Fractional shares allow investors to buy partial units of stock, enabling diversified portfolios with limited capital, while Direct Stock Purchase Plans (DSPPs) facilitate direct investment in companies, often with lower fees and no need for a broker. DSPPs typically offer dividend reinvestment options and reduced transaction costs, making them appealing for long-term investors. Explore the advantages and drawbacks of fractional shares and DSPPs to optimize your investment strategy.

Why it is important

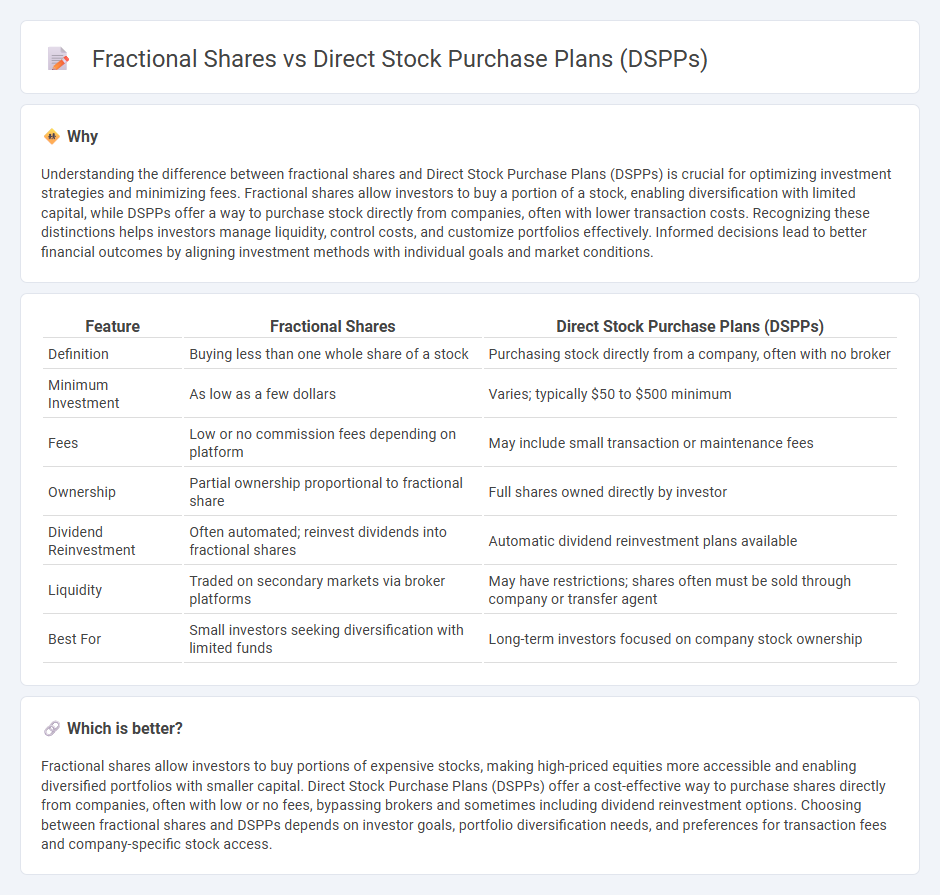

Understanding the difference between fractional shares and Direct Stock Purchase Plans (DSPPs) is crucial for optimizing investment strategies and minimizing fees. Fractional shares allow investors to buy a portion of a stock, enabling diversification with limited capital, while DSPPs offer a way to purchase stock directly from companies, often with lower transaction costs. Recognizing these distinctions helps investors manage liquidity, control costs, and customize portfolios effectively. Informed decisions lead to better financial outcomes by aligning investment methods with individual goals and market conditions.

Comparison Table

| Feature | Fractional Shares | Direct Stock Purchase Plans (DSPPs) |

|---|---|---|

| Definition | Buying less than one whole share of a stock | Purchasing stock directly from a company, often with no broker |

| Minimum Investment | As low as a few dollars | Varies; typically $50 to $500 minimum |

| Fees | Low or no commission fees depending on platform | May include small transaction or maintenance fees |

| Ownership | Partial ownership proportional to fractional share | Full shares owned directly by investor |

| Dividend Reinvestment | Often automated; reinvest dividends into fractional shares | Automatic dividend reinvestment plans available |

| Liquidity | Traded on secondary markets via broker platforms | May have restrictions; shares often must be sold through company or transfer agent |

| Best For | Small investors seeking diversification with limited funds | Long-term investors focused on company stock ownership |

Which is better?

Fractional shares allow investors to buy portions of expensive stocks, making high-priced equities more accessible and enabling diversified portfolios with smaller capital. Direct Stock Purchase Plans (DSPPs) offer a cost-effective way to purchase shares directly from companies, often with low or no fees, bypassing brokers and sometimes including dividend reinvestment options. Choosing between fractional shares and DSPPs depends on investor goals, portfolio diversification needs, and preferences for transaction fees and company-specific stock access.

Connection

Fractional shares enable investors to purchase portions of a stock, making direct stock purchase plans (DSPPs) more accessible by allowing small, incremental investments without needing to buy whole shares. DSPPs facilitate direct investment from companies, often with lower fees, complementing fractional share purchases by enabling customized portfolio growth. Together, they democratize stock ownership, especially for individual investors seeking cost-effective, diversified equity exposure.

Key Terms

Ownership Structure

Direct stock purchase plans (DSPPs) allow investors to buy shares directly from a company, often with minimal fees and the ability to reinvest dividends, leading to full ownership of whole shares. Fractional shares enable investors to purchase portions of a share through brokerage platforms, providing access to expensive stocks without the need for full share investment but resulting in partial ownership. Explore detailed comparisons to understand which option aligns best with your investment goals and ownership preferences.

Minimum Investment

Direct stock purchase plans (DSPPs) typically require a minimum initial investment, often ranging from $50 to $500, making them accessible for new investors. Fractional shares allow buying portions of whole shares with no minimum investment, offering greater flexibility for diversifying portfolios with limited capital. Explore how these investment methods compare to choose the best strategy for your financial goals.

Dividend Reinvestment

Direct stock purchase plans (DSPPs) enable investors to buy shares directly from companies, often including options for automatic Dividend Reinvestment Plans (DRIPs), which reinvest dividends to purchase additional full or fractional shares. Fractional shares allow investors to own a portion of a share based on reinvested dividends, enabling continuous portfolio growth even with small dividend payments. Explore how DSPPs and fractional share DRIPs can maximize your long-term investment returns through efficient dividend reinvestment strategies.

Source and External Links

Direct Stock Purchase Plan (DSPP) - Corporate Finance Institute - A DSPP allows individuals to buy stocks directly from a company, bypassing brokerages and thus minimizing commissions, though there may be purchase requirements and transfer fees.

Dividend Reinvestment and Direct Stock Purchase Plan - DSPPs enable new and existing stockholders to buy shares directly from the company without paying trading fees or commissions, with specific minimum investment amounts and monthly purchase options.

Direct Investment Plans: Buying Stock Directly from the Company - These plans let investors buy or sell shares directly from companies at scheduled intervals, often including dividend reinvestment options, though fees and minimum investment requirements may apply.

dowidth.com

dowidth.com