Quantamental investing combines quantitative models with fundamental analysis to identify promising stock opportunities based on data-driven insights and company performance metrics. Event-driven investing focuses on capitalizing on price inefficiencies caused by specific corporate events such as mergers, acquisitions, or earnings announcements. Explore detailed strategies and risk profiles of quantamental versus event-driven investing to boost portfolio returns.

Why it is important

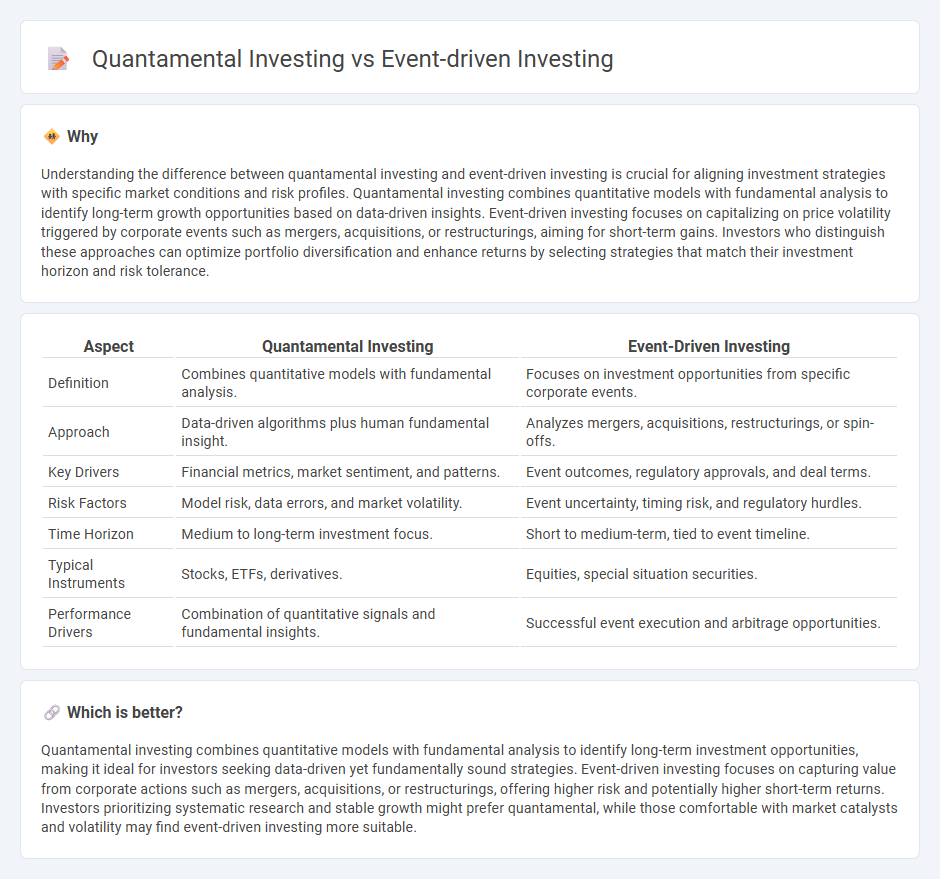

Understanding the difference between quantamental investing and event-driven investing is crucial for aligning investment strategies with specific market conditions and risk profiles. Quantamental investing combines quantitative models with fundamental analysis to identify long-term growth opportunities based on data-driven insights. Event-driven investing focuses on capitalizing on price volatility triggered by corporate events such as mergers, acquisitions, or restructurings, aiming for short-term gains. Investors who distinguish these approaches can optimize portfolio diversification and enhance returns by selecting strategies that match their investment horizon and risk tolerance.

Comparison Table

| Aspect | Quantamental Investing | Event-Driven Investing |

|---|---|---|

| Definition | Combines quantitative models with fundamental analysis. | Focuses on investment opportunities from specific corporate events. |

| Approach | Data-driven algorithms plus human fundamental insight. | Analyzes mergers, acquisitions, restructurings, or spin-offs. |

| Key Drivers | Financial metrics, market sentiment, and patterns. | Event outcomes, regulatory approvals, and deal terms. |

| Risk Factors | Model risk, data errors, and market volatility. | Event uncertainty, timing risk, and regulatory hurdles. |

| Time Horizon | Medium to long-term investment focus. | Short to medium-term, tied to event timeline. |

| Typical Instruments | Stocks, ETFs, derivatives. | Equities, special situation securities. |

| Performance Drivers | Combination of quantitative signals and fundamental insights. | Successful event execution and arbitrage opportunities. |

Which is better?

Quantamental investing combines quantitative models with fundamental analysis to identify long-term investment opportunities, making it ideal for investors seeking data-driven yet fundamentally sound strategies. Event-driven investing focuses on capturing value from corporate actions such as mergers, acquisitions, or restructurings, offering higher risk and potentially higher short-term returns. Investors prioritizing systematic research and stable growth might prefer quantamental, while those comfortable with market catalysts and volatility may find event-driven investing more suitable.

Connection

Quantamental investing combines quantitative models with fundamental analysis to identify investment opportunities, often incorporating event-driven triggers such as mergers, acquisitions, or earnings announcements. Event-driven investing focuses on profiting from specific corporate actions, which quantamental strategies can analyze using data-driven insights to enhance timing and risk assessment. The integration of quantitative algorithms with event-specific data enables investors to optimize returns by exploiting market inefficiencies around key financial events.

Key Terms

**Event-Driven Investing:**

Event-driven investing targets specific corporate events such as mergers, acquisitions, restructurings, or earnings announcements to capitalize on price inefficiencies created by these occurrences. This strategy relies on deep fundamental analysis, market timing, and an understanding of legal and regulatory outcomes to exploit short-term opportunities in equities or debt instruments. Discover how event-driven investing can diversify your portfolio and enhance risk-adjusted returns.

Mergers and Acquisitions

Event-driven investing targets profit opportunities specifically around corporate actions such as mergers and acquisitions (M&A), capitalizing on price fluctuations caused by deal announcements or regulatory approvals. Quantamental investing combines quantitative data analysis with fundamental insights to assess the intrinsic value and growth potential of companies involved in M&A activities more comprehensively. Explore how integrating data-driven models with event-specific strategies can enhance returns in the dynamic landscape of merger and acquisition investing.

Special Situations

Event-driven investing targets unique corporate events such as mergers, acquisitions, or restructurings to capture value opportunities arising from these special situations. Quantamental investing combines quantitative models with fundamental analysis to identify and evaluate these special situations, enhancing risk-adjusted returns by integrating data-driven insights with deep company analysis. Explore comprehensive strategies and case studies to understand how these investment approaches navigate complex special situations effectively.

Source and External Links

Event-Driven Investing | Fund Strategy + Examples - Wall Street Prep - Event-driven investing is a strategy where investors capitalize on pricing inefficiencies caused by corporate events like mergers, acquisitions, spin-offs, and bankruptcies, aiming to profit from the volatility and mispricing during these events, with various approaches such as merger arbitrage, distressed investing, and activist investing.

Event-Driven Hedge Funds: Trades, Top Firms, and Careers - Event-driven hedge funds focus on corporate actions with defined "hard catalysts" (e.g., M&A deals, spin-offs) and profit from fluctuations in company securities following these events, differentiating them from other funds that invest on softer expectations without specific announcements.

What is Event-Driven Investing: Common Strategies & Examples - Event-driven investing involves analyzing significant corporate events to exploit temporary pricing inefficiencies and volatility, demanding proactive evaluation of outcomes like regulatory impacts and financial restructurings to position investments effectively for potential high returns.

dowidth.com

dowidth.com