Tokenized treasury bills leverage blockchain technology to offer secure, transparent, and easily tradable government-backed debt instruments, enhancing liquidity for investors. Commercial paper represents unsecured short-term debt issued by corporations to finance immediate operational needs, typically with higher yields but increased risk compared to treasury bills. Explore the distinct advantages and applications of tokenized treasury bills versus commercial paper to optimize your investment strategy.

Why it is important

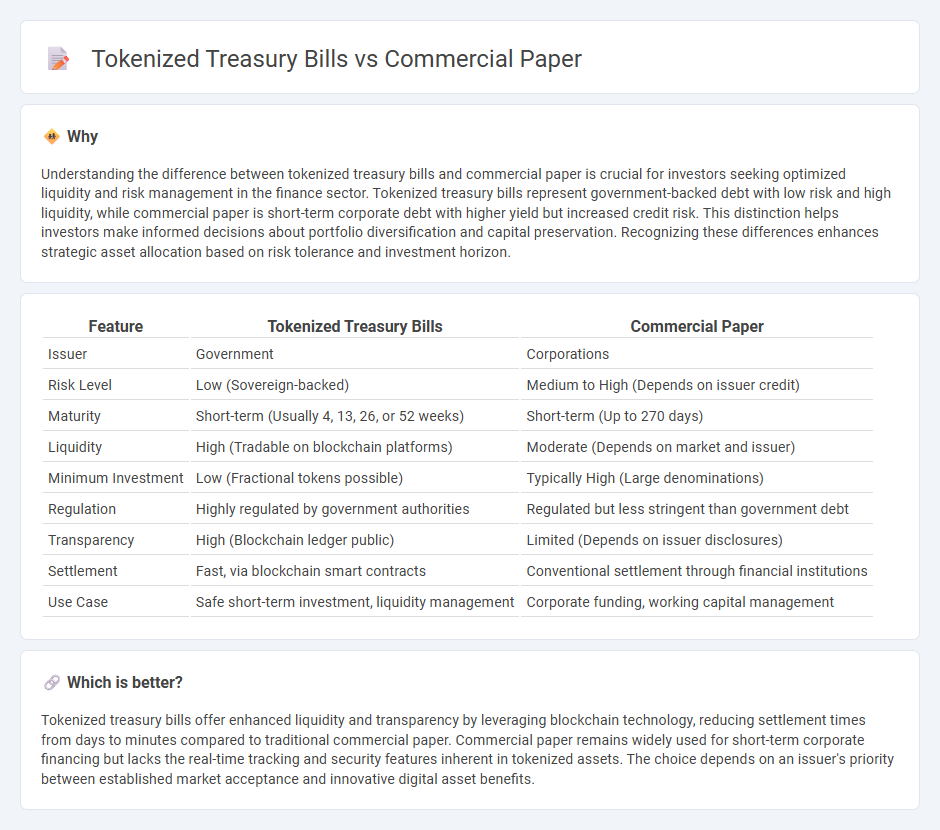

Understanding the difference between tokenized treasury bills and commercial paper is crucial for investors seeking optimized liquidity and risk management in the finance sector. Tokenized treasury bills represent government-backed debt with low risk and high liquidity, while commercial paper is short-term corporate debt with higher yield but increased credit risk. This distinction helps investors make informed decisions about portfolio diversification and capital preservation. Recognizing these differences enhances strategic asset allocation based on risk tolerance and investment horizon.

Comparison Table

| Feature | Tokenized Treasury Bills | Commercial Paper |

|---|---|---|

| Issuer | Government | Corporations |

| Risk Level | Low (Sovereign-backed) | Medium to High (Depends on issuer credit) |

| Maturity | Short-term (Usually 4, 13, 26, or 52 weeks) | Short-term (Up to 270 days) |

| Liquidity | High (Tradable on blockchain platforms) | Moderate (Depends on market and issuer) |

| Minimum Investment | Low (Fractional tokens possible) | Typically High (Large denominations) |

| Regulation | Highly regulated by government authorities | Regulated but less stringent than government debt |

| Transparency | High (Blockchain ledger public) | Limited (Depends on issuer disclosures) |

| Settlement | Fast, via blockchain smart contracts | Conventional settlement through financial institutions |

| Use Case | Safe short-term investment, liquidity management | Corporate funding, working capital management |

Which is better?

Tokenized treasury bills offer enhanced liquidity and transparency by leveraging blockchain technology, reducing settlement times from days to minutes compared to traditional commercial paper. Commercial paper remains widely used for short-term corporate financing but lacks the real-time tracking and security features inherent in tokenized assets. The choice depends on an issuer's priority between established market acceptance and innovative digital asset benefits.

Connection

Tokenized treasury bills and commercial paper are connected through their function as short-term debt instruments used by governments and corporations to raise capital efficiently. Both use blockchain technology to digitize traditional securities, enhancing liquidity, transparency, and reducing settlement times. This innovation facilitates faster trading and broader investor access to secure, low-risk financial instruments in digital asset markets.

Key Terms

Short-term debt instrument

Commercial paper is an unsecured short-term debt instrument issued by corporations to finance working capital needs, typically maturing within 270 days, while tokenized treasury bills represent government-backed securities digitized on a blockchain platform, ensuring higher liquidity and transparency. Both serve as short-term funding tools, but tokenized treasury bills offer enhanced accessibility and reduced settlement times compared to traditional commercial paper. Discover more about how tokenization is revolutionizing short-term debt financing and investment strategies.

Blockchain-based security

Commercial papers are short-term unsecured promissory notes issued by corporations, while tokenized treasury bills represent government debt digitally secured and tradable on blockchain networks. Blockchain-based security enhances transparency, reduces settlement times, and increases accessibility for tokenized treasury bills compared to traditional commercial paper markets. Explore the benefits and risks of blockchain integration in short-term debt instruments to understand this evolving financial landscape.

Liquidity

Commercial paper offers high liquidity with short maturities typically ranging from 1 to 270 days and active secondary markets among institutional investors. Tokenized treasury bills provide enhanced liquidity through blockchain technology, enabling real-time settlement, fractional ownership, and broader market access beyond traditional financial institutions. Explore the advantages of both instruments to understand which liquidity features align best with your investment goals.

Source and External Links

Commercial paper - Wikipedia - Commercial paper is a short-term money-market security issued by large corporations to finance short-term debt obligations, maturing within 270 days and typically used for operating expenses rather than fixed assets; it is usually exempt from SEC registration due to its short maturity.

Commercial Paper - Overview, How It Works, Risks - Commercial paper is an unsecured, short-term debt instrument issued by large corporations and financial institutions, generally sold at a discount and used to cover short-term funding needs, mainly accessible to highly rated corporations.

The Fed - Commercial Paper Rates and Outstanding Summary - Commercial paper consists of short-term promissory notes issued primarily by corporations with maturities up to 270 days (average about 30 days), commonly used as a lower-cost alternative to bank loans for raising working capital.

dowidth.com

dowidth.com