Special Purpose Acquisition Companies (SPACs) are investment vehicles designed for taking companies public through mergers, offering an alternative to traditional IPOs with faster timelines and reduced regulatory scrutiny. Securitization involves pooling various financial assets, such as loans or receivables, and selling them as tradable securities to investors, providing liquidity and risk distribution. Discover more about how SPACs and securitization shape modern financial markets.

Why it is important

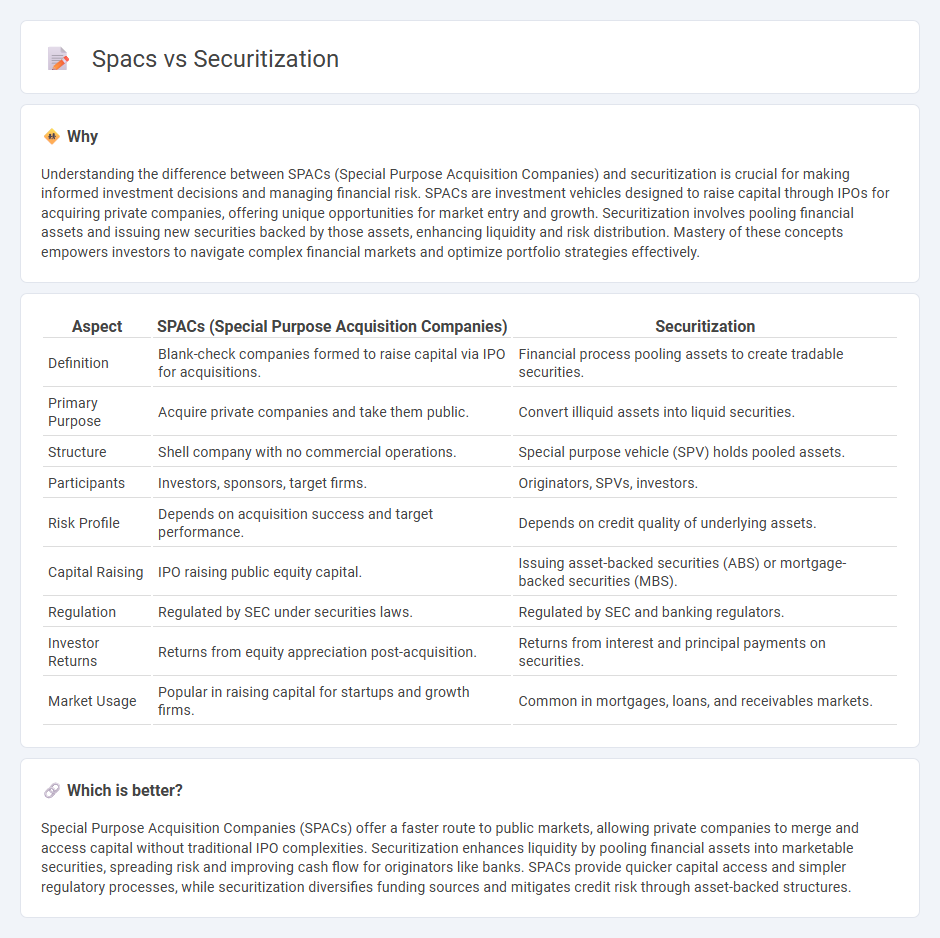

Understanding the difference between SPACs (Special Purpose Acquisition Companies) and securitization is crucial for making informed investment decisions and managing financial risk. SPACs are investment vehicles designed to raise capital through IPOs for acquiring private companies, offering unique opportunities for market entry and growth. Securitization involves pooling financial assets and issuing new securities backed by those assets, enhancing liquidity and risk distribution. Mastery of these concepts empowers investors to navigate complex financial markets and optimize portfolio strategies effectively.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Securitization |

|---|---|---|

| Definition | Blank-check companies formed to raise capital via IPO for acquisitions. | Financial process pooling assets to create tradable securities. |

| Primary Purpose | Acquire private companies and take them public. | Convert illiquid assets into liquid securities. |

| Structure | Shell company with no commercial operations. | Special purpose vehicle (SPV) holds pooled assets. |

| Participants | Investors, sponsors, target firms. | Originators, SPVs, investors. |

| Risk Profile | Depends on acquisition success and target performance. | Depends on credit quality of underlying assets. |

| Capital Raising | IPO raising public equity capital. | Issuing asset-backed securities (ABS) or mortgage-backed securities (MBS). |

| Regulation | Regulated by SEC under securities laws. | Regulated by SEC and banking regulators. |

| Investor Returns | Returns from equity appreciation post-acquisition. | Returns from interest and principal payments on securities. |

| Market Usage | Popular in raising capital for startups and growth firms. | Common in mortgages, loans, and receivables markets. |

Which is better?

Special Purpose Acquisition Companies (SPACs) offer a faster route to public markets, allowing private companies to merge and access capital without traditional IPO complexities. Securitization enhances liquidity by pooling financial assets into marketable securities, spreading risk and improving cash flow for originators like banks. SPACs provide quicker capital access and simpler regulatory processes, while securitization diversifies funding sources and mitigates credit risk through asset-backed structures.

Connection

Special Purpose Acquisition Companies (SPACs) and securitization share a common financial mechanism of pooling assets to create tradable securities, enabling liquidity and risk distribution. SPACs raise capital through an initial public offering (IPO) to acquire private companies, similar to how securitization involves aggregating financial assets like loans or receivables into marketable securities. Both structures facilitate capital access and investor participation, driving efficiency in capital markets through asset transformation and risk management.

Key Terms

Asset-backed securities (ABS)

Asset-backed securities (ABS) represent pooled financial assets like loans or receivables, offering investors predictable cash flows and risk diversification. Unlike SPACs, which are shell companies formed to acquire private firms via public listings, ABS provide liquidity by transforming illiquid assets into tradable securities. Explore the distinct roles of ABS in structured finance to understand their impact on investment strategies.

Special Purpose Acquisition Company (SPAC)

Special Purpose Acquisition Companies (SPACs) serve as shell corporations formed specifically to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with an existing company, bypassing the traditional IPO route. Unlike securitization, which pools financial assets to create marketable securities, SPACs facilitate private companies' access to public markets by offering a faster and potentially less rigorous pathway. Explore more about how SPACs are reshaping capital markets and investment strategies.

Risk transfer

Securitization involves pooling various financial assets and transferring their risk to investors through structured securities, effectively distributing credit risk. SPACs (Special Purpose Acquisition Companies) focus on raising capital through IPOs to acquire private companies, inherently shifting market and operational risks to public investors post-merger. Explore the nuances of risk transfer in both mechanisms to understand their impacts on investor exposure and financial structuring.

Source and External Links

Securitization - Securitization is the financial practice of pooling various types of contractual debt (such as mortgages, auto loans, or credit card debt) and selling the related cash flows to investors as securities, such as bonds or collateralized debt obligations, with repayment coming from the principal and interest collected on the underlying debt.

Back to basics: What Is Securitization? - The securitization process involves a company pooling income-producing assets (like loans), selling them to a special purpose vehicle, which then issues securities to investors funded by the cash flows from those assets, effectively moving the assets off the originator's balance sheet.

Introduction to Securitizations - Securitization transactions allow sponsors to obtain funding by having a special purpose entity issue securities backed by specific assets, isolating those assets from the originator's bankruptcy risk and often resulting in higher credit ratings and lower-cost financing for the originator.

dowidth.com

dowidth.com