Laddered bond ETFs diversify maturity dates by staggering bond expirations, reducing interest rate risk and enhancing cash flow predictability. BulletShares offer targeted maturity dates within a specific year, providing focused exposure with a fixed investment horizon. Explore the differences between Laddered bond ETFs and BulletShares to optimize your fixed-income portfolio strategy.

Why it is important

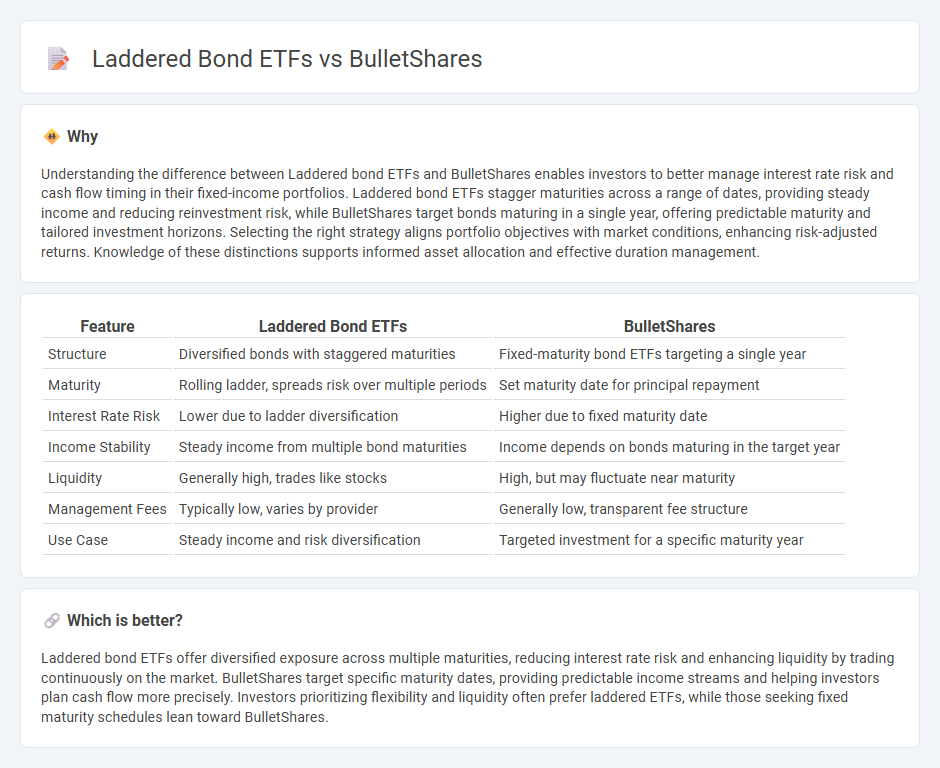

Understanding the difference between Laddered bond ETFs and BulletShares enables investors to better manage interest rate risk and cash flow timing in their fixed-income portfolios. Laddered bond ETFs stagger maturities across a range of dates, providing steady income and reducing reinvestment risk, while BulletShares target bonds maturing in a single year, offering predictable maturity and tailored investment horizons. Selecting the right strategy aligns portfolio objectives with market conditions, enhancing risk-adjusted returns. Knowledge of these distinctions supports informed asset allocation and effective duration management.

Comparison Table

| Feature | Laddered Bond ETFs | BulletShares |

|---|---|---|

| Structure | Diversified bonds with staggered maturities | Fixed-maturity bond ETFs targeting a single year |

| Maturity | Rolling ladder, spreads risk over multiple periods | Set maturity date for principal repayment |

| Interest Rate Risk | Lower due to ladder diversification | Higher due to fixed maturity date |

| Income Stability | Steady income from multiple bond maturities | Income depends on bonds maturing in the target year |

| Liquidity | Generally high, trades like stocks | High, but may fluctuate near maturity |

| Management Fees | Typically low, varies by provider | Generally low, transparent fee structure |

| Use Case | Steady income and risk diversification | Targeted investment for a specific maturity year |

Which is better?

Laddered bond ETFs offer diversified exposure across multiple maturities, reducing interest rate risk and enhancing liquidity by trading continuously on the market. BulletShares target specific maturity dates, providing predictable income streams and helping investors plan cash flow more precisely. Investors prioritizing flexibility and liquidity often prefer laddered ETFs, while those seeking fixed maturity schedules lean toward BulletShares.

Connection

Laddered bond ETFs and BulletShares both offer structured fixed-income investment strategies that stagger maturities to manage interest rate risk and provide predictable cash flows. Laddered bond ETFs hold bond segments with sequential maturities, spreading risk across different periods, while BulletShares focus on bonds maturing in a specific year, facilitating targeted investment horizons. Investors utilize these products to optimize portfolio diversification, enhance yield while controlling duration exposure, and align bond holdings with financial goals.

Key Terms

Maturity Structure

BulletShares bond ETFs concentrate holdings in bonds that mature within a single year, providing targeted exposure to specific maturity dates and reducing reinvestment risk. Laddered bond ETFs hold bonds with staggered maturities over multiple years, offering consistent income streams and mitigating interest rate risk through diversification across maturities. Explore these maturities to tailor your fixed-income strategy effectively.

Yield Management

BulletShares bond ETFs concentrate maturities within a specific year, providing targeted yield management through predictable cash flow and reduced reinvestment risk. Laddered bond ETFs diversify across multiple maturities, balancing yield and interest rate risk for steady income over time. Explore detailed comparisons to optimize your fixed-income investment strategy.

Liquidity

BulletShares ETFs concentrate bond maturities into a specific year, enhancing predictability and reducing reinvestment risk compared to Laddered bond ETFs, which spread maturities over multiple years for diversified exposure. Laddered bond ETFs typically offer greater liquidity due to continuous turnover and staggered maturities, while BulletShares provide targeted liquidity around their fixed maturity dates. Explore detailed liquidity profiles and performance metrics to determine the optimal strategy for your investment goals.

Source and External Links

Invesco BulletShares USD Corporate Bond Indexes - BulletShares Indexes blend benefits of individual bonds and diversified portfolios by targeting bonds maturing in specific years, helping investors build bond ladders that meet future cash flow needs while avoiding reinvestment risks of traditional bonds.

BulletShares(r) fixed income ETFs - Invesco - BulletShares ETFs are fixed-term bond ETFs with designated maturity years, combining individual bond-like monthly income and maturity payout with ETF benefits like diversification, liquidity, and cost-effectiveness, enabling tailored bond ladder portfolios for steady income and interest rate risk management.

BulletShares UCITS ETFs | Invesco UK - BulletShares UCITS ETFs offer targeted exposure to USD and EUR investment-grade corporate bonds with fixed maturities, providing broad diversification and intraday ETF trading with the precision of individual bonds, ideal for building diversified, cost-effective bond ladders to control interest rate risk.

dowidth.com

dowidth.com