Altcoin staking involves locking up cryptocurrency assets to support blockchain network operations, earning rewards proportional to the staked amount, while crypto airdrops distribute free tokens to holders as part of promotional campaigns or network upgrades. Staking fosters long-term investment with potential passive income, whereas airdrops offer immediate, albeit sometimes speculative, value boosts. Explore deeper insights to determine which method aligns best with your crypto investment strategy.

Why it is important

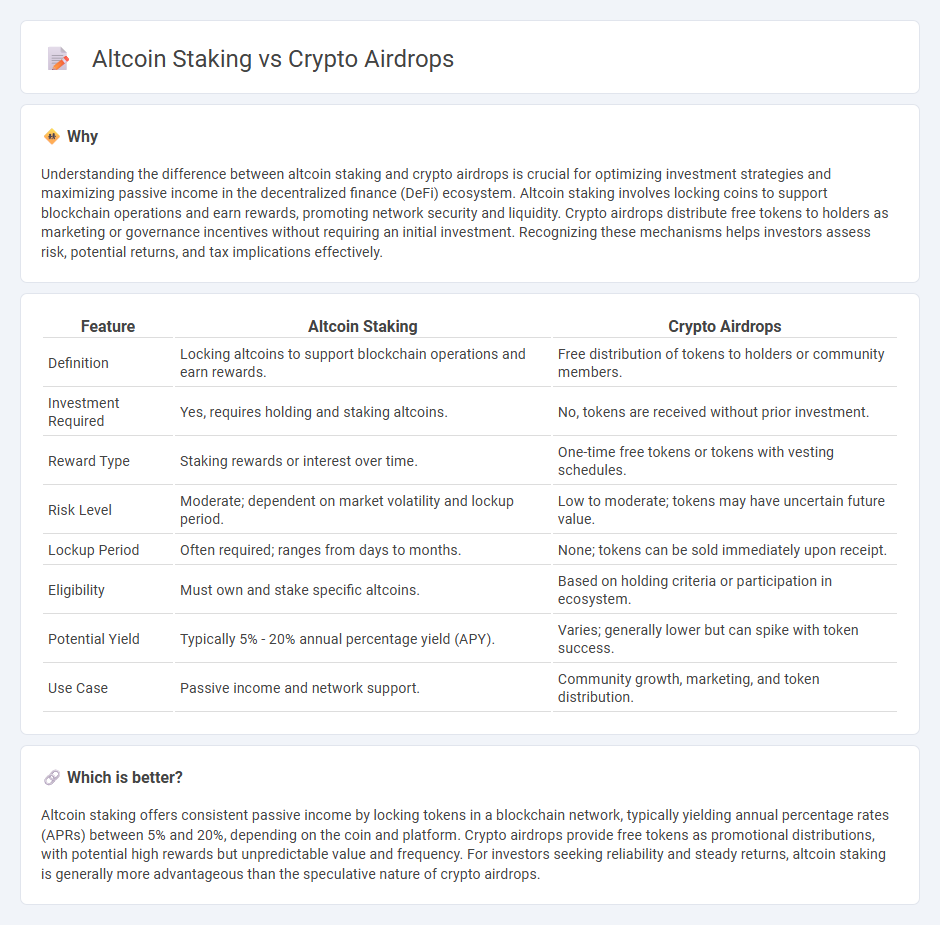

Understanding the difference between altcoin staking and crypto airdrops is crucial for optimizing investment strategies and maximizing passive income in the decentralized finance (DeFi) ecosystem. Altcoin staking involves locking coins to support blockchain operations and earn rewards, promoting network security and liquidity. Crypto airdrops distribute free tokens to holders as marketing or governance incentives without requiring an initial investment. Recognizing these mechanisms helps investors assess risk, potential returns, and tax implications effectively.

Comparison Table

| Feature | Altcoin Staking | Crypto Airdrops |

|---|---|---|

| Definition | Locking altcoins to support blockchain operations and earn rewards. | Free distribution of tokens to holders or community members. |

| Investment Required | Yes, requires holding and staking altcoins. | No, tokens are received without prior investment. |

| Reward Type | Staking rewards or interest over time. | One-time free tokens or tokens with vesting schedules. |

| Risk Level | Moderate; dependent on market volatility and lockup period. | Low to moderate; tokens may have uncertain future value. |

| Lockup Period | Often required; ranges from days to months. | None; tokens can be sold immediately upon receipt. |

| Eligibility | Must own and stake specific altcoins. | Based on holding criteria or participation in ecosystem. |

| Potential Yield | Typically 5% - 20% annual percentage yield (APY). | Varies; generally lower but can spike with token success. |

| Use Case | Passive income and network support. | Community growth, marketing, and token distribution. |

Which is better?

Altcoin staking offers consistent passive income by locking tokens in a blockchain network, typically yielding annual percentage rates (APRs) between 5% and 20%, depending on the coin and platform. Crypto airdrops provide free tokens as promotional distributions, with potential high rewards but unpredictable value and frequency. For investors seeking reliability and steady returns, altcoin staking is generally more advantageous than the speculative nature of crypto airdrops.

Connection

Altcoin staking involves locking up digital assets to support blockchain operations, generating passive income through rewards that can include crypto airdrops. Crypto airdrops distribute free tokens to stakeholders, often as incentives for participating in staking programs or network promotions. Both mechanisms enhance user engagement and liquidity within decentralized finance ecosystems by rewarding active participation.

Key Terms

Token Distribution

Crypto airdrops distribute tokens directly to wallets, often as promotional tools or rewards, ensuring widespread token dissemination and user engagement. Altcoin staking requires users to lock tokens in a network, earning rewards over time and promoting network security alongside gradual token distribution. Explore detailed comparisons to understand which method aligns best with your investment strategy and goals.

Yield/APY

Crypto airdrops provide users with free tokens, offering a one-time yield without ongoing commitment, whereas altcoin staking generates continuous rewards based on the amount and duration of tokens locked, typically reflected as APY. Staking yields vary widely, with popular altcoins like Ethereum 2.0 offering average APYs between 4-7%, while airdrops may deliver high initial value but lack sustained returns. Explore detailed comparisons of yield models and optimization strategies to understand which method aligns best with your crypto investment goals.

Wallet Eligibility

Wallet eligibility plays a crucial role in both crypto airdrops and altcoin staking, determining who can receive rewards or participate in earning yields. Airdrops typically require holding specific tokens in an eligible wallet at a certain snapshot date, while altcoin staking demands continuous wallet activity with locked tokens to earn staking rewards. Explore detailed criteria for wallet compatibility and maximize your crypto benefits by learning more.

Source and External Links

Airdrop (cryptocurrency) - Wikipedia - A crypto airdrop is an unsolicited free distribution of tokens to many wallet addresses, often used to promote new projects or expand user bases, though it carries risks like scams, token value drops, and regulatory uncertainties.

Crypto Airdrops - Claim Free Tokens Today - Cointelegraph - Projects distribute free tokens to drive adoption or reward loyalty, often requiring simple tasks like social media follows or holding tokens, helping users earn crypto with minimal effort while increasing engagement.

What is a crypto airdrop? - Coinbase - Airdrops are marketing strategies where projects send tokens to wallets based on registration or tasks, but users should beware of pump-and-dump scams and evaluate projects carefully before participation.

dowidth.com

dowidth.com