Tokenization in finance refers to the process of converting real-world assets into digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity, while dematerialization involves replacing physical certificates with electronic records to simplify asset management and transfer. Tokenization offers increased transparency, security, and programmability, making it ideal for innovative financial instruments, whereas dematerialization primarily streamlines traditional processes and reduces paperwork in securities trading. Explore the benefits and challenges of both approaches to understand their impact on modern financial markets.

Why it is important

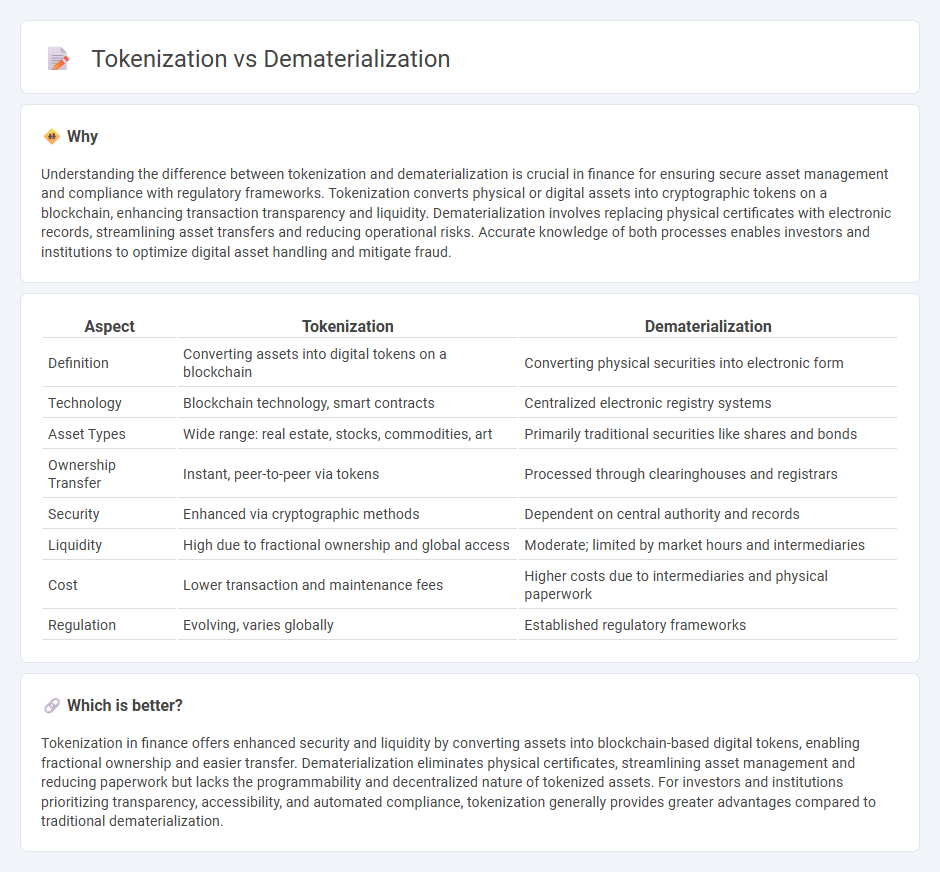

Understanding the difference between tokenization and dematerialization is crucial in finance for ensuring secure asset management and compliance with regulatory frameworks. Tokenization converts physical or digital assets into cryptographic tokens on a blockchain, enhancing transaction transparency and liquidity. Dematerialization involves replacing physical certificates with electronic records, streamlining asset transfers and reducing operational risks. Accurate knowledge of both processes enables investors and institutions to optimize digital asset handling and mitigate fraud.

Comparison Table

| Aspect | Tokenization | Dematerialization |

|---|---|---|

| Definition | Converting assets into digital tokens on a blockchain | Converting physical securities into electronic form |

| Technology | Blockchain technology, smart contracts | Centralized electronic registry systems |

| Asset Types | Wide range: real estate, stocks, commodities, art | Primarily traditional securities like shares and bonds |

| Ownership Transfer | Instant, peer-to-peer via tokens | Processed through clearinghouses and registrars |

| Security | Enhanced via cryptographic methods | Dependent on central authority and records |

| Liquidity | High due to fractional ownership and global access | Moderate; limited by market hours and intermediaries |

| Cost | Lower transaction and maintenance fees | Higher costs due to intermediaries and physical paperwork |

| Regulation | Evolving, varies globally | Established regulatory frameworks |

Which is better?

Tokenization in finance offers enhanced security and liquidity by converting assets into blockchain-based digital tokens, enabling fractional ownership and easier transfer. Dematerialization eliminates physical certificates, streamlining asset management and reducing paperwork but lacks the programmability and decentralized nature of tokenized assets. For investors and institutions prioritizing transparency, accessibility, and automated compliance, tokenization generally provides greater advantages compared to traditional dematerialization.

Connection

Tokenization and dematerialization are interconnected technologies revolutionizing finance by converting physical assets into digital tokens, facilitating seamless trading and enhanced liquidity. Dematerialization eliminates physical certificates, while tokenization creates blockchain-based representations of assets, enabling fractional ownership and transparent transactions. Together, they streamline asset management, reduce costs, and increase market accessibility for investors globally.

Key Terms

Securities

Dematerialization involves converting physical securities into electronic records to streamline trading and ownership verification, while tokenization leverages blockchain to represent securities as digital tokens offering enhanced transparency and fractional ownership. Unlike traditional dematerialization, tokenization enables programmability and real-time settlement, reducing counterparty risk and improving liquidity. Explore how these innovations are reshaping securities management and investment opportunities.

Digital Assets

Dematerialization refers to the process of converting physical assets into digital formats, eliminating paper certificates and enabling easier storage and transfer of ownership, crucial in modern financial markets. Tokenization involves creating blockchain-based tokens representing digital or physical assets, enhancing liquidity, transparency, and security through decentralized ledger technology. Explore the nuances and benefits of both to fully leverage digital asset innovations.

Blockchain

Dematerialization refers to converting physical assets or documents into digital records, enabling easier management and transfer on blockchain platforms. Tokenization involves creating digital tokens representing ownership of assets, which can be fractionally owned, traded, and secured using blockchain technology. Explore in-depth how blockchain revolutionizes asset management through dematerialization and tokenization for enhanced transparency and efficiency.

Source and External Links

Dematerialization - (Art History II - Renaissance to Modern ... - Dematerialization in art refers to minimizing or eliminating the physical aspects of an artwork to emphasize ideas and concepts over tangible materials.

Dematerialization (economics) - In economics, dematerialization means reducing the quantity of materials needed to serve economic functions--essentially doing more with less.

What is Dematerialization? Process & benefits of ... - Dematerialization is the conversion of physical shares and securities into digital or electronic form to streamline trading and ownership.

dowidth.com

dowidth.com