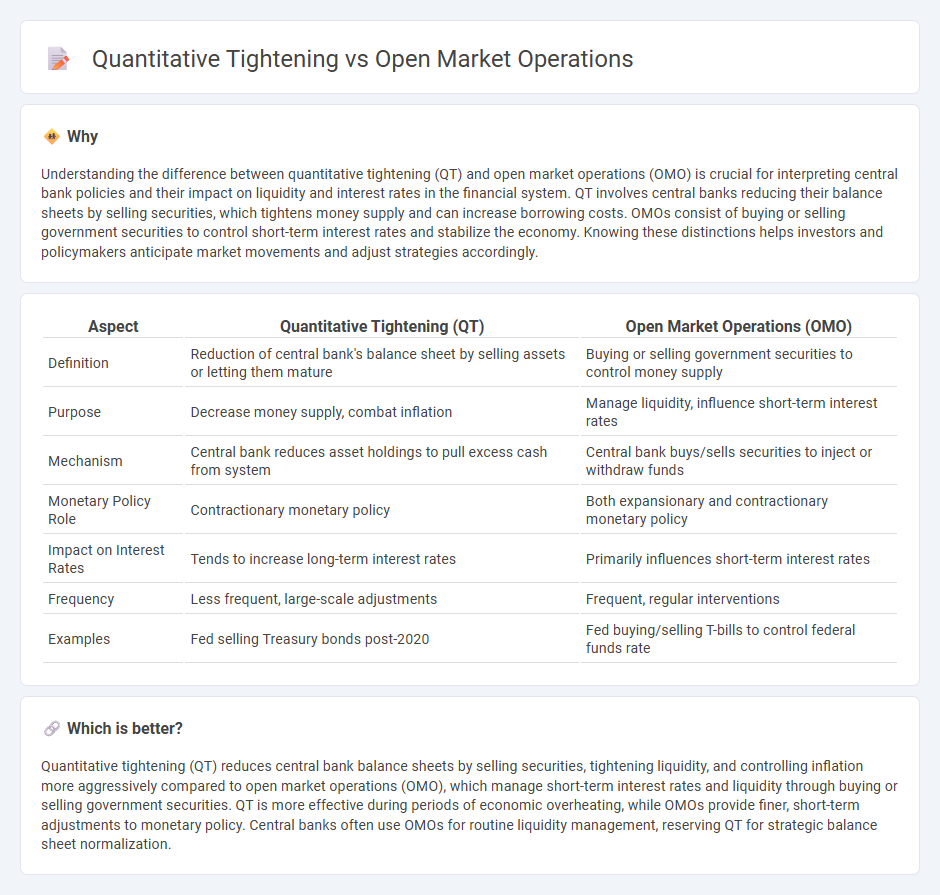

Understanding the difference between quantitative tightening (QT) and open market operations (OMO) is crucial for interpreting central bank policies and their impact on liquidity and interest rates in the financial system. QT involves central banks reducing their balance sheets by selling securities, which tightens money supply and can increase borrowing costs. OMOs consist of buying or selling government securities to control short-term interest rates and stabilize the economy. Knowing these distinctions helps investors and policymakers anticipate market movements and adjust strategies accordingly.

Comparison Table

| Aspect | Quantitative Tightening (QT) | Open Market Operations (OMO) |

|---|---|---|

| Definition | Reduction of central bank's balance sheet by selling assets or letting them mature | Buying or selling government securities to control money supply |

| Purpose | Decrease money supply, combat inflation | Manage liquidity, influence short-term interest rates |

| Mechanism | Central bank reduces asset holdings to pull excess cash from system | Central bank buys/sells securities to inject or withdraw funds |

| Monetary Policy Role | Contractionary monetary policy | Both expansionary and contractionary monetary policy |

| Impact on Interest Rates | Tends to increase long-term interest rates | Primarily influences short-term interest rates |

| Frequency | Less frequent, large-scale adjustments | Frequent, regular interventions |

| Examples | Fed selling Treasury bonds post-2020 | Fed buying/selling T-bills to control federal funds rate |

Which is better?

Quantitative tightening (QT) reduces central bank balance sheets by selling securities, tightening liquidity, and controlling inflation more aggressively compared to open market operations (OMO), which manage short-term interest rates and liquidity through buying or selling government securities. QT is more effective during periods of economic overheating, while OMOs provide finer, short-term adjustments to monetary policy. Central banks often use OMOs for routine liquidity management, reserving QT for strategic balance sheet normalization.

Connection

Quantitative tightening (QT) involves the Federal Reserve reducing its balance sheet by selling government securities or allowing them to mature, directly impacting liquidity in the financial system. Open market operations (OMO) are used by central banks to buy or sell government bonds to regulate money supply and influence short-term interest rates. QT can be seen as a large-scale, systematic form of open market operations aimed at tightening monetary conditions and controlling inflation.

Key Terms

Central Bank

Central Bank open market operations involve buying or selling government securities to regulate money supply and influence interest rates, aiming to stabilize the economy. Quantitative tightening, by contrast, reduces the central bank's balance sheet by selling securities or letting them mature, contracting liquidity to curb inflation. Explore detailed strategies and impacts of these monetary policies to understand their roles in economic management.

Government Securities

Open market operations involve central banks buying or selling government securities to regulate money supply and interest rates, primarily aiming to stimulate or cool the economy. Quantitative tightening refers to the reduction of the central bank's balance sheet by selling government securities or allowing them to mature, which decreases liquidity and increases borrowing costs. Explore more about how these tools influence fiscal stability and economic growth.

Money Supply

Open market operations (OMO) expand or contract money supply by buying or selling government securities, directly influencing bank reserves and liquidity in the financial system. Quantitative tightening (QT) reduces money supply through the central bank's balance sheet reduction by selling securities or allowing them to mature without reinvestment, thereby tightening financial conditions. Explore how these monetary tools impact inflation, interest rates, and economic growth in greater detail.

Source and External Links

Open market operation - Wikipedia - Open market operations (OMOs) are activities by central banks involving buying or selling government bonds and securities to manage liquidity, influence short-term interest rates, and implement monetary policy; post-2008, OMOs have evolved with programs like quantitative easing targeting longer-term assets.

Open Market Operations (OMO) | Economics Definition + Examples - Open market operations refer to a central bank purchasing or selling securities in the open market to influence money supply, typically increasing liquidity in banks to stimulate lending and economic activity when securities are bought.

Open market operations - European Central Bank - The ECB uses open market operations to steer interest rates and manage liquidity through instruments like main refinancing operations, longer-term refinancing operations, and pandemic emergency liquidity measures to ensure smooth financial market functioning and support the economy.

dowidth.com

dowidth.com