Dark pool routing allows institutional investors to execute large trades anonymously within private exchanges, reducing market impact and price slippage compared to traditional venues. Single dealer platforms offer direct access to liquidity from one financial institution, providing tailored pricing but potentially less competitive spreads. Explore the advantages and challenges of each trading method to optimize your investment strategy.

Why it is important

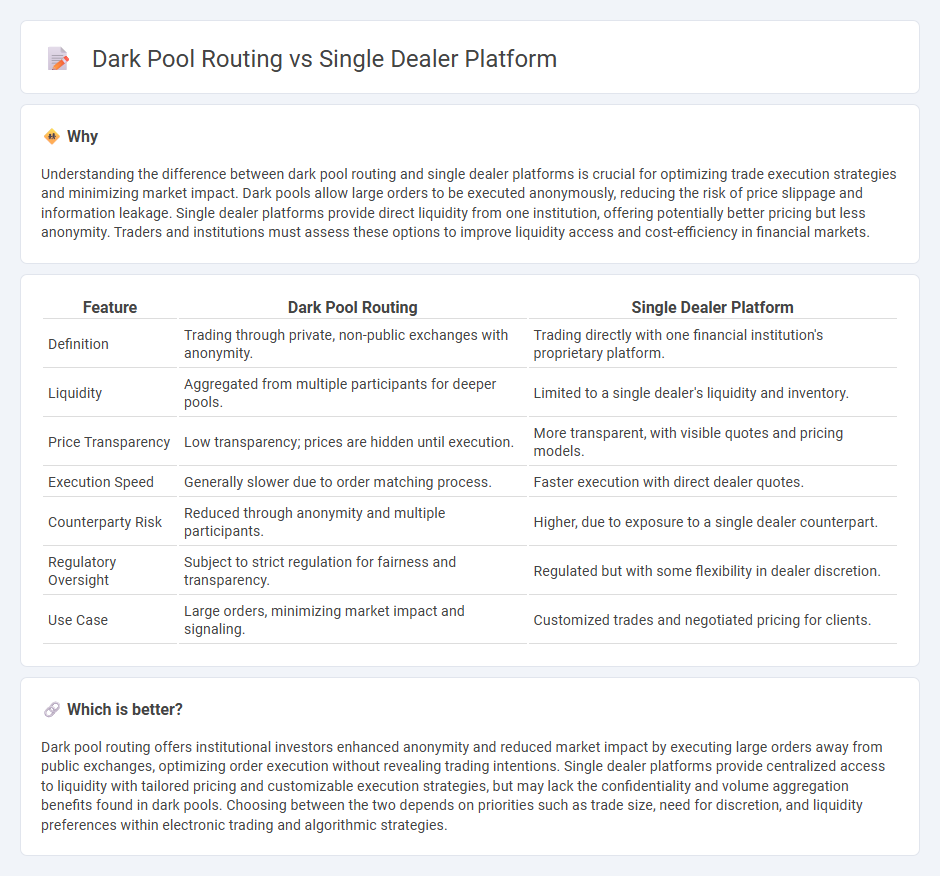

Understanding the difference between dark pool routing and single dealer platforms is crucial for optimizing trade execution strategies and minimizing market impact. Dark pools allow large orders to be executed anonymously, reducing the risk of price slippage and information leakage. Single dealer platforms provide direct liquidity from one institution, offering potentially better pricing but less anonymity. Traders and institutions must assess these options to improve liquidity access and cost-efficiency in financial markets.

Comparison Table

| Feature | Dark Pool Routing | Single Dealer Platform |

|---|---|---|

| Definition | Trading through private, non-public exchanges with anonymity. | Trading directly with one financial institution's proprietary platform. |

| Liquidity | Aggregated from multiple participants for deeper pools. | Limited to a single dealer's liquidity and inventory. |

| Price Transparency | Low transparency; prices are hidden until execution. | More transparent, with visible quotes and pricing models. |

| Execution Speed | Generally slower due to order matching process. | Faster execution with direct dealer quotes. |

| Counterparty Risk | Reduced through anonymity and multiple participants. | Higher, due to exposure to a single dealer counterpart. |

| Regulatory Oversight | Subject to strict regulation for fairness and transparency. | Regulated but with some flexibility in dealer discretion. |

| Use Case | Large orders, minimizing market impact and signaling. | Customized trades and negotiated pricing for clients. |

Which is better?

Dark pool routing offers institutional investors enhanced anonymity and reduced market impact by executing large orders away from public exchanges, optimizing order execution without revealing trading intentions. Single dealer platforms provide centralized access to liquidity with tailored pricing and customizable execution strategies, but may lack the confidentiality and volume aggregation benefits found in dark pools. Choosing between the two depends on priorities such as trade size, need for discretion, and liquidity preferences within electronic trading and algorithmic strategies.

Connection

Dark pool routing directs large block trades to private, non-transparent trading venues, minimizing market impact and price slippage. Single dealer platforms (SDPs) facilitate direct access between institutional clients and liquidity providers, often integrating dark pool routing algorithms to enhance trade execution efficiency. Combining SDP capabilities with dark pool routing ensures optimal order flow by leveraging proprietary liquidity while maintaining anonymity and reducing information leakage.

Key Terms

Liquidity

Single dealer platforms offer centralized access to liquidity directly from one financial institution, ensuring transparent pricing and consistent execution quality. Dark pool routing aggregates liquidity from multiple hidden venues, allowing large orders to execute with minimal market impact and reduced information leakage. Explore the advantages of each method to optimize your trading strategy and liquidity access.

Transparency

Single dealer platforms offer enhanced transparency by providing direct pricing and clear execution data from a single liquidity provider, allowing traders to assess trade quality with greater confidence. Dark pool routing, conversely, involves multiple undisclosed venues that often lack comprehensive pre-trade transparency, making it challenging to evaluate order flow and execution price impact. Explore the nuances of transparency in trading environments to optimize your execution strategy.

Counterparty

Single dealer platforms (SDPs) provide transparent trade execution directly with a known counterparty, enhancing credit risk management and post-trade settlement certainty for institutional investors. Dark pool routing aggregates orders anonymously but hides counterparty identities, potentially increasing counterparty risk due to limited transparency and regulatory oversight. Explore further how counterparty considerations impact trade execution strategies within SDPs versus dark pool environments.

Source and External Links

Single Dealer vs Multi-Dealer Platforms: An End to the ... - A single dealer platform is a proprietary system managed by one bank or financial institution, giving clients direct access to that bank's pricing, liquidity, and customized services.

Single-dealer platform - A single-dealer platform is software used by an investment bank to deliver integrated trading and related services across asset classes via a single user interface, primarily in OTC markets like forex and fixed income.

The evolution and future of single-dealer platforms - Single dealer platforms are becoming more sophisticated, serving as direct and efficient gateways for FX trading and adapting to meet the complex needs of institutions through advanced technology and multi-asset support.

dowidth.com

dowidth.com