Liquidity staking offers crypto holders the ability to earn rewards by locking assets in blockchain protocols while maintaining liquidity through tradable tokens, contrasting with DeFi savings accounts, which provide interest on deposits but often lack immediate access to funds. Both options present varying risk profiles, yield potentials, and flexibility, influencing investors' decisions based on their portfolio strategies and risk tolerance. Explore detailed comparisons to understand which approach aligns best with your financial goals.

Why it is important

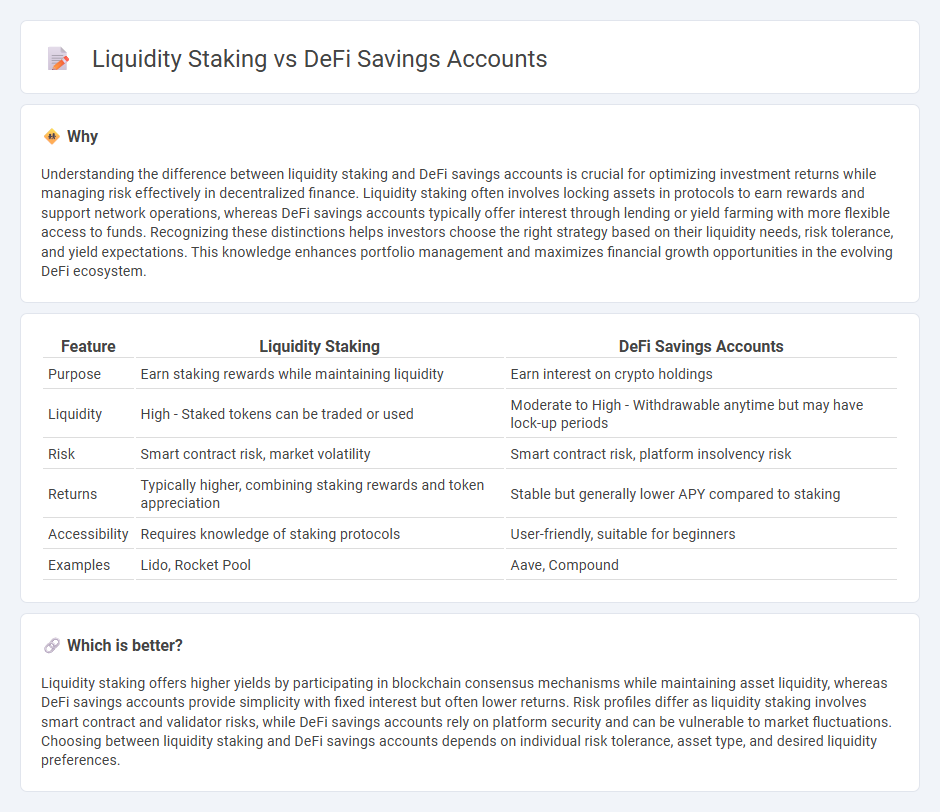

Understanding the difference between liquidity staking and DeFi savings accounts is crucial for optimizing investment returns while managing risk effectively in decentralized finance. Liquidity staking often involves locking assets in protocols to earn rewards and support network operations, whereas DeFi savings accounts typically offer interest through lending or yield farming with more flexible access to funds. Recognizing these distinctions helps investors choose the right strategy based on their liquidity needs, risk tolerance, and yield expectations. This knowledge enhances portfolio management and maximizes financial growth opportunities in the evolving DeFi ecosystem.

Comparison Table

| Feature | Liquidity Staking | DeFi Savings Accounts |

|---|---|---|

| Purpose | Earn staking rewards while maintaining liquidity | Earn interest on crypto holdings |

| Liquidity | High - Staked tokens can be traded or used | Moderate to High - Withdrawable anytime but may have lock-up periods |

| Risk | Smart contract risk, market volatility | Smart contract risk, platform insolvency risk |

| Returns | Typically higher, combining staking rewards and token appreciation | Stable but generally lower APY compared to staking |

| Accessibility | Requires knowledge of staking protocols | User-friendly, suitable for beginners |

| Examples | Lido, Rocket Pool | Aave, Compound |

Which is better?

Liquidity staking offers higher yields by participating in blockchain consensus mechanisms while maintaining asset liquidity, whereas DeFi savings accounts provide simplicity with fixed interest but often lower returns. Risk profiles differ as liquidity staking involves smart contract and validator risks, while DeFi savings accounts rely on platform security and can be vulnerable to market fluctuations. Choosing between liquidity staking and DeFi savings accounts depends on individual risk tolerance, asset type, and desired liquidity preferences.

Connection

Liquidity staking enhances DeFi savings accounts by enabling users to earn staking rewards while maintaining asset liquidity, allowing seamless access to funds without unstaking penalties. DeFi savings accounts leverage liquidity staking protocols to optimize yield generation through decentralized networks, increasing profitability compared to traditional savings methods. This integration reduces risks associated with lock-up periods and enhances capital efficiency in decentralized finance ecosystems.

Key Terms

DeFi savings accounts:

DeFi savings accounts offer users the advantage of earning passive income through decentralized protocols without relinquishing control of their assets, typically providing higher interest rates compared to traditional savings. These accounts leverage blockchain technology and smart contracts to enable seamless, secure, and transparent transactions, reducing reliance on centralized intermediaries. Explore how DeFi savings accounts optimize your crypto assets and compare them with liquidity staking advantages.

Interest rates

DeFi savings accounts typically offer stable interest rates ranging from 3% to 12%, depending on the platform and underlying assets, while liquidity staking rates can vary widely, often yielding higher returns around 10% to 30% due to market dynamics and rewards from staking protocols. Interest rates in liquidity staking are influenced by factors such as token incentives, network inflation, and asset volatility, making them potentially more lucrative but also riskier compared to the relatively predictable returns of DeFi savings accounts. Explore further to understand which option aligns best with your risk tolerance and investment goals.

Yield farming

DeFi savings accounts provide users with interest through lending protocols, while liquidity staking involves locking tokens in liquidity pools to earn trading fees and rewards, enhancing yield farming strategies. Yield farming maximizes returns by strategically allocating assets between these methods to benefit from compounded rewards and platform incentives. Explore our detailed guide to discover optimal yield farming techniques and boost your decentralized finance portfolio.

Source and External Links

Creating a High Yield "Savings Account" with Crypto & DeFi - DeFi savings accounts allow users to deposit cryptocurrencies like USDC and earn interest that compounds automatically, often alongside additional governance token rewards such as COMP, mimicking a traditional savings account but with risks linked to platform trust.

What Is Decentralized Finance (DeFi)? | Metro Credit Union - DeFi savings accounts enable cryptocurrency holders to earn better interest rates than traditional savings by leveraging decentralized apps and smart contracts on blockchains like Ethereum, offering open access and privacy but with risks such as price volatility and limited regulation.

Top Crypto Savings Accounts in 2025: How to Earn High Interest on ... - Leading DeFi savings platforms in 2025, such as Nexo, Binance Earn, YouHodler, and Crypto.com Earn, offer high APYs (up to 15%), strong security features including insurance and cold storage, and support a wide range of cryptocurrencies, making them attractive for yield-seeking crypto investors.

dowidth.com

dowidth.com