Green bond laddering involves structuring investments by staggering maturities in eco-friendly bonds to manage risk and ensure steady cash flow aligned with sustainable finance goals. Bond duration matching focuses on adjusting portfolio duration to offset interest rate risks, maintaining value stability irrespective of market fluctuations in conventional or green bonds. Explore how these strategies enhance portfolio resilience and environmental impact by learning more about their distinct benefits and applications.

Why it is important

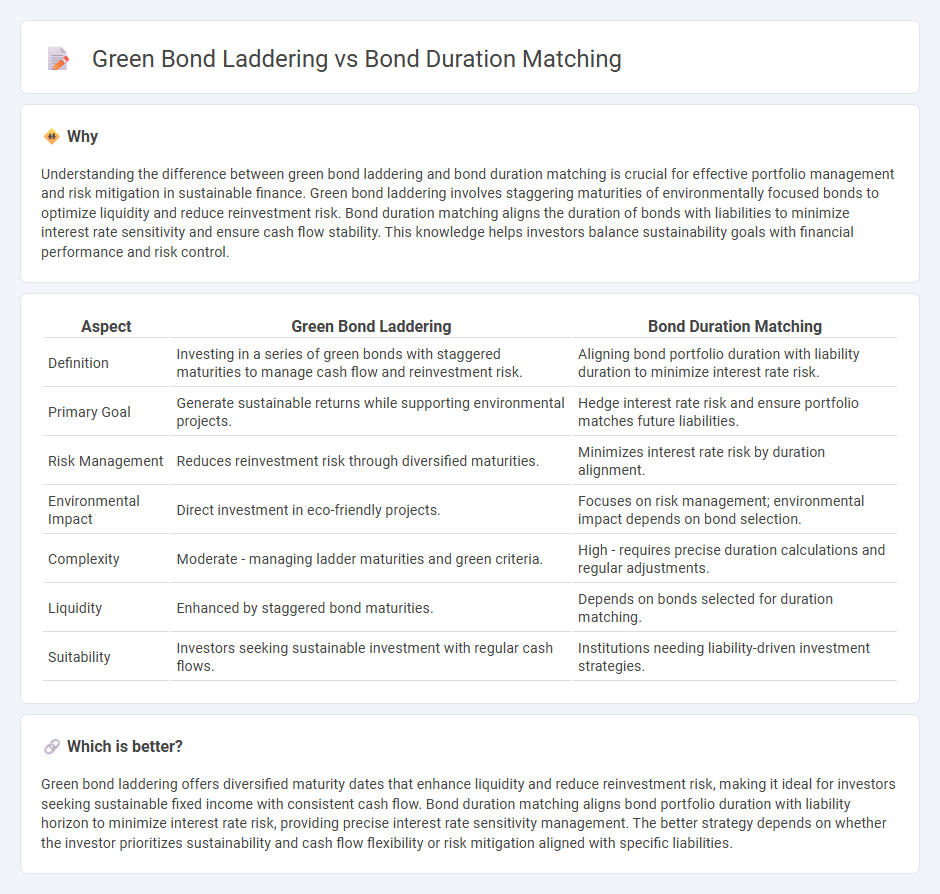

Understanding the difference between green bond laddering and bond duration matching is crucial for effective portfolio management and risk mitigation in sustainable finance. Green bond laddering involves staggering maturities of environmentally focused bonds to optimize liquidity and reduce reinvestment risk. Bond duration matching aligns the duration of bonds with liabilities to minimize interest rate sensitivity and ensure cash flow stability. This knowledge helps investors balance sustainability goals with financial performance and risk control.

Comparison Table

| Aspect | Green Bond Laddering | Bond Duration Matching |

|---|---|---|

| Definition | Investing in a series of green bonds with staggered maturities to manage cash flow and reinvestment risk. | Aligning bond portfolio duration with liability duration to minimize interest rate risk. |

| Primary Goal | Generate sustainable returns while supporting environmental projects. | Hedge interest rate risk and ensure portfolio matches future liabilities. |

| Risk Management | Reduces reinvestment risk through diversified maturities. | Minimizes interest rate risk by duration alignment. |

| Environmental Impact | Direct investment in eco-friendly projects. | Focuses on risk management; environmental impact depends on bond selection. |

| Complexity | Moderate - managing ladder maturities and green criteria. | High - requires precise duration calculations and regular adjustments. |

| Liquidity | Enhanced by staggered bond maturities. | Depends on bonds selected for duration matching. |

| Suitability | Investors seeking sustainable investment with regular cash flows. | Institutions needing liability-driven investment strategies. |

Which is better?

Green bond laddering offers diversified maturity dates that enhance liquidity and reduce reinvestment risk, making it ideal for investors seeking sustainable fixed income with consistent cash flow. Bond duration matching aligns bond portfolio duration with liability horizon to minimize interest rate risk, providing precise interest rate sensitivity management. The better strategy depends on whether the investor prioritizes sustainability and cash flow flexibility or risk mitigation aligned with specific liabilities.

Connection

Green bond laddering involves purchasing green bonds with staggered maturities to manage cash flow and reduce interest rate risk. Bond duration matching focuses on aligning the duration of green bond portfolios with future liabilities to minimize interest rate sensitivity. Both strategies aim to optimize risk-adjusted returns while supporting sustainable investment goals in finance.

Key Terms

Interest Rate Risk

Bond duration matching minimizes interest rate risk by aligning the bond portfolio's average duration with the investor's investment horizon, reducing sensitivity to rate fluctuations. Green bond laddering spreads maturities across intervals, providing steady cash flows and mitigating reinvestment risk while supporting sustainable projects. Explore how these strategies optimize interest rate risk management in green bond investing.

Environmental, Social, and Governance (ESG)

Bond duration matching aligns investment maturities with future liabilities to minimize interest rate risk, emphasizing stable returns while integrating ESG criteria ensures sustainable impact. Green bond laddering diversifies maturities across various green bonds, enhancing liquidity and exposure to multiple environmental projects aligned with ESG goals. Explore how these strategies optimize ESG investments and contribute to a resilient, sustainable portfolio.

Cash Flow Matching

Bond duration matching aligns the portfolio's duration with the liability horizon to minimize interest rate risk, while green bond laddering structures a series of staggered maturities to ensure steady cash flows and reinvestment opportunities supporting sustainable projects. Cash flow matching precisely schedules bond maturities and coupon payments to meet liability payments, reducing reinvestment risk and ensuring liquidity alignment. Explore how these strategies optimize cash flow matching for enhanced green finance outcomes.

Source and External Links

Duration Matching - What Is It, Examples, Vs Cash Flow Matching - Duration matching is a strategy to align the duration of assets and liabilities to minimize interest rate risk by matching cash inflows from fixed-income securities to the timing and amount of liability cash outflows, protecting against adverse interest rate movements.

Duration matching: an introduction - Occam Investing - Duration matching involves adjusting bond or bond fund durations to match an investment horizon, often by blending bonds of different durations, to reduce interest rate risk as the horizon shortens over time.

Duration matching in practice - Occam Investing - In practice, duration matching can be done by rebalancing bond fund allocations between different durations to keep the average portfolio duration aligned with the investment horizon, effectively eliminating interest rate risk.

dowidth.com

dowidth.com