Trader funding programs provide aspiring traders with capital to trade financial markets without risking their own money, often requiring proof of consistent profitability and risk management skills. Venture capital involves investing equity in startups or high-growth companies in exchange for ownership stakes, focusing on long-term innovation and scalability. Explore detailed comparisons to determine which funding option aligns best with your financial goals and risk appetite.

Why it is important

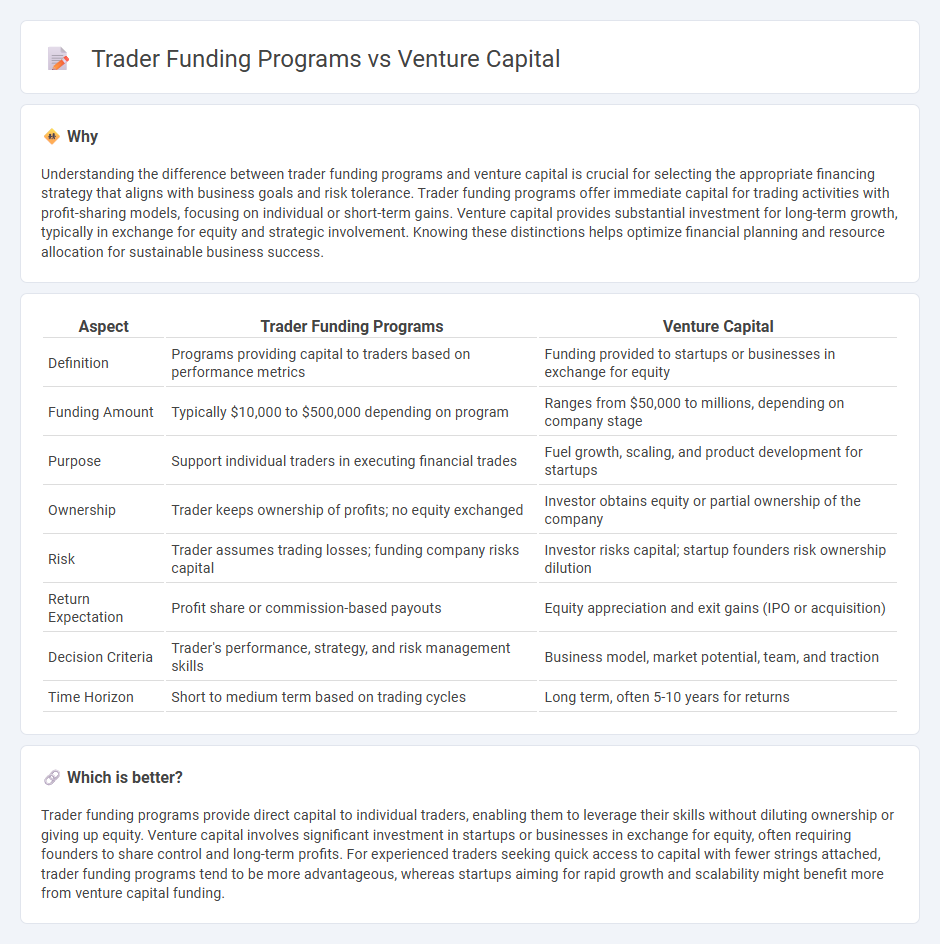

Understanding the difference between trader funding programs and venture capital is crucial for selecting the appropriate financing strategy that aligns with business goals and risk tolerance. Trader funding programs offer immediate capital for trading activities with profit-sharing models, focusing on individual or short-term gains. Venture capital provides substantial investment for long-term growth, typically in exchange for equity and strategic involvement. Knowing these distinctions helps optimize financial planning and resource allocation for sustainable business success.

Comparison Table

| Aspect | Trader Funding Programs | Venture Capital |

|---|---|---|

| Definition | Programs providing capital to traders based on performance metrics | Funding provided to startups or businesses in exchange for equity |

| Funding Amount | Typically $10,000 to $500,000 depending on program | Ranges from $50,000 to millions, depending on company stage |

| Purpose | Support individual traders in executing financial trades | Fuel growth, scaling, and product development for startups |

| Ownership | Trader keeps ownership of profits; no equity exchanged | Investor obtains equity or partial ownership of the company |

| Risk | Trader assumes trading losses; funding company risks capital | Investor risks capital; startup founders risk ownership dilution |

| Return Expectation | Profit share or commission-based payouts | Equity appreciation and exit gains (IPO or acquisition) |

| Decision Criteria | Trader's performance, strategy, and risk management skills | Business model, market potential, team, and traction |

| Time Horizon | Short to medium term based on trading cycles | Long term, often 5-10 years for returns |

Which is better?

Trader funding programs provide direct capital to individual traders, enabling them to leverage their skills without diluting ownership or giving up equity. Venture capital involves significant investment in startups or businesses in exchange for equity, often requiring founders to share control and long-term profits. For experienced traders seeking quick access to capital with fewer strings attached, trader funding programs tend to be more advantageous, whereas startups aiming for rapid growth and scalability might benefit more from venture capital funding.

Connection

Trader funding programs provide capital to skilled traders in exchange for a share of profits, enabling access to larger markets without personal financial risk. Venture capital firms often invest in these programs or fintech startups that develop proprietary trading platforms, leveraging innovative technologies to optimize trading strategies. This symbiotic relationship accelerates growth and innovation within financial markets by combining trader expertise with institutional funding.

Key Terms

Equity

Venture capital funding programs provide equity investments to startups in exchange for ownership stakes, enabling business growth through strategic support and capital infusion. Trader funding programs often offer capital for trading activities, but typically involve profit sharing agreements rather than equity ownership. Explore the key differences in equity structures and benefits in these funding models to make informed decisions.

Profit Sharing

Venture capital funding programs provide startups with equity in exchange for capital, allowing investors to share in the company's long-term profits and growth potential. Trader funding programs typically operate on a profit-sharing model where traders receive capital to trade on behalf of the firm, splitting the profits generated according to pre-agreed terms. Explore the detailed differences in profit-sharing structures to determine the best funding option for your financial goals.

Risk Tolerance

Venture capital funding programs typically exhibit lower risk tolerance due to their thorough evaluation of early-stage startups with high growth potential but uncertain outcomes. Trader funding programs generally demonstrate higher risk tolerance, as they often involve quicker capital turnover and strategies that capitalize on market volatility. Explore the key differences and determine which funding approach aligns with your financial goals and risk preferences.

Source and External Links

What is Venture Capital? - Venture capital is financing that supports high-growth startups by turning ideas into products and services, involving long-term equity investments and strategic partnership with entrepreneurs to fuel innovation and job creation.

What is Venture Capital? - Venture capital provides equity financing to startups with innovative technologies and high growth potential, taking on high risk for the chance of high returns, typically seeking liquidity events like IPOs or acquisitions over several years.

Fund your business | U.S. Small Business Administration - Venture capital involves investors providing funding in exchange for ownership equity and active involvement, focusing on high-growth companies with a longer investment horizon and higher risks relative to traditional financing.

dowidth.com

dowidth.com