Sovereign debt restructuring involves renegotiating the terms of a country's debt to improve repayment conditions without canceling the principal, often including extended maturities or reduced interest rates. Debt forgiveness, by contrast, entails the complete or partial cancellation of debt obligations, providing immediate financial relief but potentially impacting the country's credit rating. Explore the differences and implications of these financial strategies to understand their roles in managing national debt crises.

Why it is important

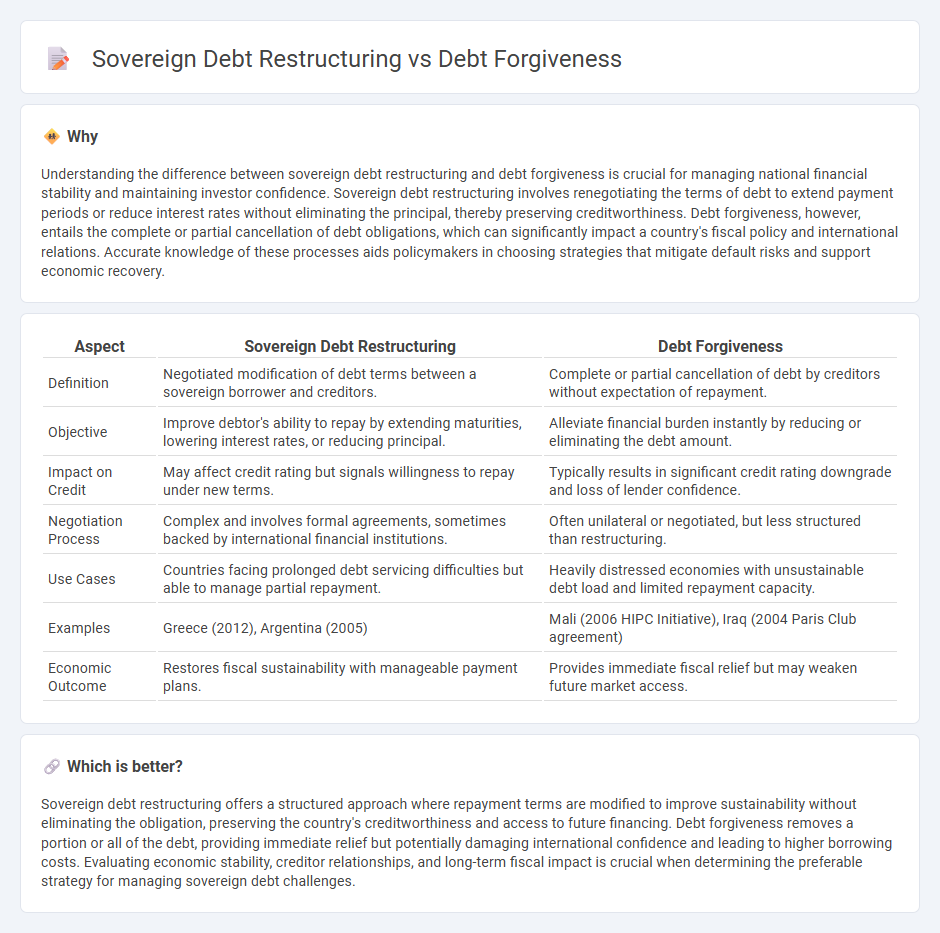

Understanding the difference between sovereign debt restructuring and debt forgiveness is crucial for managing national financial stability and maintaining investor confidence. Sovereign debt restructuring involves renegotiating the terms of debt to extend payment periods or reduce interest rates without eliminating the principal, thereby preserving creditworthiness. Debt forgiveness, however, entails the complete or partial cancellation of debt obligations, which can significantly impact a country's fiscal policy and international relations. Accurate knowledge of these processes aids policymakers in choosing strategies that mitigate default risks and support economic recovery.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Forgiveness |

|---|---|---|

| Definition | Negotiated modification of debt terms between a sovereign borrower and creditors. | Complete or partial cancellation of debt by creditors without expectation of repayment. |

| Objective | Improve debtor's ability to repay by extending maturities, lowering interest rates, or reducing principal. | Alleviate financial burden instantly by reducing or eliminating the debt amount. |

| Impact on Credit | May affect credit rating but signals willingness to repay under new terms. | Typically results in significant credit rating downgrade and loss of lender confidence. |

| Negotiation Process | Complex and involves formal agreements, sometimes backed by international financial institutions. | Often unilateral or negotiated, but less structured than restructuring. |

| Use Cases | Countries facing prolonged debt servicing difficulties but able to manage partial repayment. | Heavily distressed economies with unsustainable debt load and limited repayment capacity. |

| Examples | Greece (2012), Argentina (2005) | Mali (2006 HIPC Initiative), Iraq (2004 Paris Club agreement) |

| Economic Outcome | Restores fiscal sustainability with manageable payment plans. | Provides immediate fiscal relief but may weaken future market access. |

Which is better?

Sovereign debt restructuring offers a structured approach where repayment terms are modified to improve sustainability without eliminating the obligation, preserving the country's creditworthiness and access to future financing. Debt forgiveness removes a portion or all of the debt, providing immediate relief but potentially damaging international confidence and leading to higher borrowing costs. Evaluating economic stability, creditor relationships, and long-term fiscal impact is crucial when determining the preferable strategy for managing sovereign debt challenges.

Connection

Sovereign debt restructuring and debt forgiveness are interconnected processes that aim to alleviate the financial burdens faced by indebted countries. Restructuring involves modifying the terms of existing debt agreements, such as extending maturities or reducing interest rates, which can lead to partial debt forgiveness where creditors agree to cancel a portion of the debt. These mechanisms help restore fiscal sustainability and promote economic stability by enabling countries to manage their debt more effectively and avoid default.

Key Terms

Haircut

Debt forgiveness involves a debtor country receiving partial or full cancellation of its outstanding debt, effectively reducing the repayment burden without requiring immediate financial compensation from creditors. Sovereign debt restructuring with a focus on a haircut entails negotiating a reduction in the principal or interest payments, typically expressed as a percentage cut on the original debt value, to restore debt sustainability and avoid default. Explore the nuances of haircuts in sovereign debt management to understand their impact on global financial stability.

Principal Reduction

Debt forgiveness involves completely writing off a sovereign borrower's outstanding principal obligations, effectively eliminating the debtor's liability and providing immediate fiscal relief. Sovereign debt restructuring with principal reduction, however, modifies the terms by reducing the original principal amount owed, often combined with extended maturities or lower interest rates to restore debt sustainability. Explore further to understand how principal reduction impacts long-term economic recovery and creditor-debtor negotiations.

Maturity Extension

Debt forgiveness reduces the principal amount owed by a sovereign debtor, providing immediate financial relief, while sovereign debt restructuring, specifically through maturity extension, postpones repayment deadlines to improve liquidity without cutting the principal. Maturity extension allows debtor countries additional time to stabilize their economies and resume payments under more sustainable terms, reducing default risk and enhancing creditor recovery prospects. Explore further to understand the implications and mechanisms behind these debt relief strategies.

Source and External Links

Who Qualifies For Debt Forgiveness And How Can You Be Eligible? - Debt forgiveness means a lender agrees to wipe out all or part of a debt, often available for unsecured debts like credit cards, student loans, mortgages, medical bills, and taxes, but it requires meeting specific criteria and negotiating with creditors.

Who qualifies for credit card debt forgiveness? - Nearly anyone struggling to make credit card payments may qualify for debt forgiveness through debt settlement programs where a debt relief expert helps negotiate partial reduction of debts with creditors.

What if my debt is forgiven? | Internal Revenue Service - Debt that is forgiven may be taxable income, requiring you to report the forgiven amount to the IRS unless you qualify for exceptions like insolvency or bankruptcy.

dowidth.com

dowidth.com