Carbon trading focuses on reducing greenhouse gas emissions by allowing companies to buy and sell carbon credits, which represent a ton of carbon dioxide reduced or removed from the atmosphere. Biodiversity credits, on the other hand, aim to preserve or restore ecosystems by assigning value to the conservation of species and habitats. Explore the key differences and benefits of carbon trading versus biodiversity credits to better understand their roles in environmental finance.

Why it is important

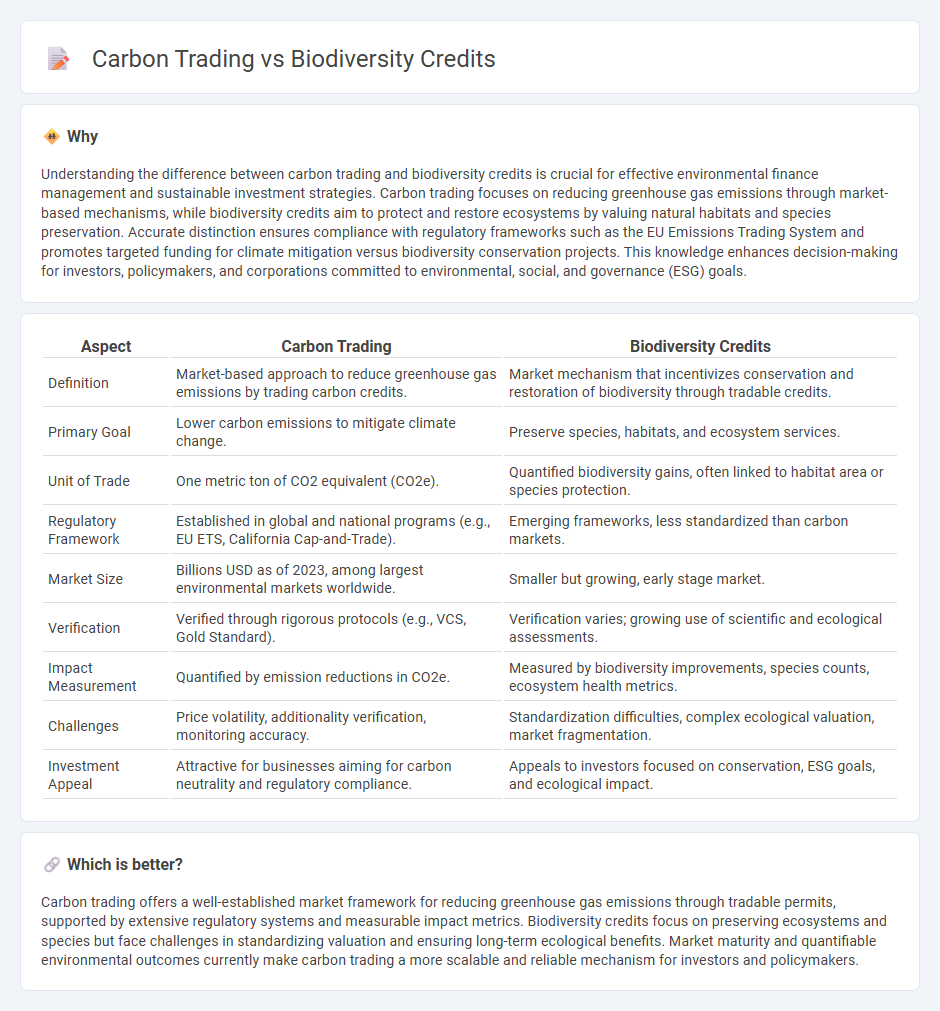

Understanding the difference between carbon trading and biodiversity credits is crucial for effective environmental finance management and sustainable investment strategies. Carbon trading focuses on reducing greenhouse gas emissions through market-based mechanisms, while biodiversity credits aim to protect and restore ecosystems by valuing natural habitats and species preservation. Accurate distinction ensures compliance with regulatory frameworks such as the EU Emissions Trading System and promotes targeted funding for climate mitigation versus biodiversity conservation projects. This knowledge enhances decision-making for investors, policymakers, and corporations committed to environmental, social, and governance (ESG) goals.

Comparison Table

| Aspect | Carbon Trading | Biodiversity Credits |

|---|---|---|

| Definition | Market-based approach to reduce greenhouse gas emissions by trading carbon credits. | Market mechanism that incentivizes conservation and restoration of biodiversity through tradable credits. |

| Primary Goal | Lower carbon emissions to mitigate climate change. | Preserve species, habitats, and ecosystem services. |

| Unit of Trade | One metric ton of CO2 equivalent (CO2e). | Quantified biodiversity gains, often linked to habitat area or species protection. |

| Regulatory Framework | Established in global and national programs (e.g., EU ETS, California Cap-and-Trade). | Emerging frameworks, less standardized than carbon markets. |

| Market Size | Billions USD as of 2023, among largest environmental markets worldwide. | Smaller but growing, early stage market. |

| Verification | Verified through rigorous protocols (e.g., VCS, Gold Standard). | Verification varies; growing use of scientific and ecological assessments. |

| Impact Measurement | Quantified by emission reductions in CO2e. | Measured by biodiversity improvements, species counts, ecosystem health metrics. |

| Challenges | Price volatility, additionality verification, monitoring accuracy. | Standardization difficulties, complex ecological valuation, market fragmentation. |

| Investment Appeal | Attractive for businesses aiming for carbon neutrality and regulatory compliance. | Appeals to investors focused on conservation, ESG goals, and ecological impact. |

Which is better?

Carbon trading offers a well-established market framework for reducing greenhouse gas emissions through tradable permits, supported by extensive regulatory systems and measurable impact metrics. Biodiversity credits focus on preserving ecosystems and species but face challenges in standardizing valuation and ensuring long-term ecological benefits. Market maturity and quantifiable environmental outcomes currently make carbon trading a more scalable and reliable mechanism for investors and policymakers.

Connection

Carbon trading and biodiversity credits intersect by monetizing environmental benefits to combat climate change and preserve ecosystems. Carbon trading markets allow entities to buy and sell carbon emission allowances, incentivizing reductions in greenhouse gases. Biodiversity credits similarly assign value to conservation efforts, promoting habitat restoration and species protection, thereby enhancing carbon sequestration and ecosystem resilience.

Key Terms

Offset Mechanism

Biodiversity credits and carbon trading both serve as offset mechanisms, but biodiversity credits specifically target ecosystem preservation and restoration, quantifying ecological benefits such as habitat protection and species conservation. Carbon trading primarily focuses on reducing greenhouse gas emissions by allowing entities to buy and sell carbon offset credits linked to emission reductions or sequestration projects. Explore how these markets integrate with environmental policies and their impact on sustainable development.

Ecosystem Services

Biodiversity credits and carbon trading both monetize ecosystem services but target distinct environmental outcomes; biodiversity credits focus on preserving species diversity and habitats, while carbon trading centers on reducing greenhouse gas emissions by valuing carbon sequestration. Ecosystem services such as pollination, water purification, and soil fertility are primarily supported through biodiversity credits, contributing to long-term ecological balance beyond carbon capture. Explore our detailed analysis to understand how these market-based mechanisms complement each other in sustaining vital ecosystem functions.

Emissions Reduction

Biodiversity credits emphasize preserving ecosystems and species diversity, contributing to sustainable emissions reduction by enhancing carbon sequestration through natural habitats. Carbon trading directly targets greenhouse gas emissions by allowing companies to buy and sell emission allowances or offsets to meet regulatory limits. Explore how biodiversity credits complement carbon trading strategies to maximize environmental impact.

Source and External Links

What are biodiversity credits, and how do they work? - Biodiversity credits are an innovative market-based tool allowing companies to invest in biodiversity protection by purchasing credits that finance conservation and restoration of ecosystems, assigning each credit a value based on conserved or restored land area and time.

Role of Biodiversity Credits in Promoting Conservation ... - Biodiversity credits provide a financial value for positive biodiversity outcomes verified through evidence, with the goal of incentivizing conservation and restoration, but require rigorous monitoring and regulatory frameworks to ensure real impact and avoid greenwashing.

Can 'Biodiversity Credits' Propel Global Conservation? - Biodiversity credits are generated when threatened habitats meet improvement targets established through biological surveys and monitored over time, and revenues from credit sales are shared between landowners and credit developers to support ongoing habitat protection.

dowidth.com

dowidth.com