Collateralized reinsurance involves the ceding insurer providing collateral to the reinsurer, enhancing credit security and reducing counterparty risk, unlike traditional reinsurance where payments rely solely on the reinsurer's financial strength. This structure improves transparency and capital efficiency, appealing to companies seeking to manage risk with greater certainty. Discover how collateralized and traditional reinsurance differ in risk management and capital allocation.

Why it is important

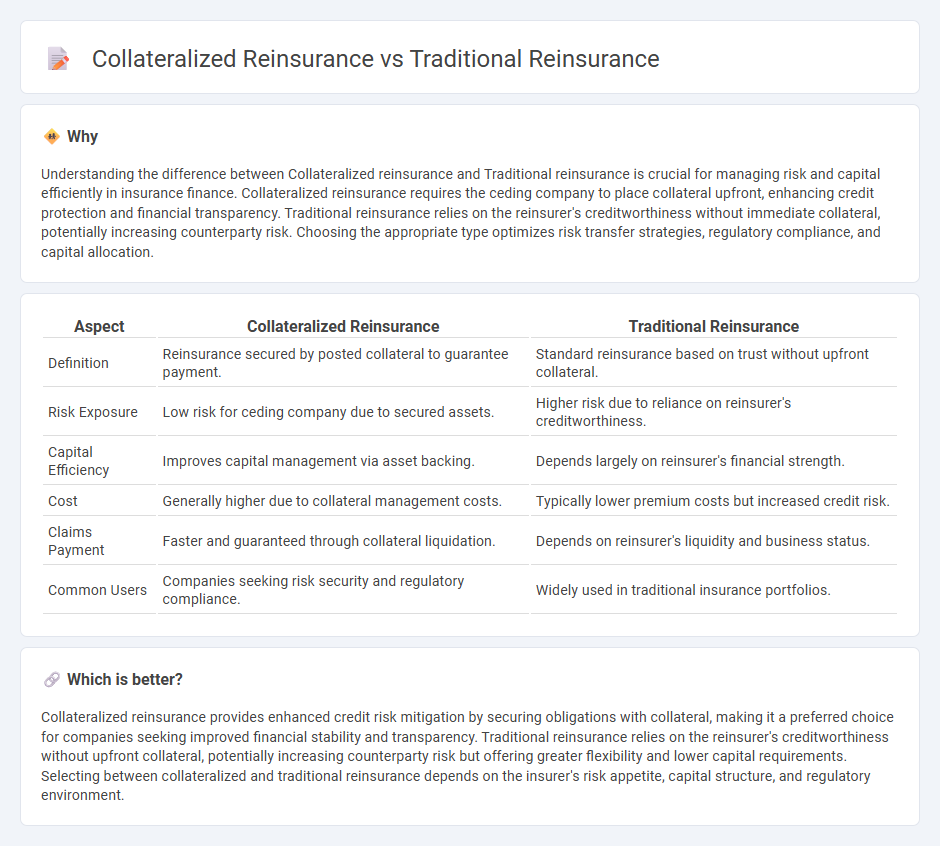

Understanding the difference between Collateralized reinsurance and Traditional reinsurance is crucial for managing risk and capital efficiently in insurance finance. Collateralized reinsurance requires the ceding company to place collateral upfront, enhancing credit protection and financial transparency. Traditional reinsurance relies on the reinsurer's creditworthiness without immediate collateral, potentially increasing counterparty risk. Choosing the appropriate type optimizes risk transfer strategies, regulatory compliance, and capital allocation.

Comparison Table

| Aspect | Collateralized Reinsurance | Traditional Reinsurance |

|---|---|---|

| Definition | Reinsurance secured by posted collateral to guarantee payment. | Standard reinsurance based on trust without upfront collateral. |

| Risk Exposure | Low risk for ceding company due to secured assets. | Higher risk due to reliance on reinsurer's creditworthiness. |

| Capital Efficiency | Improves capital management via asset backing. | Depends largely on reinsurer's financial strength. |

| Cost | Generally higher due to collateral management costs. | Typically lower premium costs but increased credit risk. |

| Claims Payment | Faster and guaranteed through collateral liquidation. | Depends on reinsurer's liquidity and business status. |

| Common Users | Companies seeking risk security and regulatory compliance. | Widely used in traditional insurance portfolios. |

Which is better?

Collateralized reinsurance provides enhanced credit risk mitigation by securing obligations with collateral, making it a preferred choice for companies seeking improved financial stability and transparency. Traditional reinsurance relies on the reinsurer's creditworthiness without upfront collateral, potentially increasing counterparty risk but offering greater flexibility and lower capital requirements. Selecting between collateralized and traditional reinsurance depends on the insurer's risk appetite, capital structure, and regulatory environment.

Connection

Collateralized reinsurance and traditional reinsurance are connected through their shared purpose of risk transfer and capital protection for insurance companies. Collateralized reinsurance involves securing obligations with collateral, enhancing creditworthiness and financial transparency, while traditional reinsurance relies on the reinsurer's promise to pay claims. Both methods manage risk exposure but differ in capital structure and regulatory treatment, influencing insurers' balance sheets and solvency positions.

Key Terms

Risk Transfer

Traditional reinsurance involves transferring insurance risk from the ceding insurer to a reinsurer, typically through contractual agreements backed by the reinsurer's financial strength and underwriting expertise. Collateralized reinsurance, on the other hand, uses posted collateral or trust funds to secure the risk transfer, minimizing counterparty risk but requiring the ceding insurer to allocate capital upfront. Explore more about how these reinsurance methods impact risk management and capital efficiency in the insurance industry.

Counterparty Credit Risk

Traditional reinsurance exposes cedents to counterparty credit risk due to the insurer's obligation to pay claims, which relies heavily on the reinsurer's financial stability and creditworthiness. Collateralized reinsurance mitigates this risk by requiring cash or secure assets to be held as collateral, ensuring that funds are readily available to cover claims, thereby significantly reducing reliance on the reinsurer's credit profile. Explore further to understand how these structures impact risk management and capital efficiency in reinsurance contracts.

Capital Requirements

Traditional reinsurance typically demands substantial capital reserves from insurers to cover potential claims, as reinsurers assume the risk directly on their balance sheets. Collateralized reinsurance, conversely, uses collateral posted by the insurer, reducing the reinsurer's capital requirement and providing more security for claim payments. Explore detailed differences in capital impacts and regulatory implications for enhanced risk management strategies.

Source and External Links

What is Traditional Risk Reinsurance? - Insuranceopedia - Traditional risk reinsurance uses capital from traditional sources such as shareholders and premium income; it is the established method favored by major reinsurers who back risks using equity capital from stock issued to shareholders.

What is a traditional reinsurer? - Artemis - Resource Library - A traditional reinsurer is equity capital backed, with shareholders and a traditional capital model, distinct from non-traditional capital which is sourced from institutional investors like pension funds and hedge funds, often via insurance linked securities.

The Theory of Reinsurance - IRMI - Traditional reinsurance involves a reinsurer assuming risk from an insurer in exchange for protection, indemnifying the ceding insurer after claims are paid, and relying on estimated ultimate loss costs though the exact losses are unknown.

dowidth.com

dowidth.com